- United States

- /

- Household Products

- /

- NasdaqGS:WDFC

WD-40 (NASDAQ:WDFC) Has Announced That It Will Be Increasing Its Dividend To $1.02

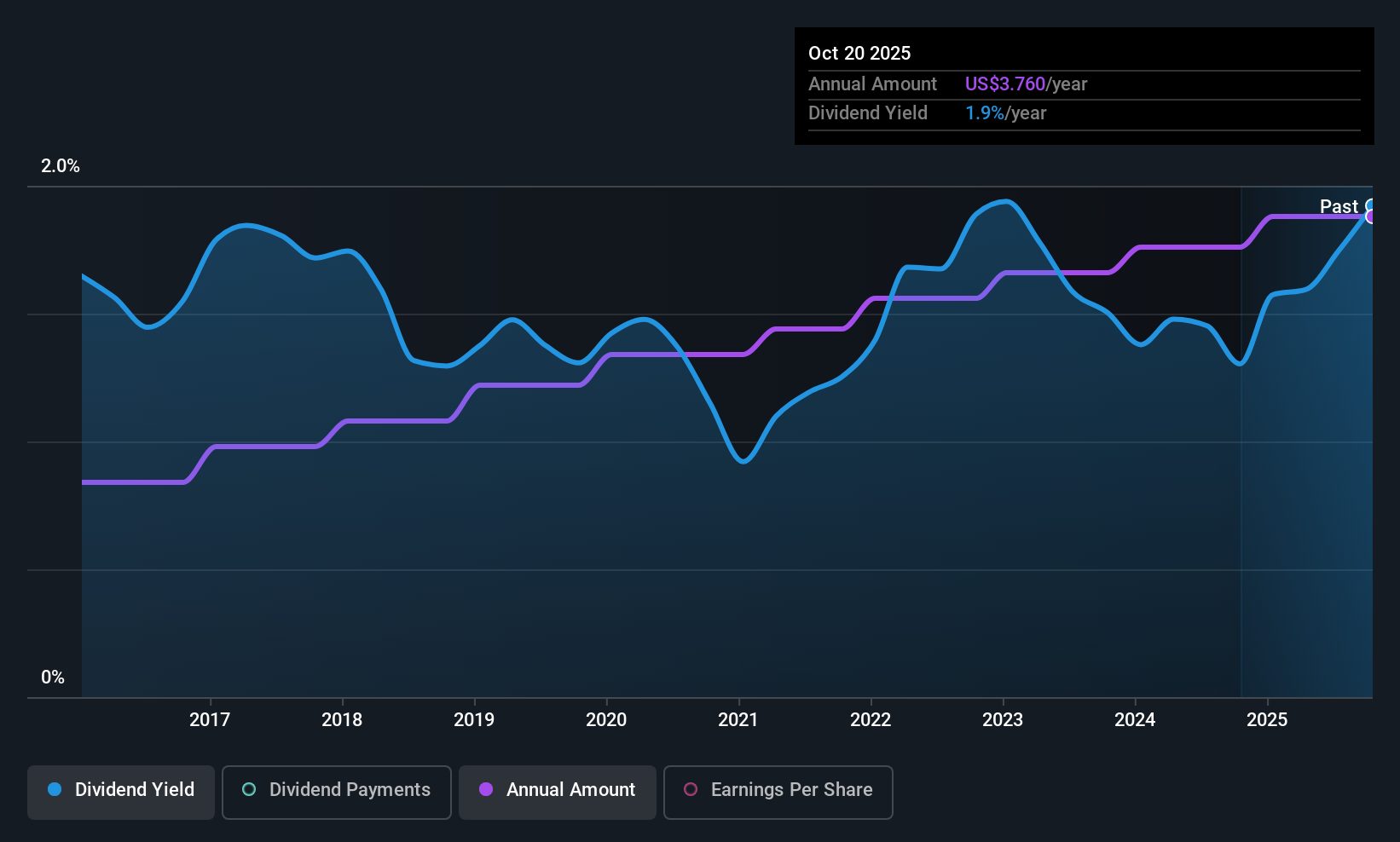

WD-40 Company's (NASDAQ:WDFC) dividend will be increasing from last year's payment of the same period to $1.02 on 30th of January. The payment will take the dividend yield to 2.0%, which is in line with the average for the industry.

WD-40's Payment Could Potentially Have Solid Earnings Coverage

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. The last dividend was quite easily covered by WD-40's earnings. This indicates that a lot of the earnings are being reinvested into the business, with the aim of fueling growth.

Looking forward, earnings per share is forecast to rise by 2.5% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 61%, which is in the range that makes us comfortable with the sustainability of the dividend.

View our latest analysis for WD-40

WD-40 Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. The annual payment during the last 10 years was $1.52 in 2015, and the most recent fiscal year payment was $4.08. This implies that the company grew its distributions at a yearly rate of about 10% over that duration. Rapidly growing dividends for a long time is a very valuable feature for an income stock.

We Could See WD-40's Dividend Growing

Investors could be attracted to the stock based on the quality of its payment history. It's encouraging to see that WD-40 has been growing its earnings per share at 8.7% a year over the past five years. Shareholders are getting plenty of the earnings returned to them, which combined with strong growth makes this quite appealing.

We Really Like WD-40's Dividend

In summary, it is always positive to see the dividend being increased, and we are particularly pleased with its overall sustainability. Earnings are easily covering distributions, and the company is generating plenty of cash. All in all, this checks a lot of the boxes we look for when choosing an income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Now, if you want to look closer, it would be worth checking out our free research on WD-40 management tenure, salary, and performance. Is WD-40 not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if WD-40 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:WDFC

WD-40

Engages in the provision of maintenance products and homecare and cleaning products in North America, Central and South America, Asia, Australia, Europe, India, the Middle East, and Africa.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)