- United States

- /

- Personal Products

- /

- NYSE:YSG

April 2025's Top Penny Stocks To Watch

Reviewed by Simply Wall St

As the U.S. stock market navigates a landscape marked by trade tensions and export restrictions, investors are keenly observing how these macroeconomic factors influence various sectors. The term 'penny stocks' might feel like a relic of past market eras, but the potential they represent is as real as ever. Typically referring to smaller or relatively new companies, these stocks can provide a mix of affordability and growth potential when paired with strong financials.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.32 | $362.76M | ✅ 3 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $2.06 | $1.2B | ✅ 3 ⚠️ 3 View Analysis > |

| Smith Micro Software (NasdaqCM:SMSI) | $0.83 | $14.31M | ✅ 4 ⚠️ 4 View Analysis > |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $2.786 | $8.28M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $3.80 | $48.82M | ✅ 4 ⚠️ 3 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.37 | $70.98M | ✅ 3 ⚠️ 1 View Analysis > |

| BAB (OTCPK:BABB) | $0.8208 | $5.66M | ✅ 2 ⚠️ 3 View Analysis > |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $229.5M | ✅ 3 ⚠️ 2 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.87 | $88.65M | ✅ 3 ⚠️ 2 View Analysis > |

| New Horizon Aircraft (NasdaqCM:HOVR) | $0.4257 | $12.15M | ✅ 3 ⚠️ 5 View Analysis > |

Click here to see the full list of 788 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Cytek Biosciences (NasdaqGS:CTKB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cytek Biosciences, Inc. is a cell analysis solutions company offering tools for biomedical research and clinical applications, with a market cap of approximately $481.65 million.

Operations: The company generates revenue from its Scientific & Technical Instruments segment, amounting to $200.45 million.

Market Cap: $481.65M

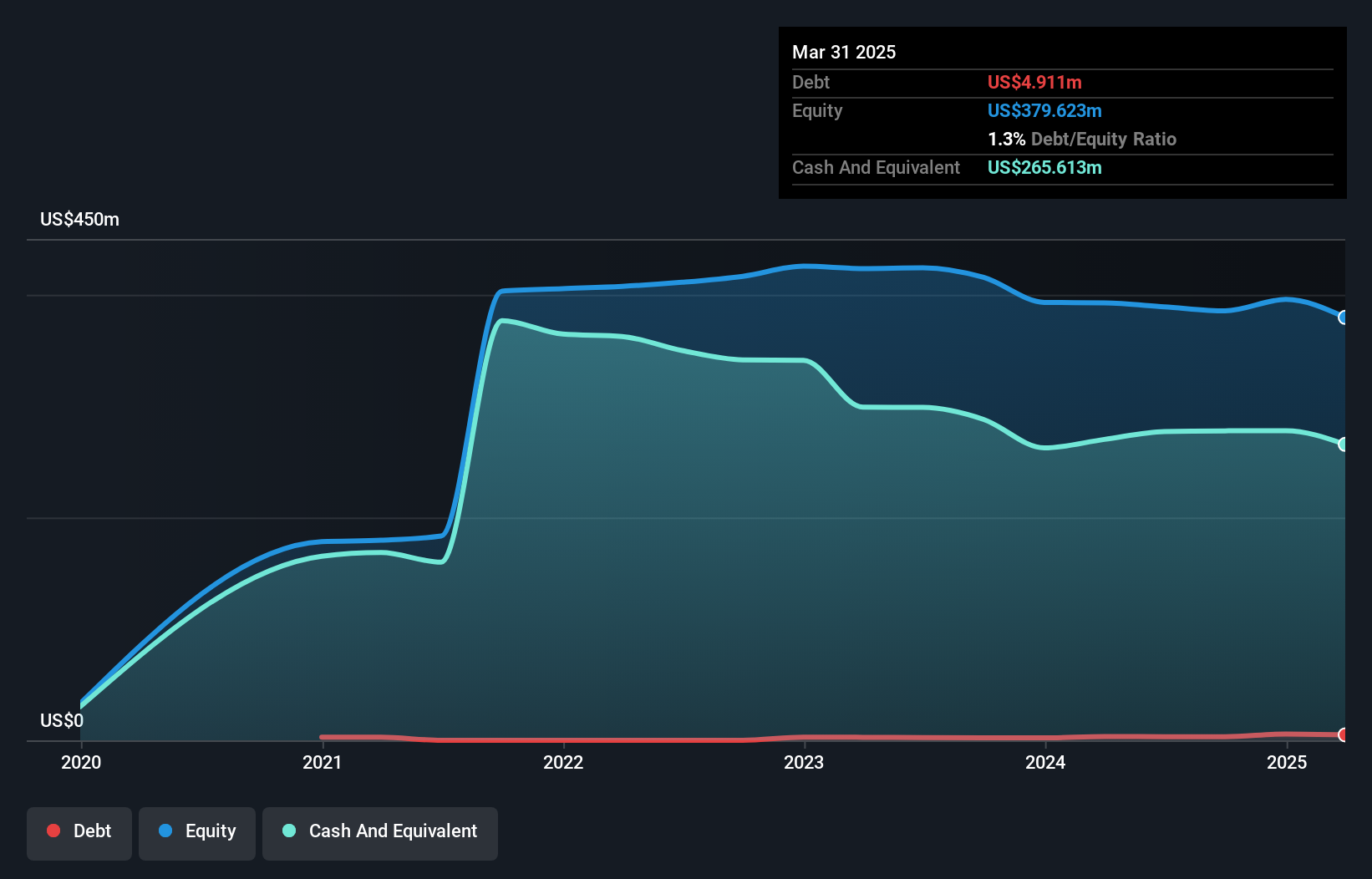

Cytek Biosciences, with a market cap of US$481.65 million, is navigating the penny stock landscape with a focus on innovative cell analysis solutions. Despite being unprofitable, the company boasts more cash than debt and a robust cash runway exceeding three years, supported by positive free cash flow growth. Recent developments include the launch of the Cytek Muse Micro cell analyzer, enhancing accessibility and precision in flow cytometry for various applications. The company's revenue grew to US$200.45 million in 2024 from US$193.02 million in 2023, although it reported a net loss reduction to US$6.02 million from US$12.15 million previously.

