- United States

- /

- Personal Products

- /

- NYSE:KVUE

Kenvue (NYSE:KVUE) Enhances Board With New Directors Amid Starboard Value Agreement

Reviewed by Simply Wall St

Kenvue (NYSE:KVUE) saw an 8.5% share price increase over the last month, likely influenced by significant board changes and agreement with activist investor Starboard Value. The addition of board members Sarah Hofstetter, Erica Mann, and Jeffrey C. Smith could enhance governance and strategic direction, appealing to shareholders concerned with stewardship and growth potential. While Kenvue's earnings results reflected stable sales and a slight decline in net income, the broader market faced headwinds, with a 1.9% decline amidst tech sector sell-offs and tariff concerns. Despite market volatility, Kenvue's moves to strengthen its board may have provided a counterbalance, signaling confidence to investors and distinguishing the stock from sector-heavy losses. As tariffs loom and economic uncertainty persists, the company's efforts to align with shareholder interests may have supported its commendable performance during a challenging market period.

Click to explore a detailed breakdown of our findings on Kenvue.

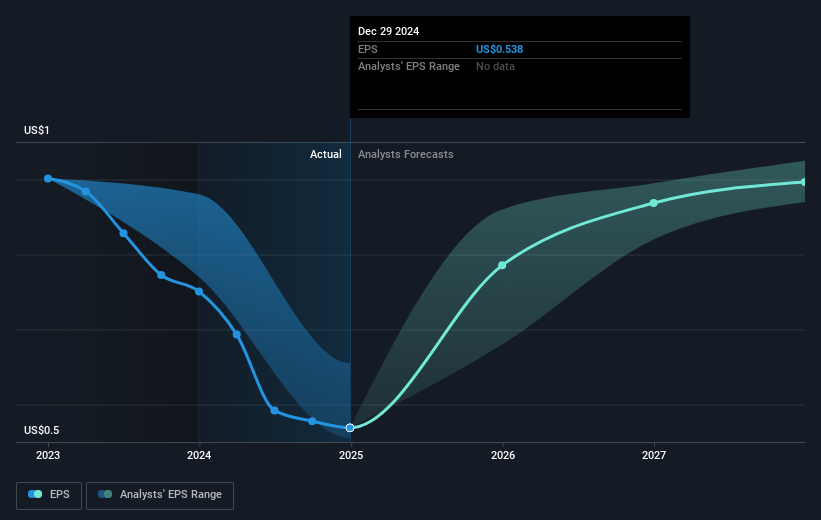

Over the last year, Kenvue's total return, including share price appreciation and dividends, was 22.32%, outperforming the US Personal Products industry, which returned 29, and the broader US market, which returned 13.1. This strong performance came despite negative earnings growth of 38.1 over the same period. A significant contributing factor to this return was the strategic implementation of stock buybacks, with Kenvue repurchasing shares worth US$98.18 million in Q1 2024 and continuing through September, totaling US$98.2 million, strengthening the share value.

Dividend enhancements also played an integral role, with a 2.5% increase in the quarterly dividend to US$0.205 per share announced in July 2024. Further amplifying investor confidence, Kenvue's inclusion in the FTSE All-World Index in September 2024 likely heightened its visibility and attractiveness to funds tracking this benchmark. Conversely, despite a slight decline in full-year net income to US$1.03 billion, these strategic moves supported its robust total return over the year.

- See whether Kenvue's current market price aligns with its intrinsic value in our detailed report

- Explore the potential challenges for Kenvue in our thorough risk analysis report.

- Hold shares in Kenvue? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kenvue might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KVUE

Kenvue

Operates as a consumer health company in the United States, Europe, the Middle East, Africa, Asia-Pacific, and Latin America.

Slight with moderate growth potential.