- United States

- /

- Personal Products

- /

- NasdaqCM:MTEX

Increases to Mannatech, Incorporated's (NASDAQ:MTEX) CEO Compensation Might Cool off for now

Performance at Mannatech, Incorporated (NASDAQ:MTEX) has been reasonably good and CEO Al Bala has done a decent job of steering the company in the right direction. As shareholders go into the upcoming AGM on 15 June 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still want to keep CEO compensation within reason.

See our latest analysis for Mannatech

How Does Total Compensation For Al Bala Compare With Other Companies In The Industry?

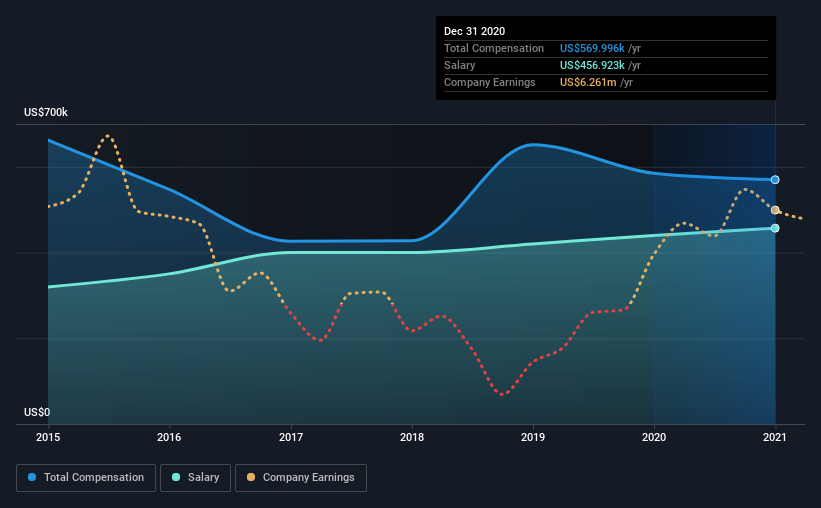

Our data indicates that Mannatech, Incorporated has a market capitalization of US$53m, and total annual CEO compensation was reported as US$570k for the year to December 2020. This means that the compensation hasn't changed much from last year. In particular, the salary of US$456.9k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the industry with market capitalizations below US$200m, reported a median total CEO compensation of US$227k. This suggests that Al Bala is paid more than the median for the industry. Furthermore, Al Bala directly owns US$115k worth of shares in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$457k | US$440k | 80% |

| Other | US$113k | US$145k | 20% |

| Total Compensation | US$570k | US$585k | 100% |

Talking in terms of the industry, salary represented approximately 58% of total compensation out of all the companies we analyzed, while other remuneration made up 42% of the pie. According to our research, Mannatech has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Mannatech, Incorporated's Growth

Mannatech, Incorporated's earnings per share (EPS) grew 106% per year over the last three years. Its revenue is down 2.1% over the previous year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's always a tough situation when revenues are not growing, but ultimately profits are more important. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Mannatech, Incorporated Been A Good Investment?

Most shareholders would probably be pleased with Mannatech, Incorporated for providing a total return of 47% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 3 warning signs for Mannatech that investors should think about before committing capital to this stock.

Switching gears from Mannatech, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade Mannatech, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:MTEX

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives