- United States

- /

- Personal Products

- /

- NYSE:EL

Discover ImmunityBio And Two Other Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

As the U.S. markets face volatility with regional bank shares under pressure and bond yields hitting new lows, investors are seeking stability in the form of high insider ownership within growth companies. In such uncertain times, stocks like ImmunityBio and others with significant insider stakes can offer a sense of confidence, as insiders' vested interests often align closely with shareholder value.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 92.9% |

| Prairie Operating (PROP) | 31.3% | 75.9% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| IREN (IREN) | 11.2% | 52.6% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11.1% | 30.3% |

| Celsius Holdings (CELH) | 10.8% | 32.1% |

| Atour Lifestyle Holdings (ATAT) | 18.2% | 23.7% |

| Astera Labs (ALAB) | 12.1% | 36.6% |

| Accelerant Holdings (ARX) | 24.9% | 66.5% |

Let's explore several standout options from the results in the screener.

ImmunityBio (IBRX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ImmunityBio, Inc. is a commercial-stage biotechnology company focused on developing next-generation therapies to enhance the natural immune system against cancers and infectious diseases, with a market cap of approximately $2.44 billion.

Operations: The company's revenue segment is primarily derived from its focus on developing next-generation therapies, amounting to $56.60 million.

Insider Ownership: 31.3%

Earnings Growth Forecast: 65% p.a.

ImmunityBio, Inc. demonstrates significant potential as a growth company, highlighted by its substantial insider ownership and promising product developments. Recent findings from the Phase 2 QUILT-3.055 study show ANKTIVA's potential in reversing lymphopenia in NSCLC patients, suggesting improved survival outcomes. The company's revenue is forecast to grow at an impressive 57.6% annually, outpacing market averages, although past shareholder dilution is a concern. ImmunityBio continues to expand its clinical research efforts beyond oncology into areas like long COVID treatment.

- Get an in-depth perspective on ImmunityBio's performance by reading our analyst estimates report here.

- Our valuation report here indicates ImmunityBio may be overvalued.

Estée Lauder Companies (EL)

Simply Wall St Growth Rating: ★★★★☆☆

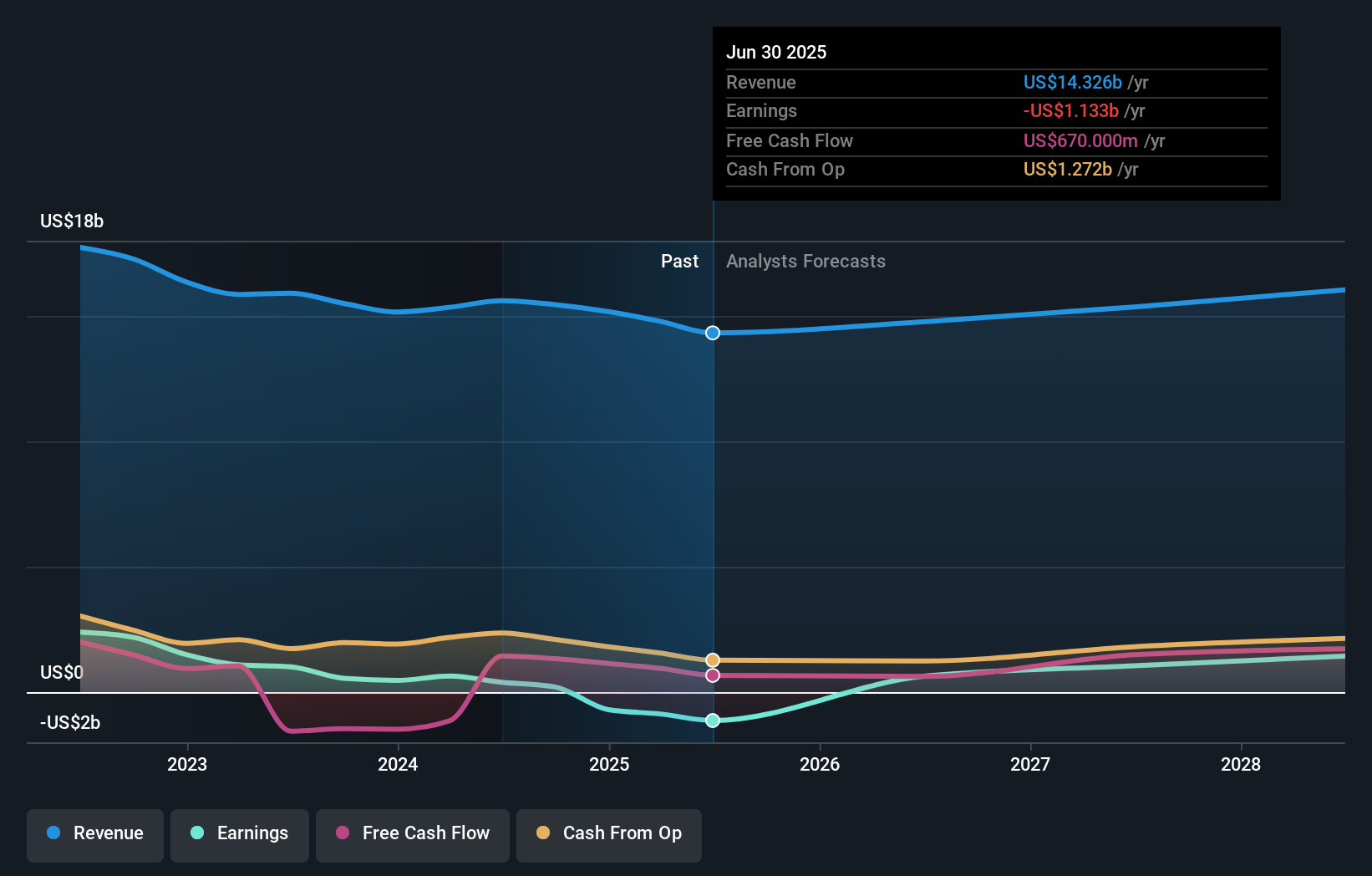

Overview: The Estée Lauder Companies Inc. is a global manufacturer, marketer, and seller of skincare, makeup, fragrance, and hair care products with a market cap of approximately $34.33 billion.

Operations: The company's revenue segments are comprised of Skin Care at $6.96 billion, Makeup at $4.21 billion, Fragrance at $2.49 billion, and Hair Care at $565 million.

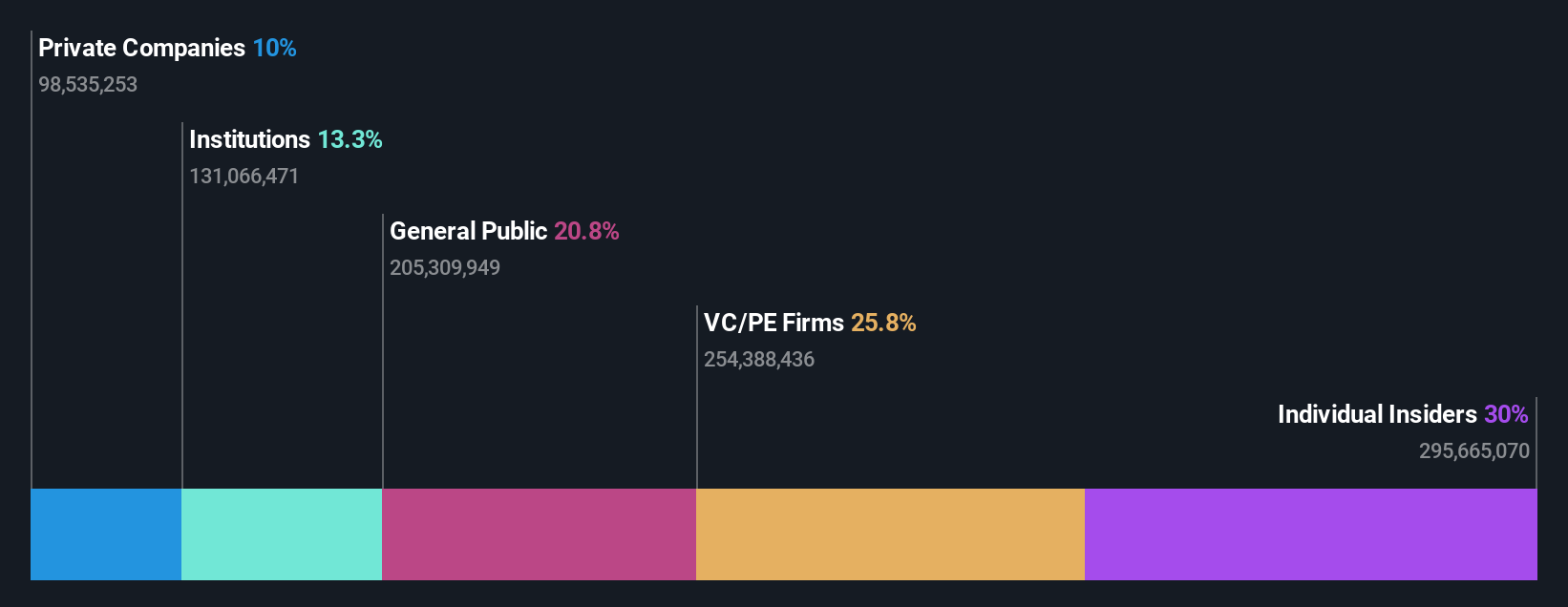

Insider Ownership: 12.7%

Earnings Growth Forecast: 50.1% p.a.

Estée Lauder Companies is positioned for growth with high insider ownership, despite recent financial challenges. Forecasts indicate a significant annual earnings growth of 50.11%, though revenue growth at 3.5% annually lags behind market averages. The company recently expanded its fragrance division with the opening of a new innovation hub in Paris, reinforcing its commitment to luxury fragrances and strategic market presence in France, while also addressing profitability challenges over the next three years.

- Click here to discover the nuances of Estée Lauder Companies with our detailed analytical future growth report.

- Our expertly prepared valuation report Estée Lauder Companies implies its share price may be too high.

TAL Education Group (TAL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TAL Education Group offers K-12 after-school tutoring services in the People’s Republic of China, with a market cap of approximately $6.66 billion.

Operations: The company's revenue segment includes after-school tutoring services, generating approximately $2.41 billion.

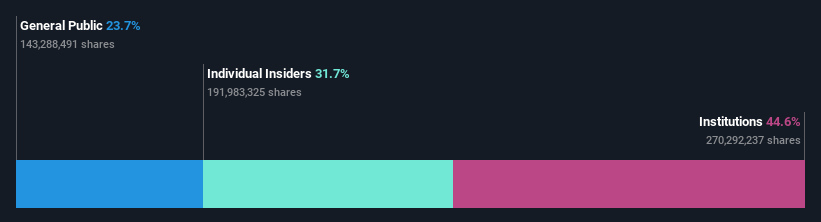

Insider Ownership: 31.6%

Earnings Growth Forecast: 32% p.a.

TAL Education Group exhibits strong growth potential, with earnings forecasted to rise significantly at 32% annually, outpacing the US market. Recent earnings showed a substantial increase in net income to US$31.28 million from US$11.4 million year-over-year. The company completed a significant share buyback and announced a new US$600 million repurchase plan, reflecting confidence in its valuation—currently trading at 57% below fair value despite high-quality earnings impacted by large one-off items.

- Take a closer look at TAL Education Group's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that TAL Education Group is trading beyond its estimated value.

Make It Happen

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 199 more companies for you to explore.Click here to unveil our expertly curated list of 202 Fast Growing US Companies With High Insider Ownership.

- Ready To Venture Into Other Investment Styles? This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Estée Lauder Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EL

Estée Lauder Companies

Manufactures, markets, and sells skin care, makeup, fragrance, and hair care products worldwide.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives