- United States

- /

- Diversified Financial

- /

- NYSE:CRBG

3 Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

In the last week, the United States market has stayed flat, while over the past 12 months it has risen by 7.2%, with earnings forecasted to grow by 14% annually. In this environment, identifying stocks that may be trading below their estimated value can offer potential opportunities for investors looking to capitalize on future growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| MINISO Group Holding (NYSE:MNSO) | $18.59 | $37.02 | 49.8% |

| MetroCity Bankshares (NasdaqGS:MCBS) | $27.99 | $55.05 | 49.2% |

| Owens Corning (NYSE:OC) | $142.63 | $283.21 | 49.6% |

| Ready Capital (NYSE:RC) | $4.36 | $8.67 | 49.7% |

| German American Bancorp (NasdaqGS:GABC) | $38.40 | $74.67 | 48.6% |

| Lantheus Holdings (NasdaqGM:LNTH) | $104.84 | $203.16 | 48.4% |

| Pure Storage (NYSE:PSTG) | $47.58 | $93.59 | 49.2% |

| HealthEquity (NasdaqGS:HQY) | $90.14 | $179.14 | 49.7% |

| Tenable Holdings (NasdaqGS:TENB) | $31.13 | $60.38 | 48.4% |

| Verra Mobility (NasdaqCM:VRRM) | $22.25 | $42.91 | 48.1% |

We'll examine a selection from our screener results.

Palomar Holdings (NasdaqGS:PLMR)

Overview: Palomar Holdings, Inc. is a specialty insurance company that offers property and casualty insurance to individuals and businesses in the United States, with a market cap of approximately $4.16 billion.

Operations: Palomar Holdings generates revenue through its provision of specialty property and casualty insurance services to both individual and business clients across the United States.

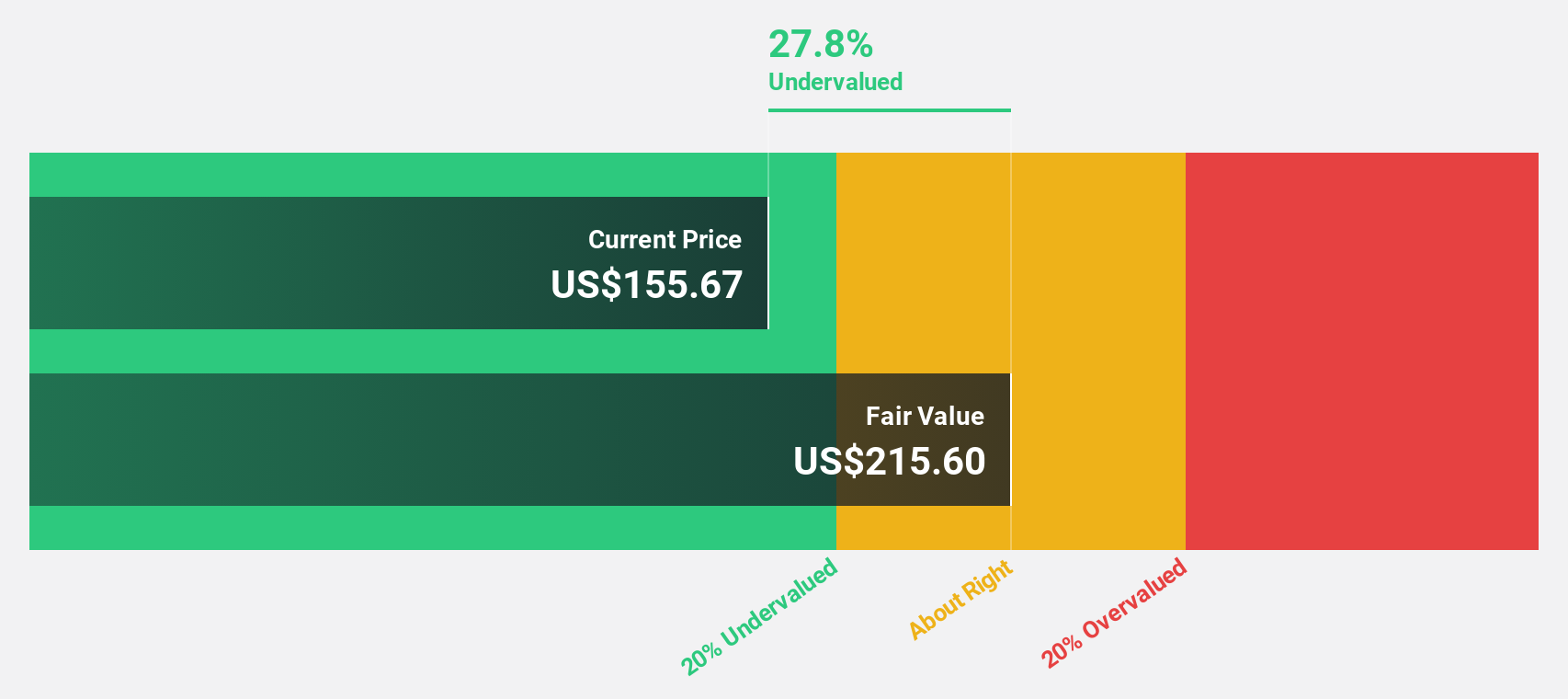

Estimated Discount To Fair Value: 28.6%

Palomar Holdings is trading at US$156.33, significantly below its estimated fair value of US$218.8, suggesting it may be undervalued based on cash flows. Recent earnings for Q1 2025 showed a net income increase to US$42.92 million from US$26.38 million the previous year, indicating strong financial performance despite significant insider selling in the past quarter. Earnings are forecast to grow at 20.3% annually, outpacing both revenue growth and market averages.

- Our earnings growth report unveils the potential for significant increases in Palomar Holdings' future results.

- Click to explore a detailed breakdown of our findings in Palomar Holdings' balance sheet health report.

Corebridge Financial (NYSE:CRBG)

Overview: Corebridge Financial, Inc. operates in the United States offering retirement solutions and insurance products, with a market cap of approximately $16.90 billion.

Operations: Corebridge Financial, Inc. generates revenue through its retirement solutions and insurance products in the United States.

Estimated Discount To Fair Value: 34.4%

Corebridge Financial, trading at US$31.29, is valued below its estimated fair value of US$47.70, indicating it may be undervalued based on cash flows. Despite a recent Q1 2025 net loss of US$664 million and reduced revenue of US$3.59 billion compared to the previous year, earnings are forecast to grow significantly at 29.3% annually over the next three years, surpassing market averages. However, profit margins have decreased from last year’s levels.

- The analysis detailed in our Corebridge Financial growth report hints at robust future financial performance.

- Get an in-depth perspective on Corebridge Financial's balance sheet by reading our health report here.

Olo (NYSE:OLO)

Overview: Olo Inc. operates an open SaaS platform for restaurants in the United States and has a market cap of approximately $1.23 billion.

Operations: The company generates revenue of $284.94 million from its Internet Software & Services segment.

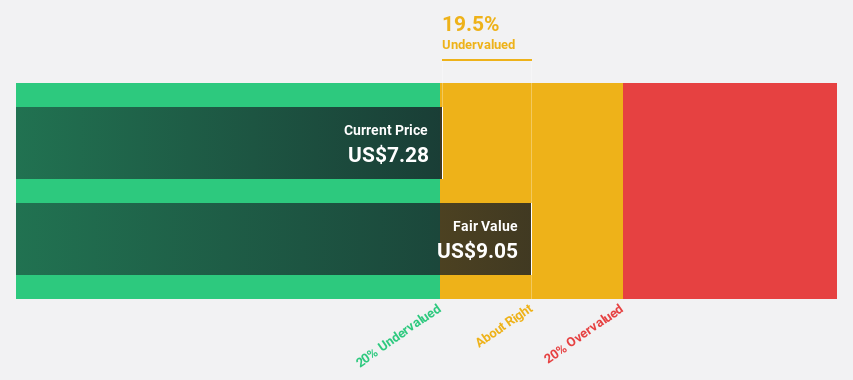

Estimated Discount To Fair Value: 18.6%

Olo, trading at US$7.41, is valued below its estimated fair value of US$9.11, suggesting potential undervaluation based on cash flows. The company has narrowed its net loss significantly over the past year and expects revenue growth of 15.7% annually, outpacing the broader U.S. market's growth rate. Recent M&A interest could influence stock dynamics, while new partnerships like Waffle House delivery enhance service offerings and revenue prospects despite insider selling activity.

- Our comprehensive growth report raises the possibility that Olo is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Olo stock in this financial health report.

Next Steps

- Unlock more gems! Our Undervalued US Stocks Based On Cash Flows screener has unearthed 175 more companies for you to explore.Click here to unveil our expertly curated list of 178 Undervalued US Stocks Based On Cash Flows.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Corebridge Financial, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRBG

Corebridge Financial

Provides retirement solutions and insurance products in the United States.

Reasonable growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives