- United States

- /

- Personal Products

- /

- NasdaqCM:LFVN

LifeVantage (NASDAQ:LFVN) Has Announced A Dividend Of $0.035

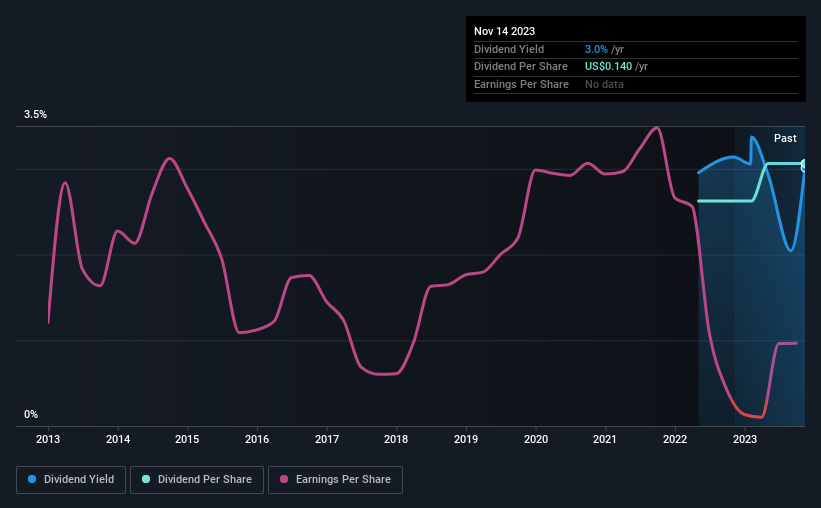

LifeVantage Corporation (NASDAQ:LFVN) will pay a dividend of $0.035 on the 15th of December. This means that the annual payment will be 3.0% of the current stock price, which is in line with the average for the industry.

Check out our latest analysis for LifeVantage

LifeVantage Doesn't Earn Enough To Cover Its Payments

We aren't too impressed by dividend yields unless they can be sustained over time. The last dividend was quite easily covered by LifeVantage's earnings. This indicates that a lot of the earnings are being reinvested into the business, with the aim of fueling growth.

Looking forward, EPS could fall by 13.6% if the company can't turn things around from the last few years. If the dividend continues along recent trends, we estimate the payout ratio could reach 308%, which could put the dividend in jeopardy if the company's earnings don't improve.

LifeVantage Doesn't Have A Long Payment History

It is tough to make a judgement on how stable a dividend is when the company hasn't been paying one for very long. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

The Dividend Has Limited Growth Potential

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Unfortunately things aren't as good as they seem. Over the past five years, it looks as though LifeVantage's EPS has declined at around 14% a year. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future.

In Summary

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We don't think LifeVantage is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Case in point: We've spotted 4 warning signs for LifeVantage (of which 2 are a bit unpleasant!) you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:LFVN

LifeVantage

Engages in the identification, research, development, formulation, and sale of advanced nutrigenomic activators, dietary supplements, nootropics, weight management, pre- and pro-biotics and skin and hair care products.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives