- United States

- /

- Chemicals

- /

- NYSEAM:FSI

3 US Penny Stocks With Market Caps Over $40M

Reviewed by Simply Wall St

As the U.S. stock market attempts to recover from a recent sell-off, major indexes like the Dow Jones and S&P 500 have shown mixed performance, reflecting investor uncertainty amid fluctuating economic indicators. In such a climate, investors often seek opportunities in less conventional areas of the market, including penny stocks. Despite their outdated name, penny stocks represent smaller or newer companies that can offer significant growth potential when backed by strong financials.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.78651 | $5.71M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.20 | $547.49M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.60 | $2.07B | ★★★★★★ |

| Better Choice (NYSEAM:BTTR) | $1.7889 | $3.24M | ★★★★★★ |

| ARC Document Solutions (NYSE:ARC) | $3.42 | $147.91M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.61 | $51.81M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.70 | $113.74M | ★★★★★★ |

| MIND C.T.I (NasdaqGM:MNDO) | $1.88 | $39.56M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.07 | $96.23M | ★★★★★☆ |

Click here to see the full list of 764 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Cheche Group (NasdaqCM:CCG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cheche Group Inc. operates an auto insurance technology platform and has a market cap of $65.03 million.

Operations: The company generates revenue of CN¥3.33 billion from its insurance brokers segment.

Market Cap: $65.03M

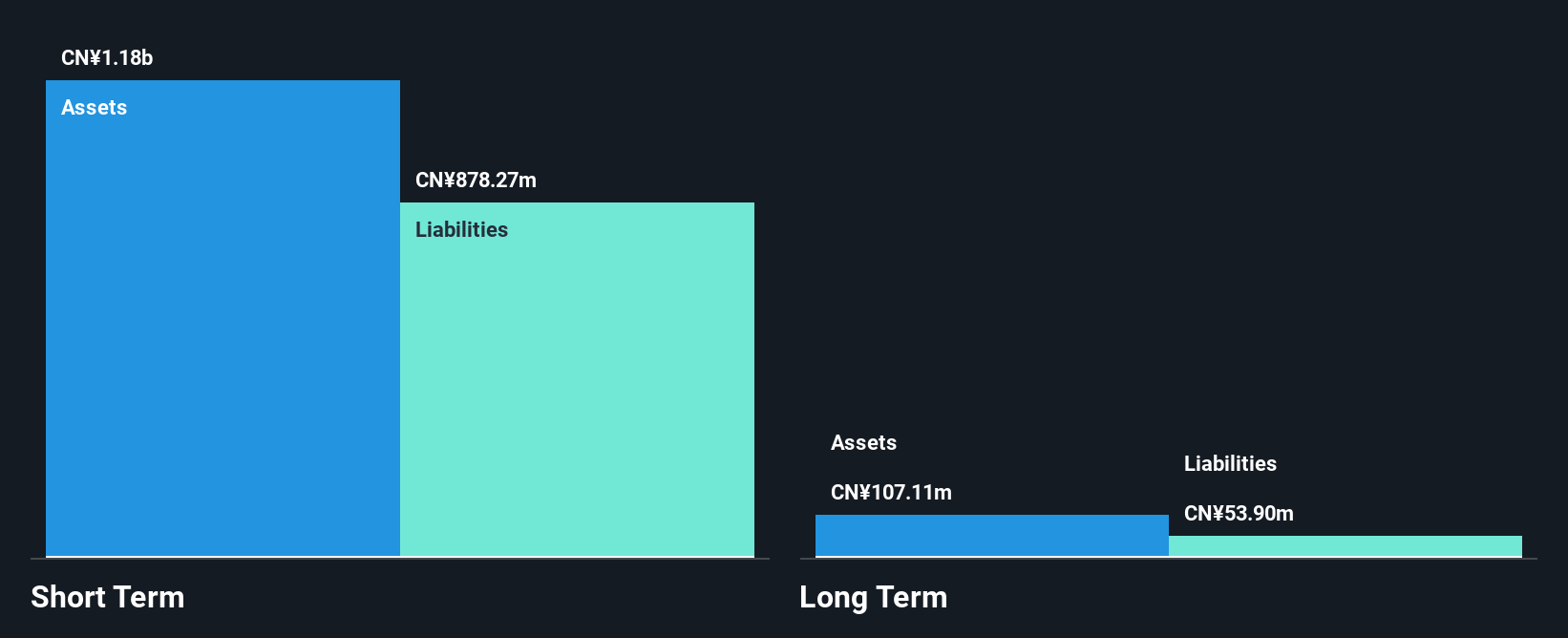

Cheche Group Inc., with a market cap of US$65.03 million, is navigating the penny stock landscape by leveraging strategic partnerships to enhance its auto insurance technology platform. The company reported CN¥3.33 billion in revenue from its insurance brokers segment and has formed alliances with major players like Tokio Marine & Nichido Fire Insurance and Great Wall Motor Company, expanding its reach in China's automotive sector. Despite being unprofitable, Cheche's collaborations aim to diversify revenue streams and improve service capabilities, while maintaining a stable cash runway exceeding three years amidst high share price volatility.

- Dive into the specifics of Cheche Group here with our thorough balance sheet health report.

- Gain insights into Cheche Group's future direction by reviewing our growth report.

Cardiff Oncology (NasdaqCM:CRDF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cardiff Oncology, Inc. is a clinical-stage biotechnology company based in California that focuses on developing novel cancer therapies, with a market cap of $130.80 million.

Operations: The company generates revenue from its Biotechnology (Startups) segment, amounting to $0.67 million.

Market Cap: $130.8M

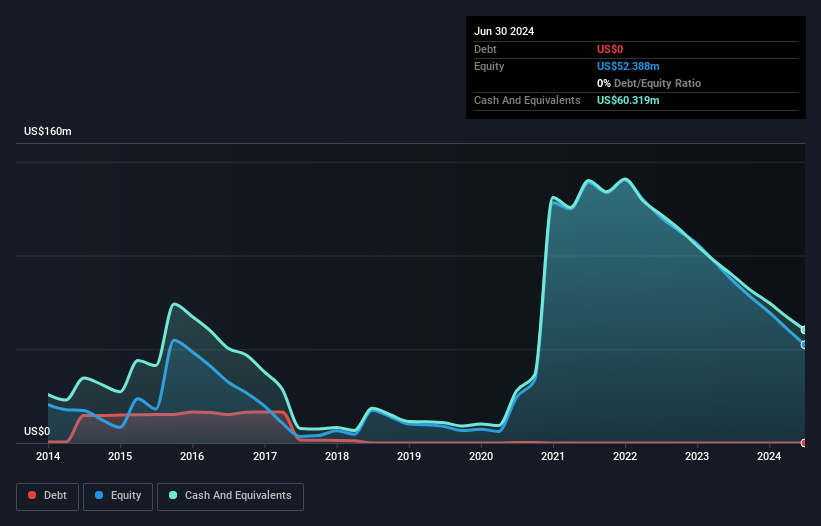

Cardiff Oncology, Inc., a clinical-stage biotech firm with a US$130.80 million market cap, remains pre-revenue with earnings forecasted to decline by 29% annually over the next three years. Despite this, the company benefits from being debt-free and having short-term assets of US$62.2 million that cover both its short- and long-term liabilities. The management team is experienced, though shareholders faced dilution last year. Cardiff's recent inclusion in the S&P Global BMI Index highlights some recognition in financial markets, yet its unprofitability continues with losses increasing over five years at 20.9% per annum.

- Take a closer look at Cardiff Oncology's potential here in our financial health report.

- Understand Cardiff Oncology's earnings outlook by examining our growth report.

Flexible Solutions International (NYSEAM:FSI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Flexible Solutions International, Inc. develops, manufactures, and markets specialty chemicals to reduce water evaporation in Canada, the United States, and internationally with a market cap of $47.69 million.

Operations: The company's revenue is primarily derived from Biodegradable Polymers (TPA) at $37.42 million, with a smaller contribution from Energy and Water Conservation Products (EWCP) totaling $0.48 million.

Market Cap: $47.69M

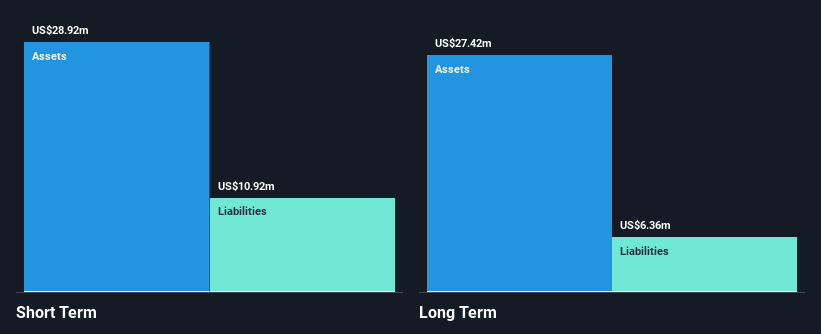

Flexible Solutions International, with a market cap of US$47.69 million, has shown mixed financial performance. Recent revenue growth is evident, with third-quarter sales rising from US$8.721 million in 2023 to US$9.287 million in 2024. However, the company faces challenges such as declining profit margins and negative earnings growth over the past year compared to industry averages. Despite this, it maintains strong financial health with short-term assets exceeding both its short- and long-term liabilities and more cash than debt. The board's experienced tenure adds stability, while shareholders have not faced significant dilution recently.

- Click here and access our complete financial health analysis report to understand the dynamics of Flexible Solutions International.

- Assess Flexible Solutions International's future earnings estimates with our detailed growth reports.

Turning Ideas Into Actions

- Reveal the 764 hidden gems among our US Penny Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:FSI

Flexible Solutions International

Develops, manufactures, and markets specialty chemicals that slow the evaporation of water in Canada, the United States, and internationally.

Flawless balance sheet with solid track record.