- United States

- /

- Insurance

- /

- NasdaqGS:UFCS

Market Might Still Lack Some Conviction On United Fire Group, Inc. (NASDAQ:UFCS) Even After 28% Share Price Boost

The United Fire Group, Inc. (NASDAQ:UFCS) share price has done very well over the last month, posting an excellent gain of 28%. Looking back a bit further, it's encouraging to see the stock is up 25% in the last year.

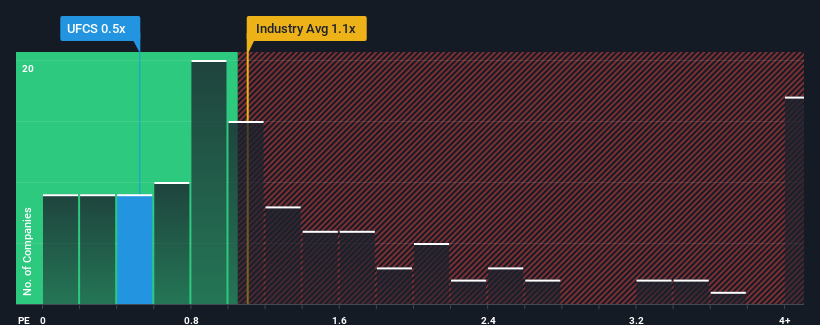

Even after such a large jump in price, when close to half the companies operating in the United States' Insurance industry have price-to-sales ratios (or "P/S") above 1.1x, you may still consider United Fire Group as an enticing stock to check out with its 0.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for United Fire Group

How Has United Fire Group Performed Recently?

Recent times haven't been great for United Fire Group as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on United Fire Group.How Is United Fire Group's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like United Fire Group's to be considered reasonable.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. Revenue has also lifted 9.3% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Turning to the outlook, the next year should generate growth of 7.7% as estimated by the only analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 4.3%, which is noticeably less attractive.

With this information, we find it odd that United Fire Group is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On United Fire Group's P/S

Despite United Fire Group's share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at United Fire Group's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for United Fire Group that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:UFCS

United Fire Group

Provides property and casualty insurance for individuals and businesses in the United States.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives