- United States

- /

- Insurance

- /

- NasdaqGS:ACGL

Should You Be Adding Arch Capital Group (NASDAQ:ACGL) To Your Watchlist Today?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Arch Capital Group (NASDAQ:ACGL). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Arch Capital Group

How Fast Is Arch Capital Group Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Who among us would not applaud Arch Capital Group's stratospheric annual EPS growth of 46%, compound, over the last three years? That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

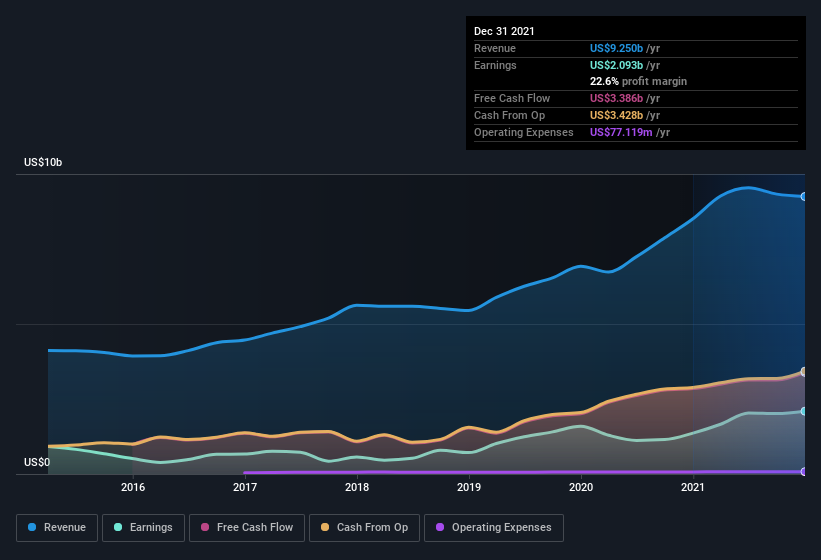

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of Arch Capital Group's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. The good news is that Arch Capital Group is growing revenues, and EBIT margins improved by 2.6 percentage points to 24%, over the last year. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Arch Capital Group EPS 100% free.

Are Arch Capital Group Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We did see some selling in the last twelve months, but that's insignificant compared to the whopping US$20m that the Independent Chairman of the Board, John Pasquesi spent acquiring shares. The average price paid was about US$41.23. The quantum of that insider purchase is both rare and a sight to behold, not unlike an endangered Amur Leopard in the wild.

Along with the insider buying, another encouraging sign for Arch Capital Group is that insiders, as a group, have a considerable shareholding. Notably, they have an enormous stake in the company, worth US$539m. I would find that kind of skin in the game quite encouraging, if I owned shares, since it would ensure that the leaders of the company would also experience my success, or failure, with the stock.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. The cherry on top is that the CEO, Marc Grandisson is paid comparatively modestly to CEOs at similar sized companies. I discovered that the median total compensation for the CEOs of companies like Arch Capital Group, with market caps over US$8.0b, is about US$12m.

Arch Capital Group offered total compensation worth US$8.8m to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does Arch Capital Group Deserve A Spot On Your Watchlist?

Arch Capital Group's earnings have taken off like any random crypto-currency did, back in 2017. The incing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Arch Capital Group deserves timely attention. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Arch Capital Group is trading on a high P/E or a low P/E, relative to its industry.

The good news is that Arch Capital Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Arch Capital Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ACGL

Arch Capital Group

Provides insurance, reinsurance, and mortgage insurance products in the United States, Canada, Bermuda, the United Kingdom, Europe, and Australia.

Very undervalued with excellent balance sheet.