- United States

- /

- Insurance

- /

- NasdaqGS:PLMR

Palomar Holdings (PLMR): Assessing Valuation Following Upgrades and Strong Earnings Momentum

Reviewed by Kshitija Bhandaru

Palomar Holdings (PLMR) is attracting market attention after repeatedly beating earnings estimates and achieving healthy year-over-year growth projections. Consensus upgrades recently reflect growing confidence in the company’s outlook across key financial metrics.

See our latest analysis for Palomar Holdings.

Momentum has firmly shifted in Palomar Holdings’ favor this year, as reflected by a 29.6% total shareholder return over the past 12 months. After a surge of buying last week, the stock now sits at $119.74. Its year-to-date share price return of nearly 15% stands out amid some recent volatility in the broader small-cap space. Consistently positive company updates and bullish sentiment have helped reinforce the notion that Palomar’s growth story is gaining traction, both in the short and long term.

If recent gains in Palomar have sparked your interest, this is the perfect chance to broaden your search and uncover fast growing stocks with high insider ownership.

While PLMR has posted impressive gains and projects strong future growth, its current valuation sparks a key debate for investors. Is there still room for upside, or has the market already priced in the company’s success?

Most Popular Narrative: 25% Undervalued

Palomar Holdings’ latest fair value estimate stands well above its recent closing price, setting expectations for meaningful upside. This backdrop lays the foundation for a deeper dive into what is driving such a bullish outlook.

Ongoing investment in proprietary technology, data analytics, and advanced underwriting disciplines is improving risk assessment and pricing accuracy, already reflected in strong combined ratios and low loss ratios. These factors should continue to enhance underwriting profitability and expand net margins over time.

Curious how a blend of premium growth, margin expansion, and future financial targets come together in this narrative? There is a bold earnings projection and a confidence in margin momentum that fuel this fair value. The door is open for those who want to peek behind the optimistic math. Discover the details that anchor this outlook now.

Result: Fair Value of $159.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Palomar’s outlook faces headwinds. Intensifying competition and heavy reliance on catastrophe-exposed lines could challenge both growth and earnings stability.

Find out about the key risks to this Palomar Holdings narrative.

Another View: Looking Through the Multiples Lens

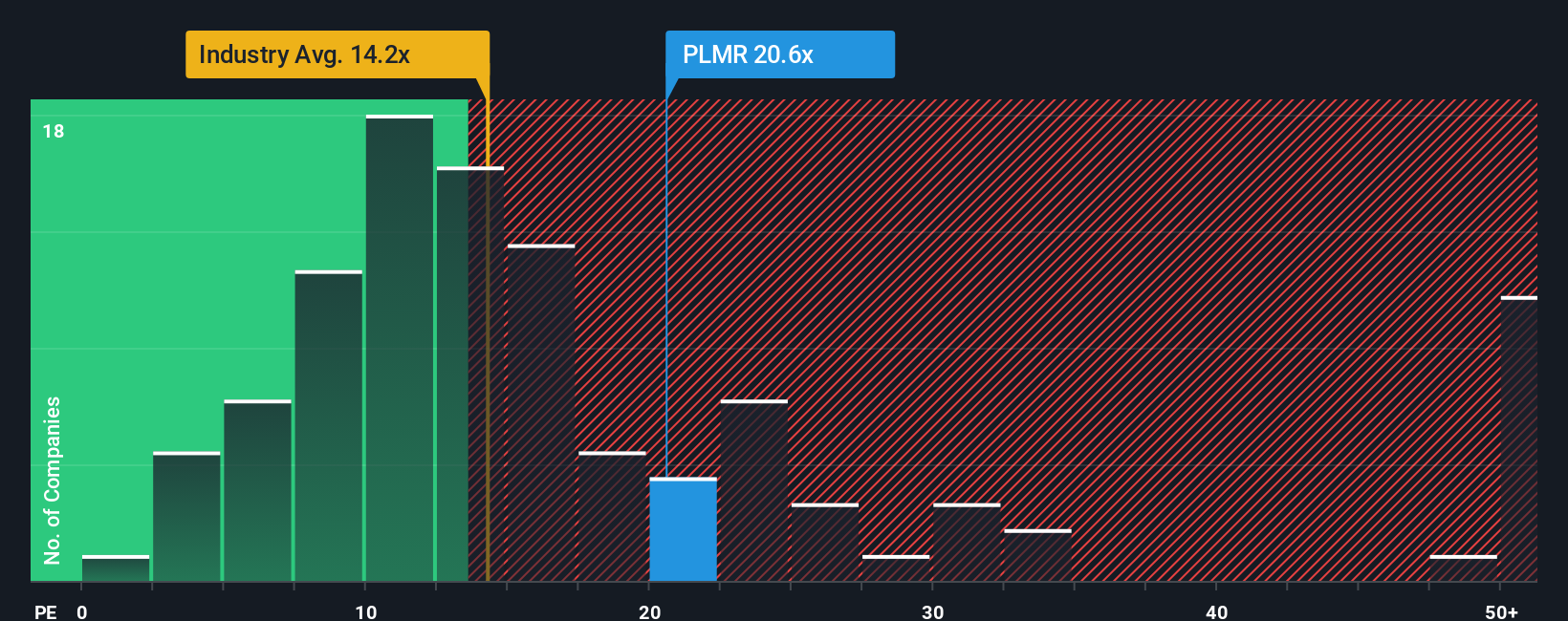

While Palomar appears undervalued by fair value estimates, the company trades at a price-to-earnings ratio of 20.7x, which is noticeably higher than both the US Insurance industry average of 13.9x and the peer group average of 16.7x. Compared to a fair ratio of 16x, this premium means investors are paying up for Palomar's growth story. This raises the question: is the market right to assign this much optimism, or could this elevate valuation risk if expectations cool?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Palomar Holdings Narrative

If you have your own perspective or want to dig deeper into Palomar's numbers, you can craft your personal view in just a few minutes. Do it your way

A great starting point for your Palomar Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Simply Wall Street’s powerful Screener offers pathways to fresh stocks and overlooked gems you might otherwise miss.

- Uncover income-generating opportunities and tap into these 18 dividend stocks with yields > 3% to zero in on dependable yields for your portfolio.

- Ride the next technology wave by checking out these 25 AI penny stocks, where you’ll spot companies fueling real breakthroughs in artificial intelligence.

- Boost your search for rare value plays with these 897 undervalued stocks based on cash flows and strengthen your portfolio with stocks trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLMR

Palomar Holdings

A specialty insurance company, provides property and casualty insurance to individuals and businesses in the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives