- United States

- /

- Personal Products

- /

- NasdaqCM:UPXI

Will Upexi’s (UPXI) Digital Asset Strategy Reshape Its Investment Narrative or Complicate Regulatory Risks?

Reviewed by Sasha Jovanovic

- Upexi, Inc. recently participated in the Digital Asset Treasury Showcase, where Chief Strategy Officer Brian Benjamin Rudick presented insights into the company’s digital asset and treasury strategies.

- This ongoing focus on digital assets is shaping Upexi's investment narrative, while continued regulatory and compliance challenges remain a concern for stakeholders.

- We’ll explore how Upexi’s digital asset strategy spotlight informs its investment narrative amid recurring compliance and regulatory uncertainties.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Upexi's Investment Narrative?

Shareholders in Upexi need to buy into a big-picture story where digital asset strategies offset operational and regulatory growing pains. The latest Treasury Showcase appearance by Chief Strategy Officer Brian Rudick draws a brighter spotlight onto Upexi’s ambitions in digital assets, perhaps suggesting a more serious commitment to this avenue. However, this focus lands against a backdrop of persistent losses, sharp revenue contractions, and recent heavy share dilution, all combining with continued compliance worries. While the company’s high-profile initiatives and new advisory committee tap respected names in the crypto and finance worlds, material short-term catalysts, like resolving ongoing regulatory filings, stabilizing earnings, or boosting revenues, remain overshadowed by these risks. Recent news signals intent rather than an immediate operational turnaround, so perceptions of risk and recovery are still very much at play for most investors.

On the flip side, recurring compliance and reporting delays are still front of mind for investors.

Exploring Other Perspectives

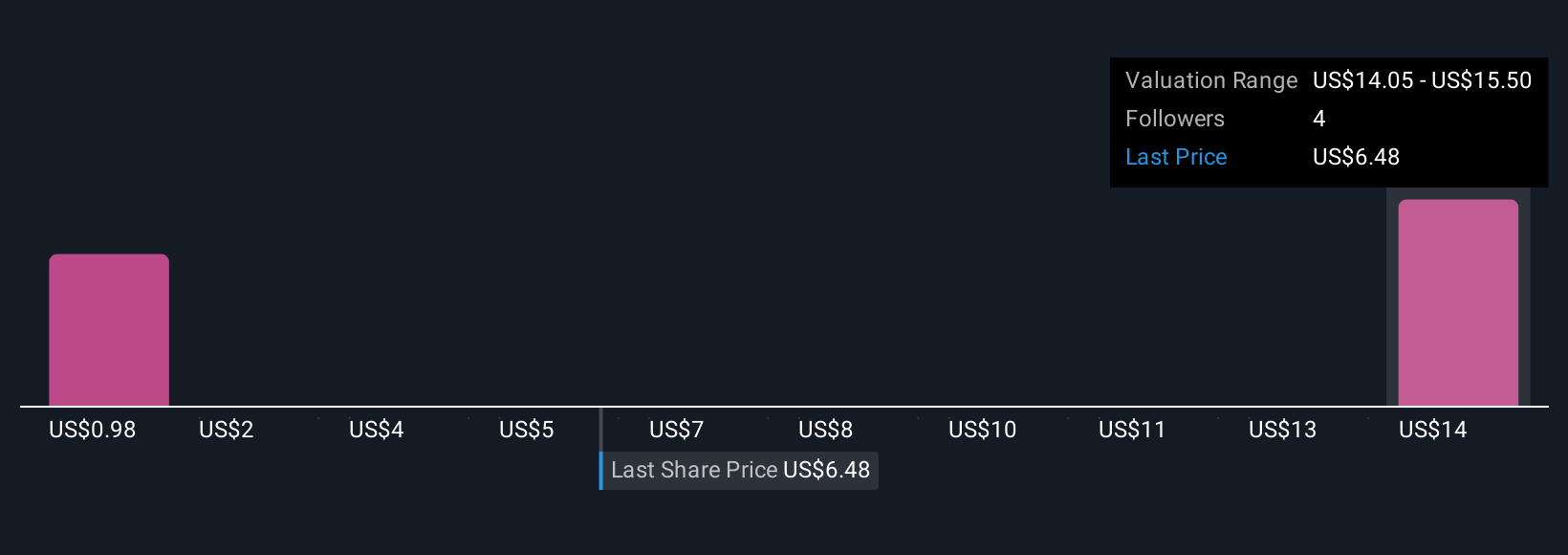

Explore 4 other fair value estimates on Upexi - why the stock might be worth less than half the current price!

Build Your Own Upexi Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Upexi research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Upexi research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Upexi's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:UPXI

Upexi

Engages in the development, manufacture, and distribution of consumer products.

Excellent balance sheet with low risk.

Market Insights

Community Narratives