- United States

- /

- Insurance

- /

- NasdaqGS:PLMR

Palomar Holdings (PLMR): Revisiting Valuation After Pricing Headwinds, Sector Rotation and Margin Concerns

Reviewed by Simply Wall St

Palomar Holdings (PLMR) is back in focus after recent market commentary flagged a tricky mix of weaker commercial pricing, a rotation out of insurance names, and nagging questions around underwriting margins.

See our latest analysis for Palomar Holdings.

Against that backdrop, Palomar’s share price has still posted a solid year to date share price return. The recent 7 day share price return of 8.2% suggests sentiment is stabilising after earlier volatility, and its multi year total shareholder return remains impressive.

If Palomar’s move has you rethinking your portfolio balance, this could be a good moment to explore fast growing stocks with high insider ownership for other high conviction ideas beyond insurance.

With Palomar still trading at a hefty discount to analyst targets but carrying a strong multi year shareholder return, investors now face a key question: is this a fresh entry point or is future growth already baked in?

Most Popular Narrative: 20.3% Undervalued

With Palomar Holdings last closing at $127.54 against a narrative fair value near $160, the story being told leans firmly toward upside from here.

Improved reinsurance terms, proactive risk management, and capital strength (including a $150M buyback program) enable Palomar to maintain conservative retentions while locking in favorable reinsurance economics through 2026, underpinning future earnings stability and supporting continued growth in book value and return on equity.

If you want to see how this playbook translates into the current price gap, from rapid top line expansion to resilient margins and a punchy earnings multiple, dive into the full narrative to uncover the exact assumptions driving that fair value.

Result: Fair Value of $160 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy catastrophe exposure and intensifying competition in commercial property lines could quickly challenge those upside assumptions if pricing or loss trends change direction.

Find out about the key risks to this Palomar Holdings narrative.

Another Angle on Valuation

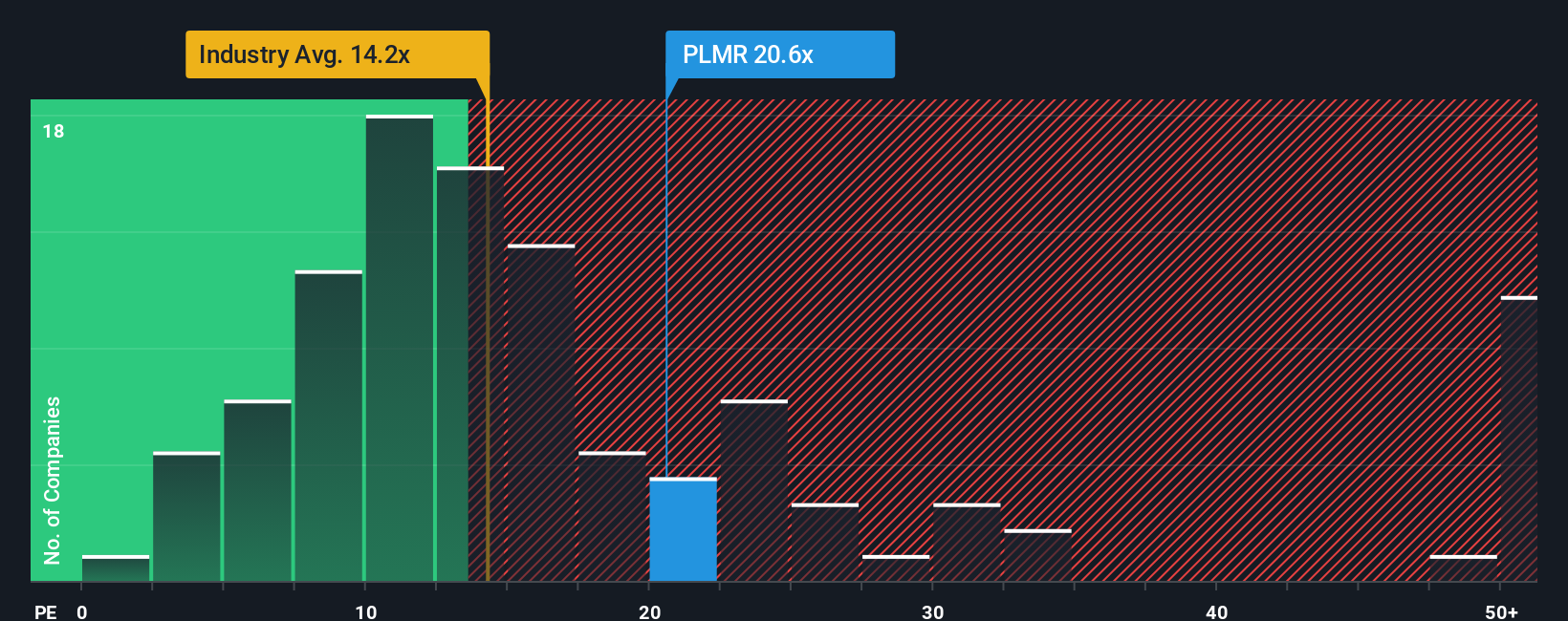

Palomar screens cheap against intrinsic value, but its 19.2x earnings multiple is rich versus the US insurance sector at 13.6x, peers at 17.4x, and a fair ratio of 16.3x. That premium points to valuation risk if growth or margins slip from here. Is the upside worth paying up for?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Palomar Holdings Narrative

If you see the setup differently or want to dig into the numbers yourself, you can shape a personalised view in just minutes: Do it your way.

A great starting point for your Palomar Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investment move?

Do not stop at one compelling story; use the Simply Wall Street Screener to uncover fresh, data backed opportunities that match your goals before the market moves on.

- Capture early stage potential by reviewing these 3625 penny stocks with strong financials that combine market excitement with underlying financial strength.

- Position yourself at the forefront of innovation by assessing these 25 AI penny stocks reshaping industries with real world AI applications.

- Lock in stronger value prospects by targeting these 13 dividend stocks with yields > 3% offering reliable income streams alongside solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLMR

Palomar Holdings

A specialty insurance company, provides property and casualty insurance to individuals and businesses in the United States.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)