- Click here to discover the nuances of Cytek Biosciences with our detailed analytical financial health report.

- Gain insights into Cytek Biosciences' outlook and expected performance with our report on the company's earnings estimates.

Ribbon Communications (NasdaqGS:RBBN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ribbon Communications Inc. offers communications technology solutions across the United States, Europe, the Middle East, Africa, the Asia Pacific, and globally with a market cap of approximately $616.79 million.

Operations: The company's revenue is derived from two primary segments: Cloud and Edge, which generated $505.16 million, and IP Optical Networks, contributing $328.72 million.

Market Cap: $616.79M

Ribbon Communications, with a market cap of US$616.79 million, is actively involved in the communications sector through its Cloud and Edge and IP Optical Networks segments. Despite being unprofitable, it has managed to reduce losses over five years while maintaining a strong cash runway for more than three years. Recent strategic moves include showcasing advanced optical solutions at industry conferences and expanding ties with Converge ICT Solutions to enhance network capabilities. The company plans to increase authorized shares, which could impact future capital structure decisions. Analysts suggest potential stock price appreciation based on current valuations.

- Click to explore a detailed breakdown of our findings in Ribbon Communications' financial health report.

- Evaluate Ribbon Communications' prospects by accessing our earnings growth report.

Yatsen Holding (NYSE:YSG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Yatsen Holding Limited develops and sells beauty products under various brands in China, with a market cap of $337.68 million.

Operations: In the People's Republic of China, Yatsen Holding generated revenue of CN¥3.39 billion from its beauty product sales.

Market Cap: $337.68M

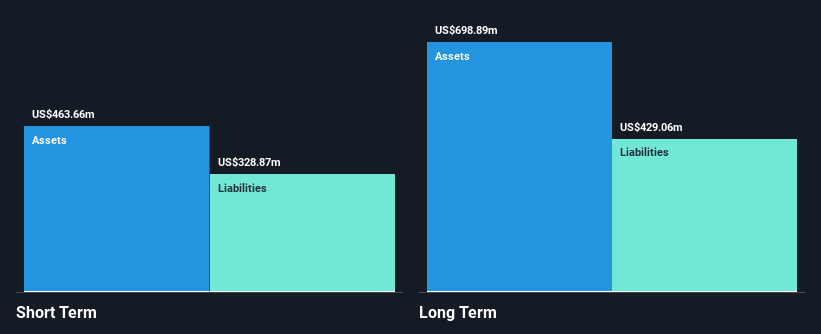

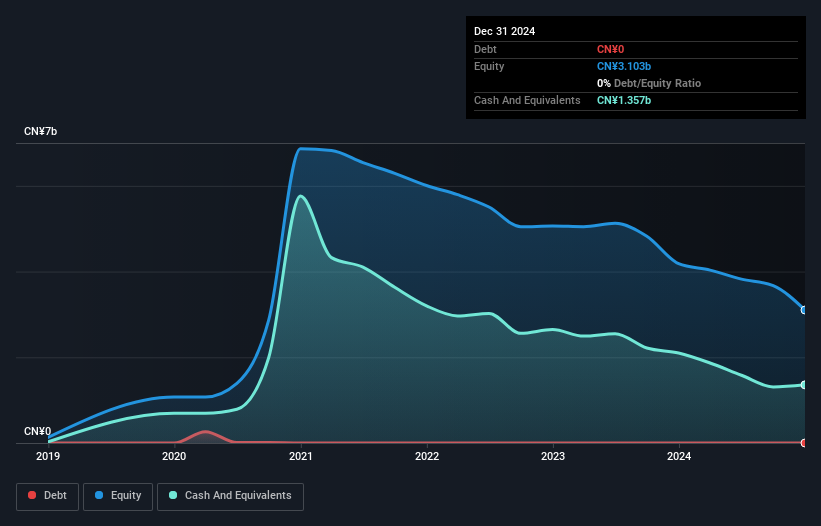

Yatsen Holding, with a market cap of US$337.68 million, operates within the beauty industry in China. Despite being unprofitable, it has reduced losses over the past five years by 23% annually. Recent earnings reported a net loss of CN¥708.17 million for 2024, with revenue slightly declining to CN¥3.39 billion from the previous year. The company anticipates modest revenue growth in Q1 2025 between RMB788.8 million and RMB866.2 million, despite facing goodwill impairments totaling USD 55.2 million for Q4 2024. Yatsen's short-term assets exceed both its short-term and long-term liabilities significantly, providing some financial stability amidst volatility concerns.

- Get an in-depth perspective on Yatsen Holding's performance by reading our balance sheet health report here.

- Explore Yatsen Holding's analyst forecasts in our growth report.

Taking Advantage

- Explore the 788 names from our US Penny Stocks screener here.

- Contemplating Other Strategies? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Yatsen Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YSG

Yatsen Holding

Engages in the development and sale of beauty products under the Perfect Diary, Little Ondine, Pink Bear, Abby’s Choice, GalÃnic, DR.WU, Eve Lom, and EANTiM brands in the People’s Republic of China.

Good value with adequate balance sheet.

Market Insights

Community Narratives