- United States

- /

- Insurance

- /

- NasdaqCM:ACIC

Undervalued Small Caps With Insider Buying In The Region

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 1.9% drop, yet it remains up by 14% over the past year with earnings forecasted to grow annually by the same percentage. In this dynamic environment, identifying small-cap stocks that are perceived as undervalued and have insider buying activity can indicate potential opportunities for investors seeking growth.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| First Mid Bancshares | 11.2x | 2.8x | 38.24% | ★★★★★★ |

| First United | 10.6x | 2.8x | 43.80% | ★★★★★☆ |

| Quanex Building Products | 27.8x | 0.7x | 41.31% | ★★★★☆☆ |

| S&T Bancorp | 11.3x | 3.9x | 39.87% | ★★★★☆☆ |

| Innovex International | 8.7x | 1.8x | 42.08% | ★★★★☆☆ |

| German American Bancorp | 17.4x | 5.8x | 48.40% | ★★★☆☆☆ |

| Franklin Financial Services | 14.9x | 2.4x | 25.63% | ★★★☆☆☆ |

| Alpha Metallurgical Resources | 9.3x | 0.6x | -193.97% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -48.83% | ★★★☆☆☆ |

| Thryv Holdings | NA | 0.9x | 3.56% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

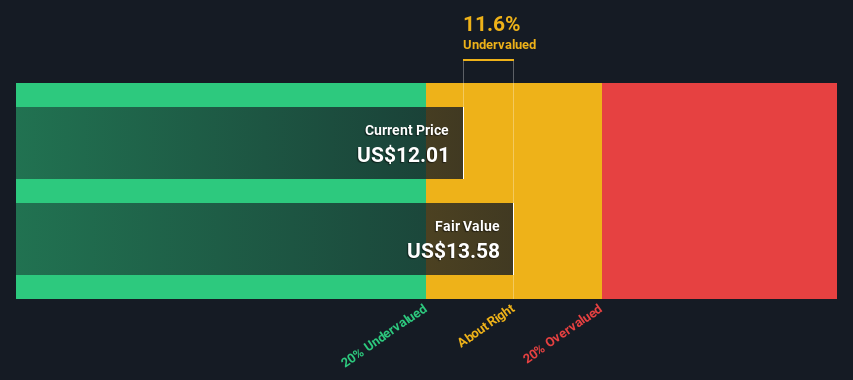

American Coastal Insurance (NasdaqCM:ACIC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: American Coastal Insurance operates as a provider of property and casualty insurance, focusing on offering coverage solutions primarily for residential and commercial properties, with a market capitalization of approximately $0.17 billion.

Operations: ACIC's revenue streams have shown fluctuations, with a notable increase in gross profit margin from 0.24% to 52.70% over recent periods. The company has experienced varying net income margins, swinging from negative to positive figures, reaching up to 29.17%. Cost of goods sold (COGS) and operating expenses are significant components influencing financial outcomes, with COGS showing a decrease relative to revenue in the latest quarters.

PE: 8.1x

American Coastal Insurance, a smaller company in the insurance sector, recently reported a revenue increase to US$79.27 million for Q4 2024 from US$51.25 million the previous year, though net income dropped significantly to US$4.95 million from US$14.28 million. Despite relying entirely on external borrowing for funding, indicating higher risk than customer deposits, insider confidence is evident with recent share purchases by executives. The new CEO aims to enhance market position and shareholder value through strategic initiatives and operational improvements.

- Take a closer look at American Coastal Insurance's potential here in our valuation report.

Learn about American Coastal Insurance's historical performance.

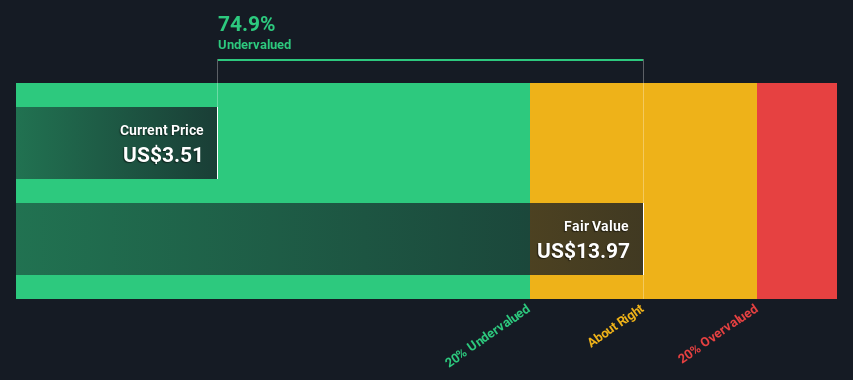

OraSure Technologies (NasdaqGS:OSUR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: OraSure Technologies is a company that specializes in providing diagnostic and molecular solutions, with a market cap of approximately $0.5 billion.

Operations: The company's revenue primarily stems from its Diagnostics and Molecular Solutions segment, with a recent quarterly figure of $185.83 million. The gross profit margin has fluctuated over time, reaching 44.26% in the latest quarter. Operating expenses are significant, with General & Administrative expenses being a major component at $46.22 million for the same period.

PE: -12.4x

OraSure Technologies, a smaller player in the U.S. market, has seen its shares pressured by legal challenges and declining sales, with fourth-quarter 2024 revenues dropping to US$37.45 million from US$75.88 million the previous year. Despite these setbacks, insider confidence is evident as company leaders have been purchasing shares over recent months. The firm is exploring acquisitions to boost innovation while expanding access to their HIV self-test for younger users following FDA approval changes in January 2025.

agilon health (NYSE:AGL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Agilon Health operates within the healthcare facilities and services sector, focusing on transforming primary care for seniors, with a market capitalization of approximately $8.82 billion.

Operations: The company's primary revenue stream is from healthcare facilities and services, with recent revenues reaching $6.06 billion. The cost of goods sold (COGS) closely aligns with revenue figures, indicating high operational costs. Notably, the gross profit margin has shown a significant decline over time, dropping to 0.08% as of the latest period. Operating expenses are substantial, with general and administrative expenses being a major component consistently above $260 million in recent periods.

PE: -5.8x

agilon health's recent earnings report showed a substantial revenue increase to US$1.52 billion for Q4 2024, up from US$1.06 billion the previous year, while net losses narrowed significantly. Despite being unprofitable and relying on external borrowing, insider confidence was evident with share purchases in February 2025. The company anticipates revenues between US$5.83 billion and US$6.03 billion for 2025, reflecting potential growth in its healthcare services sector despite current volatility in share prices over the past three months.

- Delve into the full analysis valuation report here for a deeper understanding of agilon health.

Evaluate agilon health's historical performance by accessing our past performance report.

Summing It All Up

- Embark on your investment journey to our 63 Undervalued US Small Caps With Insider Buying selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade American Coastal Insurance, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ACIC

American Coastal Insurance

Through its subsidiaries, primarily engages in the commercial and personal property, and casualty insurance business in the United States.

Good value with adequate balance sheet.