- United States

- /

- Personal Products

- /

- NYSE:YSG

It's A Story Of Risk Vs Reward With Yatsen Holding Limited (NYSE:YSG)

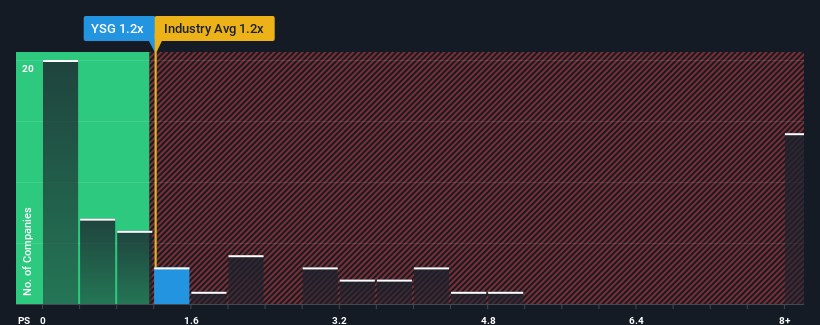

There wouldn't be many who think Yatsen Holding Limited's (NYSE:YSG) price-to-sales (or "P/S") ratio of 1.2x is worth a mention when the median P/S for the Personal Products industry in the United States is very similar. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Yatsen Holding

How Yatsen Holding Has Been Performing

Yatsen Holding has been struggling lately as its revenue has declined faster than most other companies. Perhaps the market is expecting future revenue performance to begin matching the rest of the industry, which has kept the P/S from declining. You'd much rather the company improve its revenue if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Yatsen Holding will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Yatsen Holding?

The only time you'd be comfortable seeing a P/S like Yatsen Holding's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 32% decrease to the company's top line. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 18% during the coming year according to the four analysts following the company. With the industry only predicted to deliver 7.1%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Yatsen Holding is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Yatsen Holding's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Yatsen Holding currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Yatsen Holding that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:YSG

Yatsen Holding

Engages in the development and sale of beauty products under the Perfect Diary, Little Ondine, Pink Bear, Abby’s Choice, GalÃnic, DR.WU, Eve Lom, and EANTiM brands in the People’s Republic of China.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives