- United States

- /

- Personal Products

- /

- NasdaqGM:ODD

Oddity Tech (ODD) Raises 2025 Outlook After Online Sales Surge and International Expansion Momentum

Reviewed by Sasha Jovanovic

- Earlier this week, Oddity Tech raised its full-year 2025 financial outlook, citing accelerated net revenue growth, a surge in online sales, and gains from international expansion.

- This development underscores the company's momentum in broadening its global footprint and strengthening its digital-first business model to support future growth.

- We'll explore how Oddity Tech's upgraded outlook and strong online revenue gains could shape its investment narrative moving forward.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Oddity Tech Investment Narrative Recap

To invest in Oddity Tech, you essentially need to believe in its ability to sustain rapid digital-driven growth, outpace global competitors in international markets, and defend its technology edge as new beauty brands and territories are launched. The recent upgraded full-year guidance, driven by strong online sales and expansion, supports near-term momentum but does not materially change the fact that Oddity’s greatest immediate catalyst, and its biggest risk, remains the execution and returns on its aggressive international rollout. Among recent developments, Oddity’s recurring increases to full-year guidance, including the most recent bump to US$799 million to US$804 million in 2025 revenue, stand out. This continued upward revision reflects confidence in ongoing online growth and international progress, but also raises the stakes if new markets underperform or incur higher-than-expected costs. Yet despite digital momentum, investors should stay mindful of rising customer acquisition costs and online competition that...

Read the full narrative on Oddity Tech (it's free!)

Oddity Tech is projected to reach $1.3 billion in revenue and $177.0 million in earnings by 2028. This outlook assumes a 19.0% annual revenue growth rate and a $66.9 million increase in earnings from the current level of $110.1 million.

Uncover how Oddity Tech's forecasts yield a $73.20 fair value, a 45% upside to its current price.

Exploring Other Perspectives

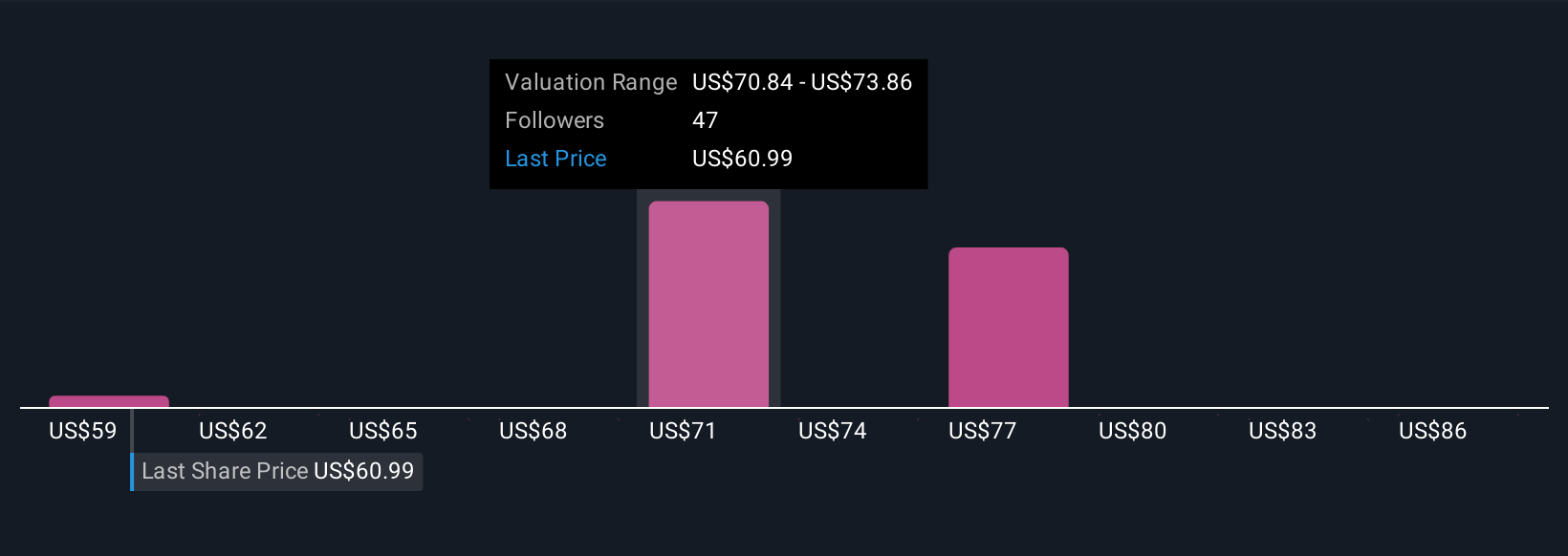

Six Simply Wall St Community members valued Oddity Tech between US$58.79 and US$88.92, reflecting wide disagreement over fair value. While some see a big addressable market in Europe as a key driver, execution overseas could shape the company’s long-term fortunes, consider these varied opinions as you review Oddity’s outlook.

Explore 6 other fair value estimates on Oddity Tech - why the stock might be worth just $58.79!

Build Your Own Oddity Tech Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oddity Tech research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Oddity Tech research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oddity Tech's overall financial health at a glance.

No Opportunity In Oddity Tech?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ODD

Oddity Tech

Operates as a consumer tech company that builds digital-first brands for the beauty and wellness industries in the United States and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives