- United States

- /

- Personal Products

- /

- NYSE:YSG

Yatsen Holding Limited (NYSE:YSG) Stock's 26% Dive Might Signal An Opportunity But It Requires Some Scrutiny

The Yatsen Holding Limited (NYSE:YSG) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 33% share price drop.

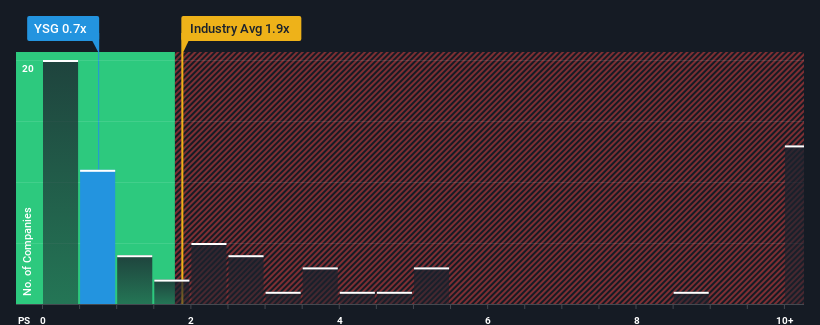

Following the heavy fall in price, Yatsen Holding may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.7x, since almost half of all companies in the Personal Products industry in the United States have P/S ratios greater than 1.9x and even P/S higher than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Yatsen Holding

How Yatsen Holding Has Been Performing

Yatsen Holding hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Yatsen Holding will help you uncover what's on the horizon.How Is Yatsen Holding's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Yatsen Holding's is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 4.4%. The last three years don't look nice either as the company has shrunk revenue by 40% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 11% during the coming year according to the four analysts following the company. That's shaping up to be materially higher than the 7.5% growth forecast for the broader industry.

With this information, we find it odd that Yatsen Holding is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Yatsen Holding's P/S

Yatsen Holding's P/S has taken a dip along with its share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A look at Yatsen Holding's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Yatsen Holding that you need to be mindful of.

If you're unsure about the strength of Yatsen Holding's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YSG

Yatsen Holding

Engages in the development and sale of beauty products under the Perfect Diary, Little Ondine, Pink Bear, Abby’s Choice, GalÃnic, DR.WU, Eve Lom, and EANTiM brands in the People’s Republic of China.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives