- United States

- /

- Personal Products

- /

- NYSE:MED

Medifast, Inc.'s (NYSE:MED) 26% Dip In Price Shows Sentiment Is Matching Earnings

Unfortunately for some shareholders, the Medifast, Inc. (NYSE:MED) share price has dived 26% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 61% share price decline.

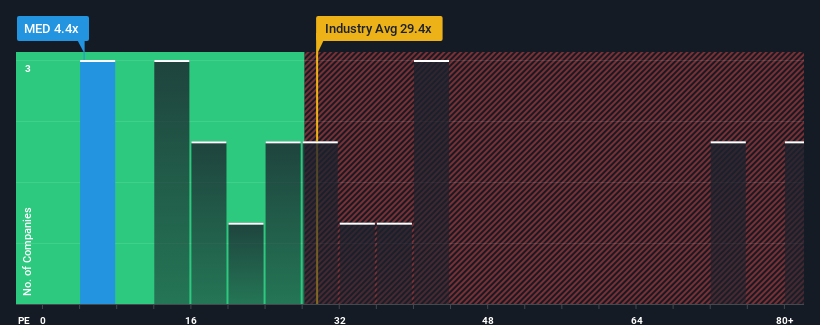

Following the heavy fall in price, Medifast may be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 4.4x, since almost half of all companies in the United States have P/E ratios greater than 17x and even P/E's higher than 32x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent times haven't been advantageous for Medifast as its earnings have been falling quicker than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Medifast

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as Medifast's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 29%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 5.5% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to slump, contracting by 38% during the coming year according to the dual analysts following the company. Meanwhile, the broader market is forecast to expand by 13%, which paints a poor picture.

With this information, we are not surprised that Medifast is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Medifast's P/E?

Medifast's P/E looks about as weak as its stock price lately. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Medifast maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Medifast with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:MED

Medifast

Through its subsidiaries, operates as a health and wellness company that provides habit-based and coach-guided lifestyle solutions to address obesity and support a healthy life in the United States.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives