- United States

- /

- Household Products

- /

- NYSE:PG

Why Procter & Gamble (NYSE:PG) was one of the Rare Companies Delivering Positive Returns Last Week

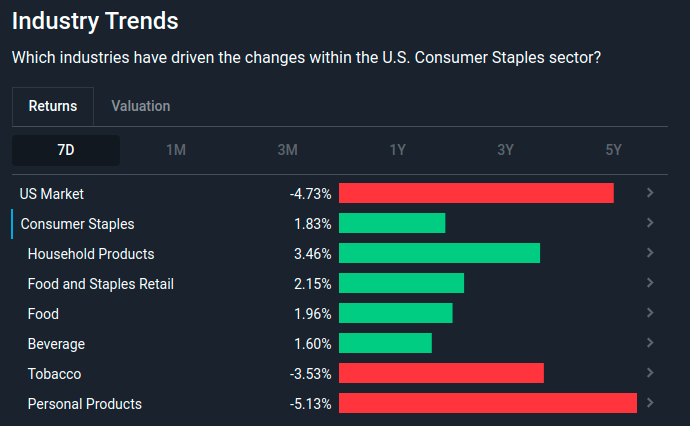

The U.S. market is starting to see some short-term turmoil, as the 7-day returns are currently -4.73%. We drilled down at the industry level to see which stocks are holding up against the tide, and found that the Consumer Staples are part of the rare group still managing short term positive returns. Today, we will review the importance of this industry, as well as single out The Procter & Gamble Company (NYSE:PG) for our analysis.

The key takeaways from our analysis are:

- Consumer Staples are demonstrating defensive properties, and investors are increasing their appetite for this industry.

- The industry is retaining a higher 24.7x PE, indicating more optimism than the broader market 16.7x PE

- Procter & Gamble are at the top of the gainers list, as the stocks has regular earnings, a diversified product portfolio, and stable dividends.

If you are interested in getting a full fundamental picture on Procter & Gamble, you can take a look at our daily report.

Industry Movements

While the general market is slightly down, we can see that the Consumer Staples industry is hanging on. A drill-down of its sub-categories shows that household products is the top gainer with 3.46%.

You can also view how other industries are doing within our Markets segment.

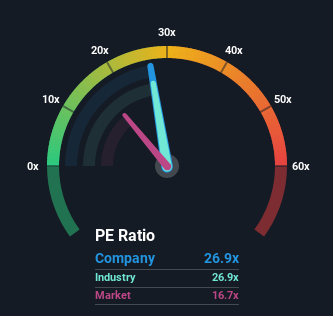

The median Price to Earnings ratio for the consumer stales industry is currently 24.7x while the 3-year historical average is 21.2x for this industry.

The P/E has recently grown over historical averages in this industry, which may indicate that investors are rotating toward defensive stocks with stable earnings power.

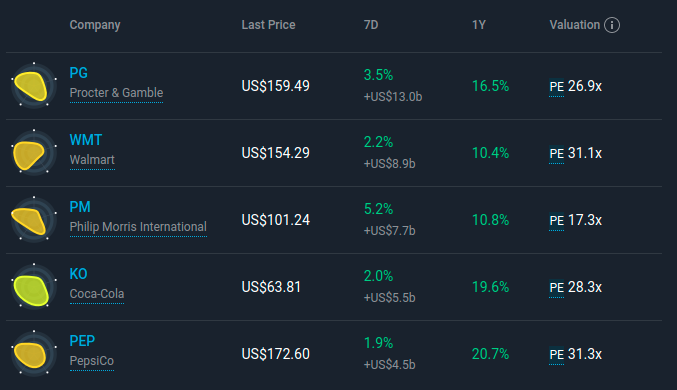

We will explore how these stocks are priced in the chart below:

The top gainers seem to be stable blue-chip stocks with recognizable brand names and pricing power which allows them to pass on costs downstream.

We chose to focus on Procter and Gamble for this analysis, because it seems to have reasonable pricing, backed by a stable 2.18% dividend yield.

Additionally, here are the reasons we excluded the other stocks:

- Walmart (NYSE:WMT): seems to have limited upside on account of its maturity and the significant gains made in the last 2 years.

- Philip Morris (NYSE:PM): Global smoking trends are in decline, and while economic stress may prompt people to increase tobacco use temporarily, the levied taxes leave slim earnings for investors. Notably, it has a 4.94% dividend yield.

- Coca-Cola (NYSE:KO): Seems to be fully priced, and global demand for soft drinks is stagnating.

- PepsiCo (NYSE:PEP): Has great fundamentals and dividends, however it sells branded products that may give way to essentials and the price to earnings implies additional growth.

Procter & Gamble Pricing Analysis

Considering that close to half the companies in the United States have a PE around 16x, you may consider Procter & Gamble as a stock to avoid with its 26.9x P/E ratio.

However, the company seems to be appropriately priced based on the industry P/E, and consumers may change their behavior in the future - from discrete and luxury products to the essentials.

See our latest analysis for Procter & Gamble

Want the full picture on analyst estimates for the company? Then our free report on Procter & Gamble will help you uncover what's on the horizon.

Future estimates from the analysts covering the company suggest earnings should grow by 4.7% per year over the next three years.

While we can see no significant growth, Procter & Gamble's wide product portfolio gives the company diversification protections, and should economic pressures become stronger, it is more likely that smaller competitors will suffer more, while Procter & Gamble picks up additional market share.

The company also appears to be in outstanding financial health, with little interest rate and liquidity risks.

Conclusion

Investors who believe that the current economic climate will pressure future earnings, will be inclined to turn to companies with proven and stable profits. This seems to be partly why the consumers staple industry has slightly held up, while the market was down 4.7%.

Staples, or essential goods, are the goods which consumers prioritize or even stockpile when they anticipate an economic downturn. While these companies have limited upside and profits, they can be used as a more secure store of wealth until we cycle back into growth.

Procter and Gamble is one of the companies that was primarily chosen for our analysis on account of its regular earnings, stable dividend, diverse product portfolio and good balance sheet health. While this is a mature blue-chip stock, it may be well positioned to take market share from competitors that are smaller and more risky.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a P/E below 20x.

If you're looking to trade Procter & Gamble, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:PG

Procter & Gamble

Engages in the provision of branded consumer packaged goods worldwide.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives