- United States

- /

- Insurance

- /

- NasdaqGS:ACGL

Reassessing Arch Capital Group (ACGL): Is the Market Undervaluing This Quiet Performer?

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 18.3% Undervalued

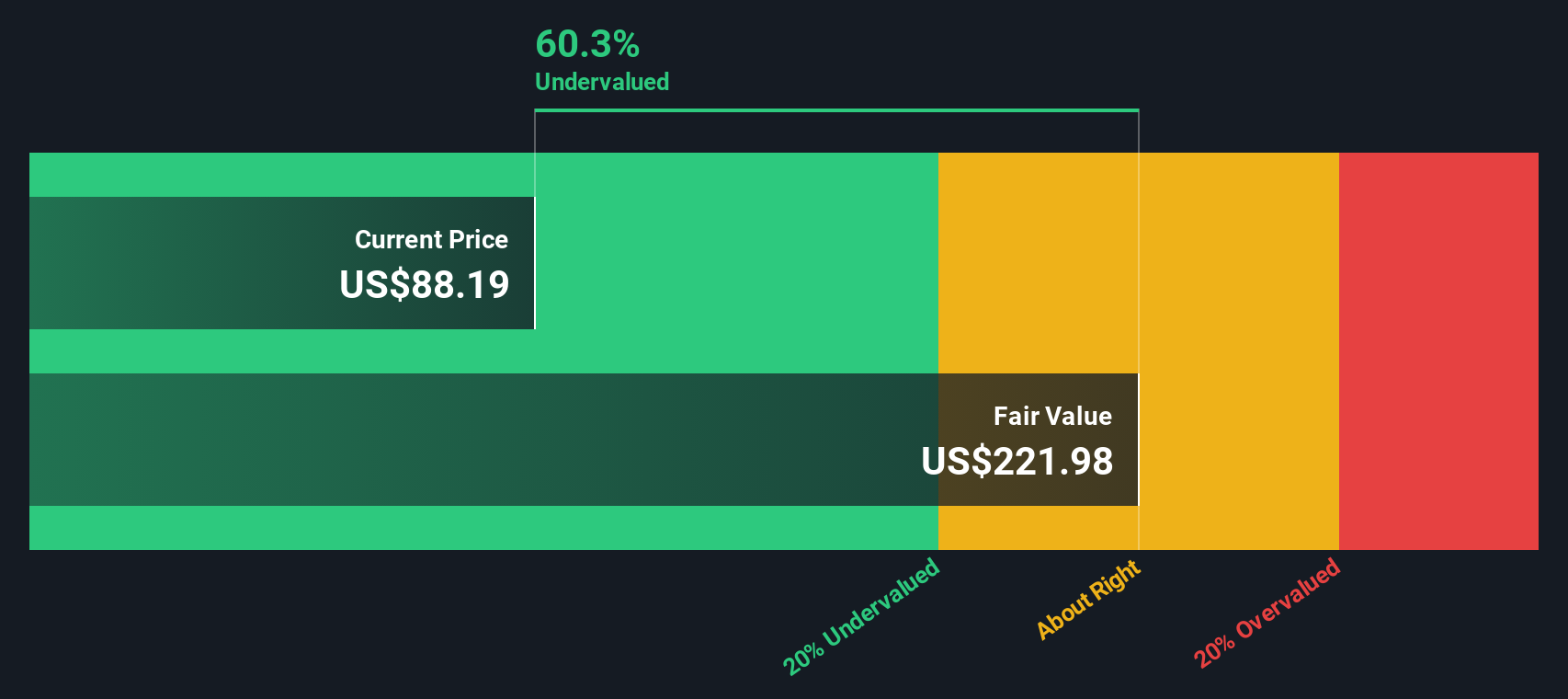

Arch Capital Group is seen as significantly undervalued in the most widely followed narrative, with a fair value estimate well above the current market price.

"Arch Capital's cycle management strategy focuses on allocating capital to lines of business with attractive risk-adjusted returns, potentially driving future earnings growth. The company's investment in data and analytics is seen as a catalyst for enhancing risk selection capabilities, improving underwriting profitability and net margins over time."

Want to know the secret sauce behind this undervaluation? The narrative points to powerful financial projections and a bold shift in profitability expectations. Curious which big changes in core earnings and margins drive the higher price target? The underlying numbers might surprise you. Dig deeper to see what sets this valuation apart.

Result: Fair Value of $108.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, significant catastrophe losses and intensifying industry competition could quickly challenge even the most optimistic outlook for Arch Capital Group.

Find out about the key risks to this Arch Capital Group narrative.Another View: Discounted Cash Flow

Taking a different approach, our DCF model also finds Arch Capital Group to be undervalued at current levels. But does this method really capture all the moving parts? Or is something still missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Arch Capital Group Narrative

If you see things differently or want a fresh take based on your own analysis, you can dive in and build a unique perspective in just a few minutes. Do it your way

A great starting point for your Arch Capital Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Savvy investors always keep their options open. Make sure you’re not missing out on tomorrow’s top opportunities by checking out other focused investment themes that Just Might Outperform.

- Tap into long-term income streams and stability by scanning for dividend stocks with yields > 3% offering yields above 3%.

- Spot emerging leaders where artificial intelligence breakthroughs are reshaping industries with our powerful AI penny stocks search.

- Capitalize on under-the-radar potential with a handpicked selection of undervalued stocks based on cash flows primed for future growth based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACGL

Arch Capital Group

Provides insurance, reinsurance, and mortgage insurance products in the United States, Canada, Bermuda, the United Kingdom, Europe, and Australia.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives