- United States

- /

- Personal Products

- /

- NYSE:COTY

Does Coty’s Strategic Overhaul and Consumer Beauty Review Signal a Shift in Its Core Focus (COTY)?

Reviewed by Sasha Jovanovic

- In late September 2025, Coty Inc. announced an organizational overhaul, integrating its Prestige Beauty and Mass Fragrance businesses and launching a comprehensive strategic review of its Consumer Beauty segment, with options ranging from partnerships to potential divestitures or spin-offs.

- This move brings into focus Coty's intent to maximize value from its core fragrance strength while actively considering significant changes to well-known brands such as CoverGirl, Rimmel, Sally Hansen, and Max Factor.

- We’ll evaluate how Coty’s in-depth review of its Consumer Beauty business could reshape the company’s investment narrative and future direction.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Coty Investment Narrative Recap

For Coty shareholders, the investment case often comes down to believing in management’s ability to drive margin expansion and restore growth through streamlined operations and successful portfolio shifts, despite industry volatility. The recent launch of senior notes to refinance debt does not materially alter the near-term catalyst for the business, which remains tied to an anticipated end to U.S. inventory destocking. However, high debt levels persist as a structural risk that could strain flexibility if sell-out trends or asset disposals underperform.

Of recent announcements, the launch of a private senior notes offering on October 2, 2025 stands out, as Coty aims to redeem certain outstanding notes and manage costs. While this move may simplify Coty's debt profile, it keeps focus on the underlying need for consistent cash flow and a stronger balance sheet, especially as the company engages in an extensive strategic review of its Consumer Beauty business amid ongoing market headwinds.

But while prospects hinge on execution, investors should be aware that persistent headwinds in U.S. inventory destocking could ...

Read the full narrative on Coty (it's free!)

Coty's outlook anticipates $6.1 billion in revenue and $302.1 million in earnings by 2028. This scenario assumes a 1.3% annual revenue growth rate and a $683.2 million increase in earnings from the current -$381.1 million.

Uncover how Coty's forecasts yield a $5.04 fair value, a 26% upside to its current price.

Exploring Other Perspectives

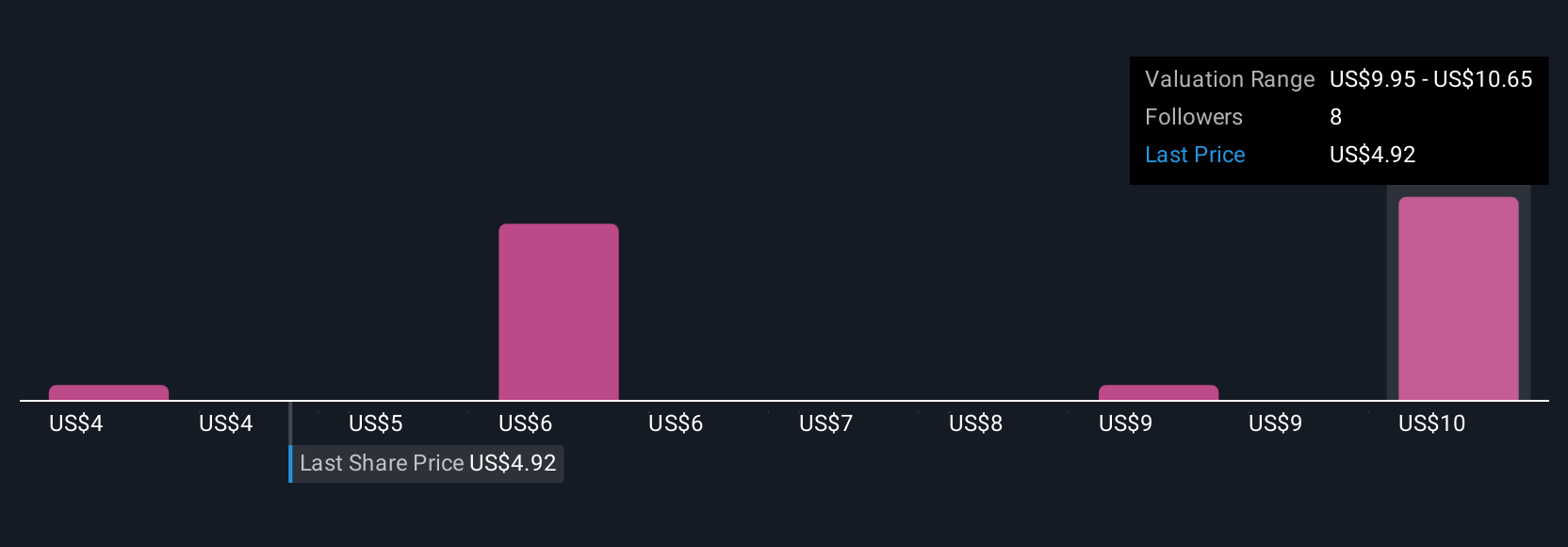

Simply Wall St Community members shared five fair value estimates for Coty Inc., spanning from US$3.69 to US$10.81 per share. As these viewpoints vary widely, many remain mindful of ongoing risks surrounding debt and the company’s ongoing turnaround, inviting you to explore these perspectives and factor in diverse opinions when assessing Coty’s outlook.

Explore 5 other fair value estimates on Coty - why the stock might be worth 8% less than the current price!

Build Your Own Coty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coty research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Coty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coty's overall financial health at a glance.

No Opportunity In Coty?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COTY

Coty

Manufactures, markets, distributes, and sells branded beauty products worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives