- United States

- /

- Banks

- /

- NasdaqGS:WTBA

Undiscovered Gems in the US Market December 2025

Reviewed by Simply Wall St

As the U.S. market navigates a period of volatility with major indices like the S&P 500 and Dow Jones Industrial Average experiencing consecutive losses, concerns over an AI bubble and tepid labor data have become focal points for investors. In this environment, identifying undiscovered gems requires a keen eye for companies that demonstrate resilience and potential for growth despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Tri-County Financial Group | 102.20% | -2.69% | -15.63% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Affinity Bancshares | 43.06% | 2.84% | 3.44% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| FineMark Holdings | 114.54% | 2.38% | -28.53% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Donegal Group (DGIC.A)

Simply Wall St Value Rating: ★★★★★☆

Overview: Donegal Group Inc. is an insurance holding company offering commercial and personal lines of property and casualty coverages, with a market cap of approximately $726.99 million.

Operations: Revenue primarily comes from commercial lines at $551.73 million and personal lines at $379.20 million, supplemented by investment income of $53.12 million.

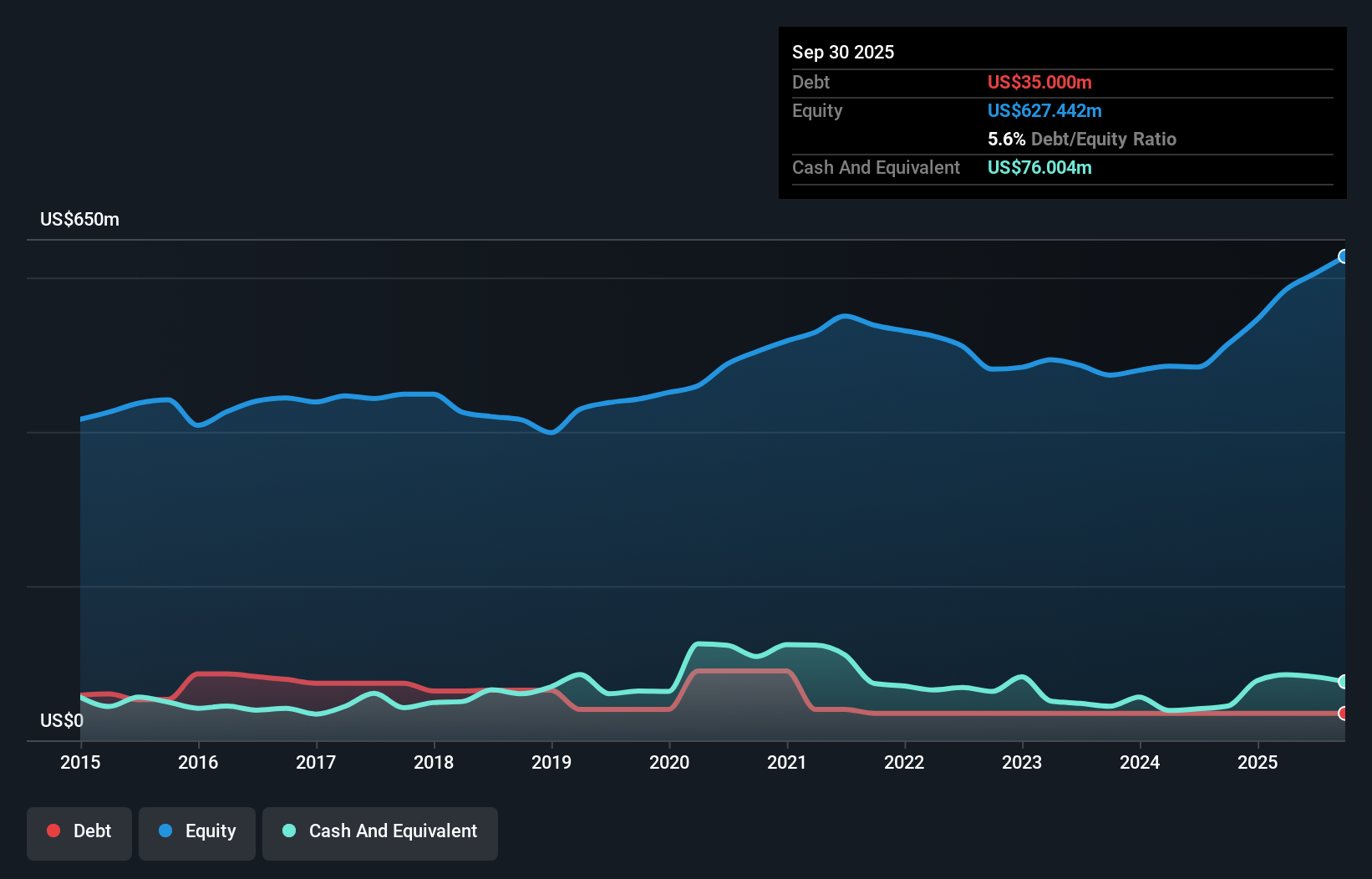

Donegal Group, a smaller player in the insurance sector, has demonstrated impressive earnings growth of 246.1% over the past year, significantly outpacing the industry's 11.6%. With a price-to-earnings ratio of 8.8x compared to the US market's 19x, it trades at an attractive valuation relative to peers. The company has effectively reduced its debt-to-equity ratio from 17.9% to 5.6% over five years and maintains robust interest coverage with EBIT covering interest payments by a factor of 84.1x. However, future earnings are projected to decrease by an average of 3.3% annually over the next three years, suggesting potential challenges ahead despite current financial strengths.

- Take a closer look at Donegal Group's potential here in our health report.

Examine Donegal Group's past performance report to understand how it has performed in the past.

PCB Bancorp (PCB)

Simply Wall St Value Rating: ★★★★★★

Overview: PCB Bancorp is the bank holding company for PCB Bank, offering a range of banking products and services to small and middle-market businesses and individuals, with a market cap of $337.19 million.

Operations: PCB Bancorp generates revenue primarily from its banking operations, amounting to $107.74 million. The company's financial performance is reflected in its net profit margin, which stands at 31.5%.

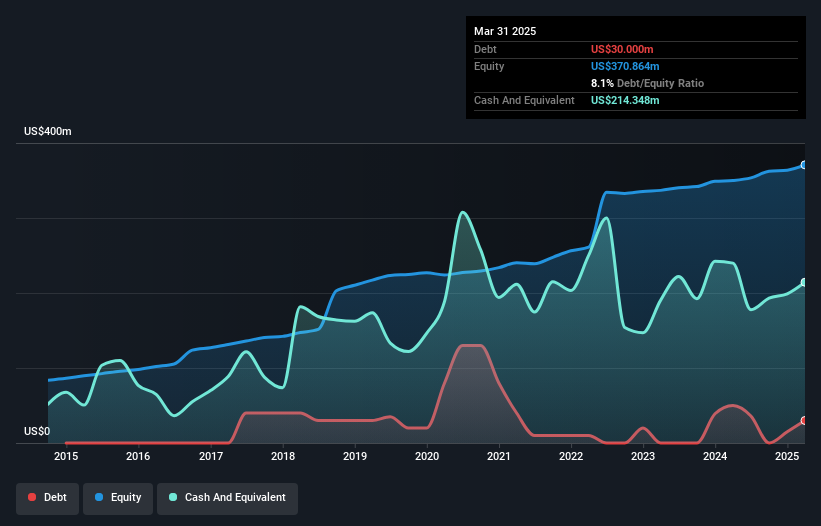

PCB Bancorp, with total assets of US$3.4 billion and equity of US$384.5 million, stands out with its robust financial health. The bank's deposits amount to US$2.9 billion while loans total US$2.7 billion, highlighting a well-balanced portfolio. Earnings have surged by 42% over the past year, surpassing the industry average of 18%. A net interest margin of 3% and an allowance for bad loans at just 0.3% reflect prudent management practices. Recent buybacks saw the company repurchase shares worth US$7 million, indicating confidence in its valuation which trades below estimated fair value by about 22%.

- Unlock comprehensive insights into our analysis of PCB Bancorp stock in this health report.

Review our historical performance report to gain insights into PCB Bancorp's's past performance.

West Bancorporation (WTBA)

Simply Wall St Value Rating: ★★★★★★

Overview: West Bancorporation, Inc. is a financial holding company offering community banking and trust services to individuals and small- to medium-sized businesses in the United States, with a market cap of $402.51 million.

Operations: The company's revenue is primarily derived from its community banking segment, amounting to $91.78 million. The net profit margin stands at 28.5%, indicating efficiency in converting revenue into profit.

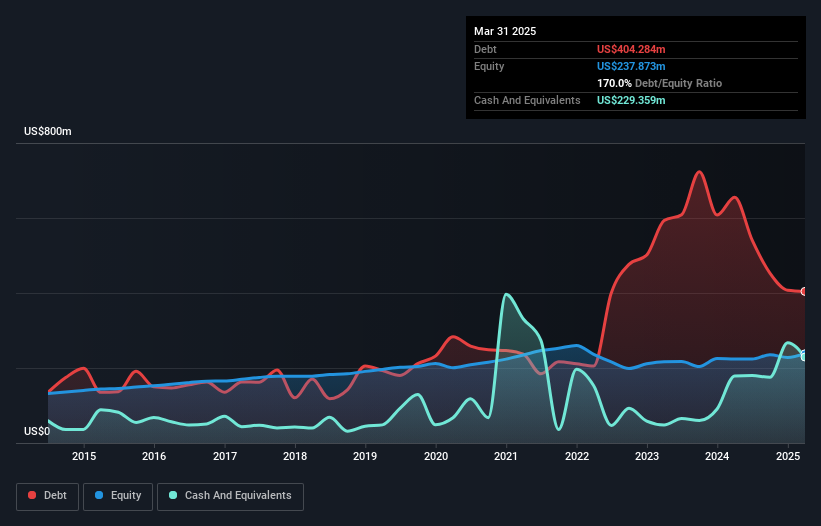

West Bancorporation, with assets totaling $4 billion and equity of $255.1 million, is an intriguing player in the financial sector. It holds deposits of $3.3 billion against loans of $3 billion, demonstrating a solid balance sheet. The bank boasts a net interest margin of 1.9% and maintains a sufficient allowance for bad loans at 0.01% of total loans, highlighting its prudent risk management approach. Despite recent insider selling activity, the company trades at 15% below estimated fair value and has experienced impressive earnings growth over the past year at 50%, outpacing industry averages significantly.

Turning Ideas Into Actions

- Explore the 295 names from our US Undiscovered Gems With Strong Fundamentals screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if West Bancorporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WTBA

West Bancorporation

Operates as the financial holding company provides community banking and trust services to individuals and small- to medium-sized businesses in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion