- United States

- /

- Insurance

- /

- NasdaqGS:PLMR

Is There an Opportunity in Palomar Holdings After 22.8% Share Price Surge?

Reviewed by Bailey Pemberton

If you've been eyeing Palomar Holdings lately and wondering whether it's a smart move to buy, sell, or hold, you're in good company. The stock just closed at $118.07, and its price movements over the past few years have certainly caught investors' attention. In just the last week, Palomar Holdings nudged up by 1.3% and managed to squeeze out a 1.1% gain in the last 30 days. It’s the longer-term story, though, that’s hard to ignore. The stock is up 13.1% so far this year, 22.8% over the past twelve months, and has achieved nearly 30% gains over the last three and five years. These numbers suggest that the market sees growth, or perhaps that risk perceptions are shifting, especially amid evolving trends in the specialty insurance space and a broader appetite for risk-sensitive financials.

Of course, price performance is just one side of the coin. If you’re really trying to figure out whether Palomar Holdings is undervalued or possibly overhyped, it helps to step back and look at the metrics that matter. On the valuation front, Palomar Holdings chalks up a value score of 3 out of 6, meaning it’s considered undervalued in half of the six key checks analysts use. That’s neither a screaming bargain nor a red flag, so where does that leave you?

Up next, let’s walk through those valuation approaches one by one to see how Palomar stacks up. We will then wrap up with what could be an even sharper way to judge whether the stock is a buy today.

Approach 1: Palomar Holdings Excess Returns Analysis

The Excess Returns valuation model focuses on the company’s ability to generate returns above its cost of equity. In the case of Palomar Holdings, this approach examines not just how much capital the business has invested, but how efficiently it turns that equity into profits over time.

Based on current analysis, Palomar Holdings has a Book Value of $31.64 per share and generates a stable Earnings Per Share (EPS) of $9.12. These estimates are derived from the weighted future Return on Equity projections of six analysts and highlight a consistently strong profit profile. The company’s Cost of Equity stands at $2.73 per share, so Palomar captures an Excess Return of $6.39 per share each year. Its average Return on Equity is 22.65%, which is notably strong for the insurance sector. With a stable Book Value projected at $40.27 per share, the model underlines healthy growth prospects ahead.

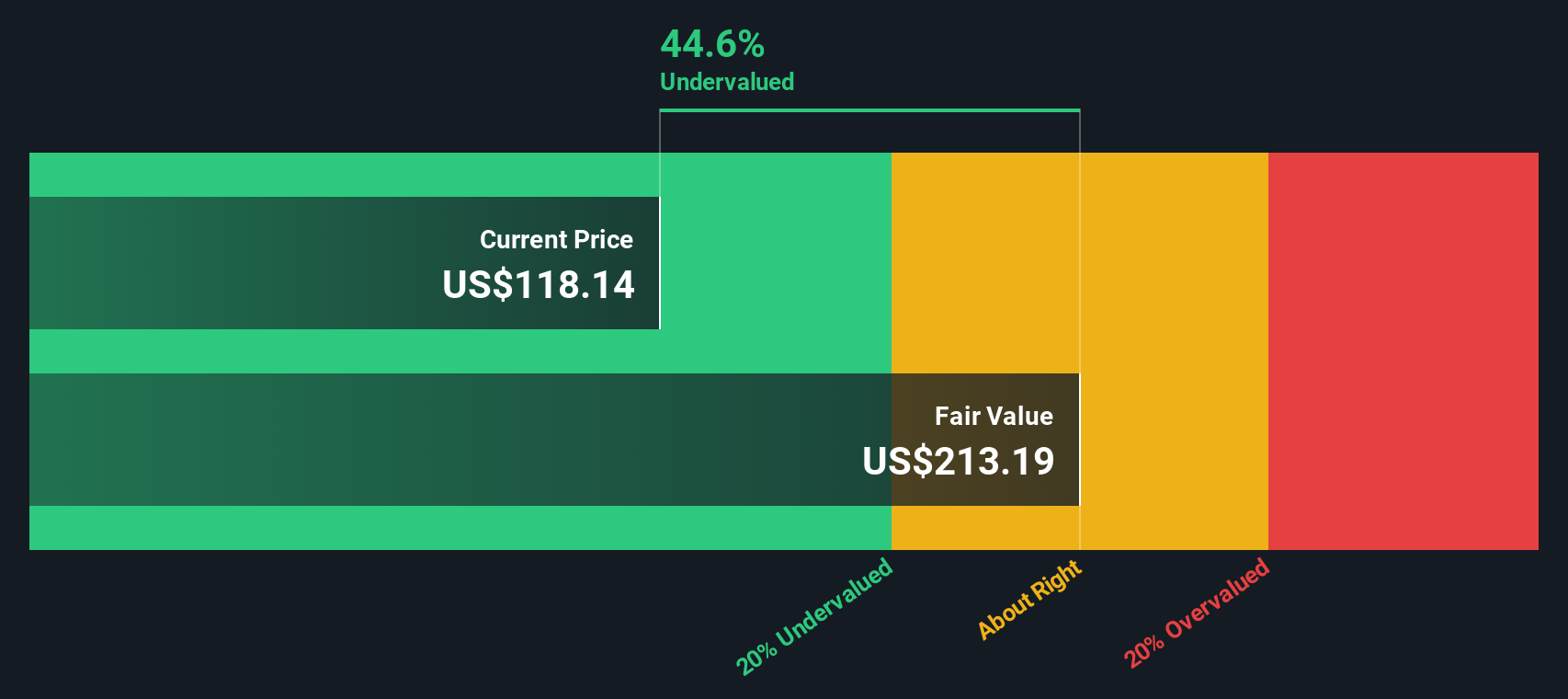

Applying this methodology, the resulting intrinsic value for Palomar Holdings is $213.19 per share. With shares recently trading at $118.07, this suggests the stock is currently 44.6% undervalued compared to its intrinsic value.

Result: UNDERVALUED

Our Excess Returns analysis suggests Palomar Holdings is undervalued by 44.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Palomar Holdings Price vs Earnings (PE)

For profitable companies like Palomar Holdings, the Price-to-Earnings (PE) ratio is a widely used and effective valuation metric. It measures how much investors are willing to pay for each dollar of the company’s earnings, giving a quick sense of market sentiment and expectations around profitability.

Growth expectations and perceived risks play a big role in shaping what constitutes a normal or fair PE ratio. Companies with stronger growth prospects or lower risk profiles often justify higher PE multiples, while slower-growing or riskier firms tend to trade at lower multiples.

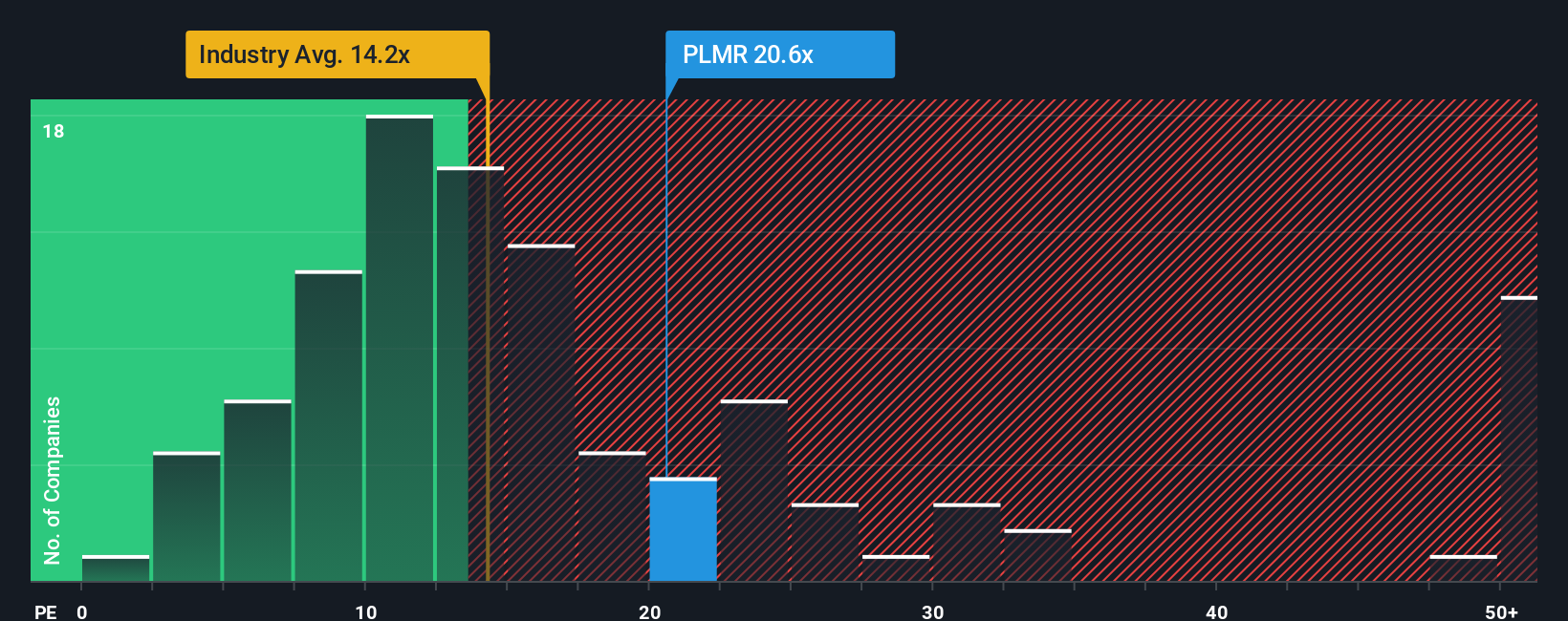

Currently, Palomar Holdings trades at a PE ratio of 20.41x. This is noticeably higher than the industry average of 13.82x and the peer average of 16.57x. This reflects the market’s conviction in Palomar’s growth and profitability. However, Simply Wall St calculates a “Fair Ratio” of 16.29x for Palomar, which is calibrated specifically for the company by taking into account its earnings growth rate, industry dynamics, profit margins, market size, and risk profile. This proprietary Fair Ratio offers a more nuanced benchmark than broad industry or peer comparisons because it tailors the valuation to Palomar’s particular strengths and risk factors.

Comparing the Fair Ratio (16.29x) to Palomar’s current PE ratio (20.41x) suggests that, relative to its fundamentals and outlook, the stock is trading at a premium.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Palomar Holdings Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your opportunity to attach a story or perspective to a company’s numbers. It's your own view of where Palomar Holdings is headed and why. Narratives let you bring together your expectations for revenue, earnings, and margins, linking the company’s story with a future forecast and a fair value estimate.

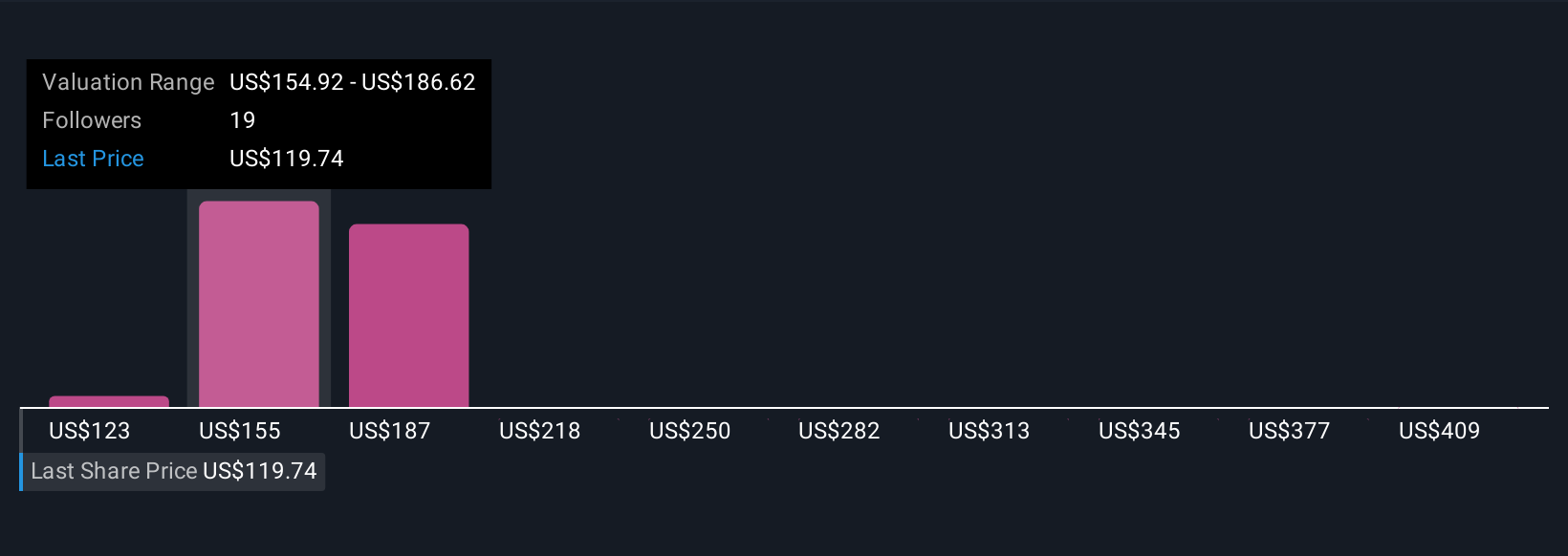

Narratives are easy to create and update using Simply Wall St’s Community page, where millions of investors share their views and see how changing events might alter their outlook. By comparing your Narrative’s Fair Value to the current share price, you get a clearer, more dynamic decision point for buying or selling. These Narratives automatically update when news or earnings are released, so your view stays relevant.

For example, some investors believe Palomar, with its climate-focused growth and strong tech edge, deserves a fair value near $213 per share, while others, more cautious about sector risks and competition, peg it closer to $160. Narratives help you decide which story makes the most sense for you. This can help you invest with greater confidence and clarity.

Do you think there's more to the story for Palomar Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLMR

Palomar Holdings

A specialty insurance company, provides property and casualty insurance to individuals and businesses in the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives