- United States

- /

- Professional Services

- /

- NasdaqGS:PAYX

Top 3 Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

In the wake of recent inflation data that came in cooler than expected, major U.S. stock indexes like the Dow Jones and S&P 500 have rebounded, snapping a four-session losing streak and reflecting renewed investor optimism. Amidst this backdrop of market recovery, dividend stocks continue to attract attention for their potential to provide steady income streams, making them an appealing consideration for investors looking to balance growth with stability in their portfolios.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 4.59% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.18% | ★★★★★★ |

| OTC Markets Group (OTCM) | 4.85% | ★★★★★★ |

| Host Hotels & Resorts (HST) | 5.12% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 5.29% | ★★★★★★ |

| Farmers National Banc (FMNB) | 4.71% | ★★★★★★ |

| Ennis (EBF) | 5.51% | ★★★★★★ |

| Dillard's (DDS) | 4.82% | ★★★★★★ |

| Columbia Banking System (COLB) | 4.97% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.13% | ★★★★★★ |

Click here to see the full list of 111 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

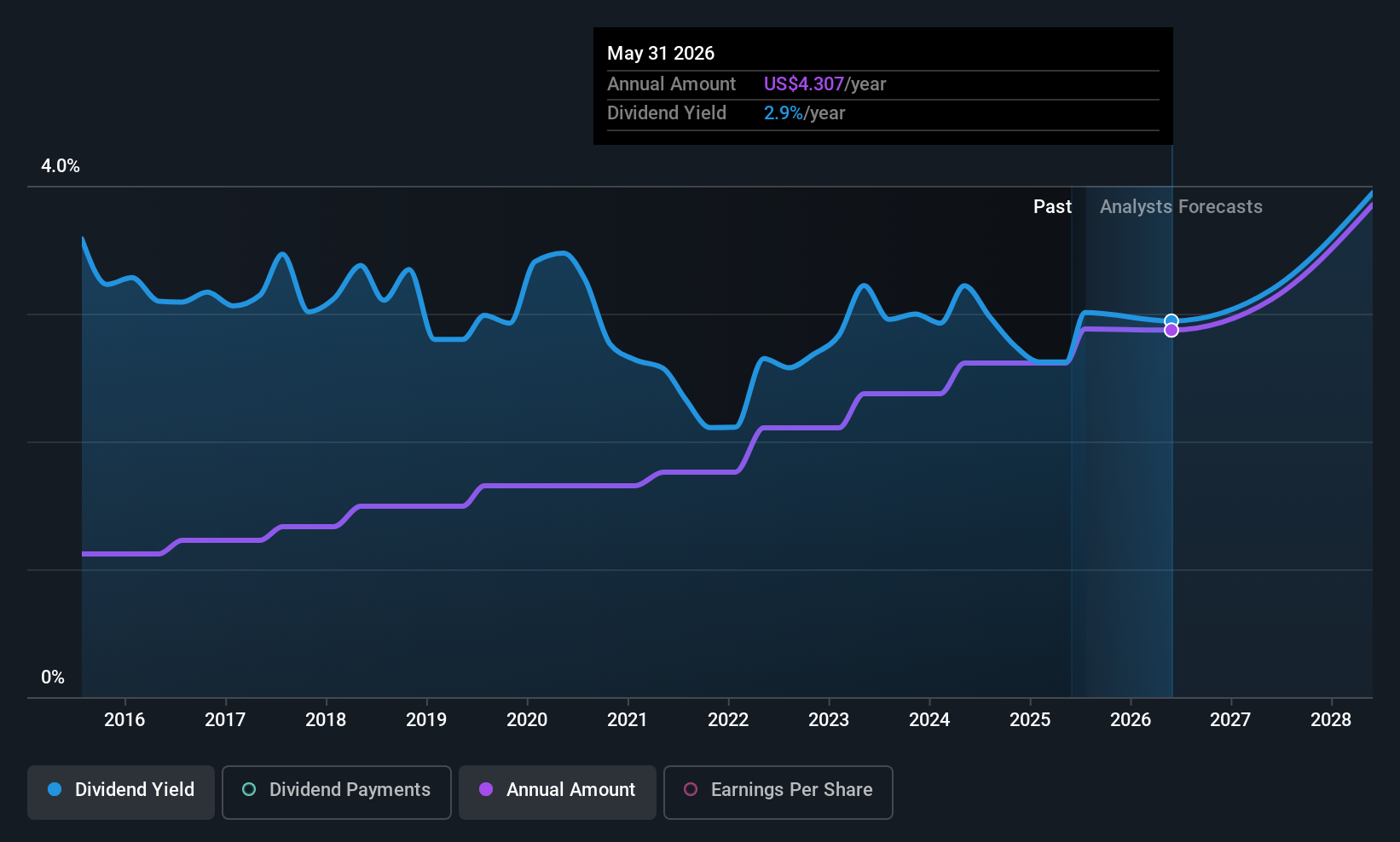

Interparfums (IPAR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Interparfums, Inc. manufactures, markets, and distributes a variety of fragrances and related products both in the United States and internationally, with a market cap of approximately $2.73 billion.

Operations: Interparfums generates its revenue primarily from fragrances and fragrance-related products, amounting to $1.46 billion.

Dividend Yield: 3.8%

Interparfums, Inc. offers a mixed dividend outlook. Despite its volatile dividend history over the past decade, recent payments have been sustainable with a payout ratio of 61.5% and cash payout ratio of 72.3%. The company announced a regular quarterly dividend of $0.80 per share for December 2025, reflecting stable earnings coverage. Recent guidance suggests flat earnings growth for 2025 but anticipates modest sales growth in the coming year to $1.48 billion by end-2026.

- Get an in-depth perspective on Interparfums' performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Interparfums shares in the market.

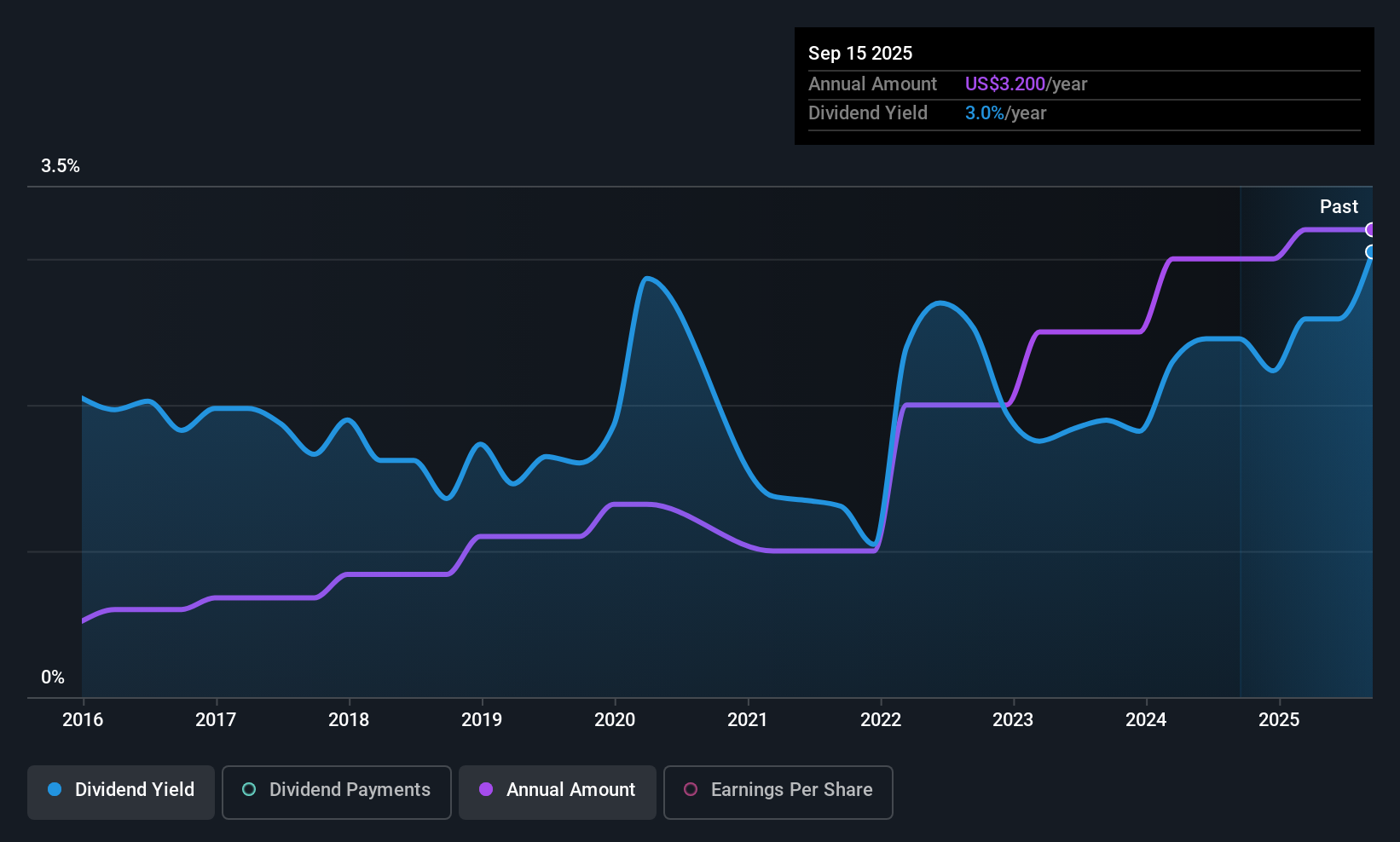

Paychex (PAYX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Paychex, Inc. offers human capital management solutions including payroll, employee benefits, HR, and insurance services for small to medium-sized businesses across the United States, Europe, and India with a market cap of approximately $41.99 billion.

Operations: Paychex, Inc. generates revenue from its Staffing & Outsourcing Services segment, which accounts for $5.79 billion.

Dividend Yield: 3.7%

Paychex's dividends have been stable and growing over the past decade, though its high payout ratio of 92% indicates dividends are not well covered by earnings. Despite this, cash flows sufficiently cover dividend payments with an 83.5% cash payout ratio. The stock trades below estimated fair value but offers a lower yield compared to top-tier US dividend payers. Recent AI innovations and M&A activities aim to drive future growth, potentially impacting long-term dividend sustainability positively.

- Click here and access our complete dividend analysis report to understand the dynamics of Paychex.

- The valuation report we've compiled suggests that Paychex's current price could be quite moderate.

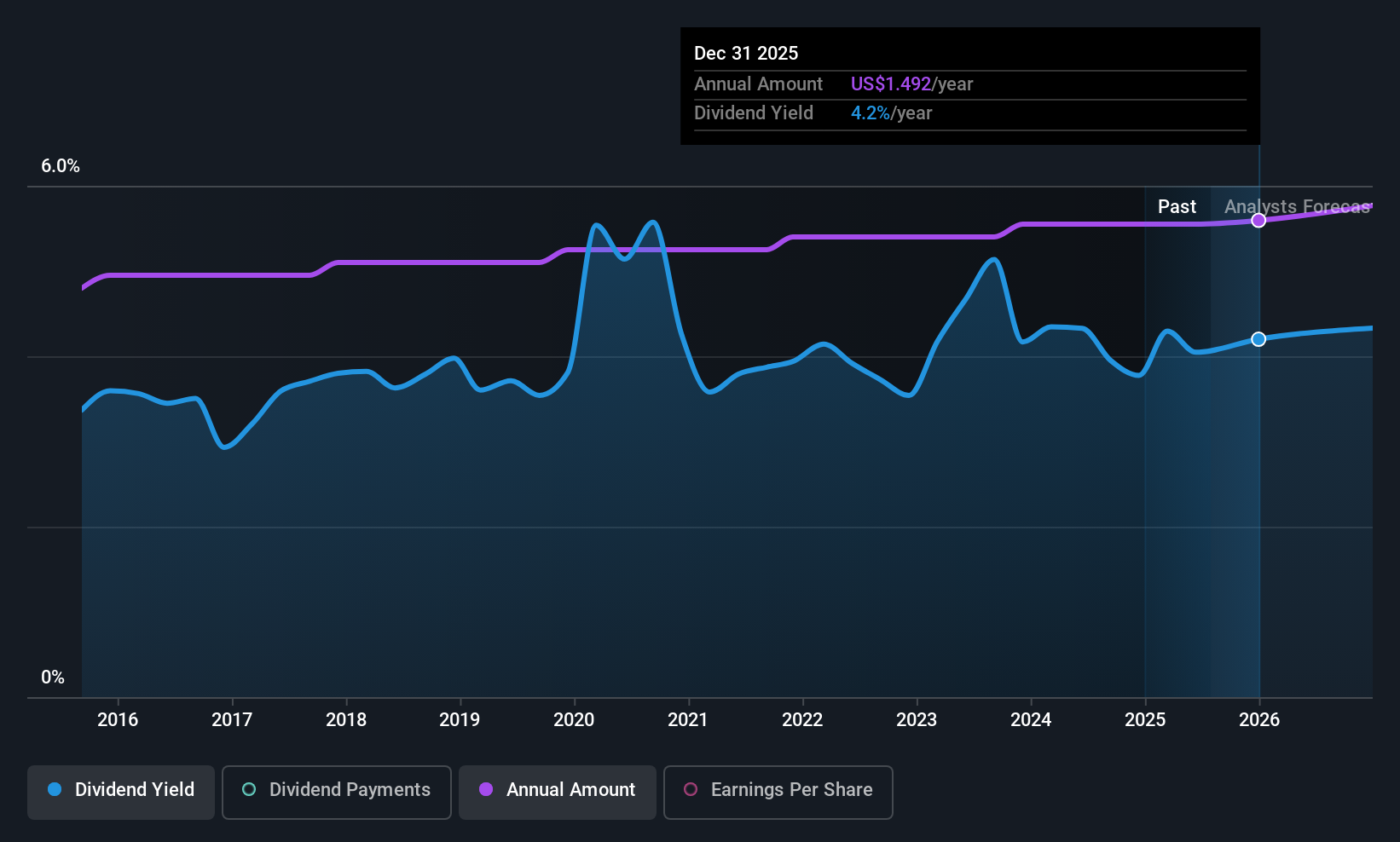

United Bankshares (UBSI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: United Bankshares, Inc., with a market cap of $5.53 billion, operates in the United States offering commercial and retail banking products and services through its subsidiaries.

Operations: United Bankshares, Inc. generates revenue through its subsidiaries by offering a range of commercial and retail banking products and services across the United States.

Dividend Yield: 3.7%

United Bankshares offers a stable dividend history with consistent growth over the past decade. Its current payout ratio of 48.3% ensures dividends are well covered by earnings, and future forecasts suggest continued coverage. The recent increase to an annual dividend of $1.49 per share reflects this stability, though its yield of 3.68% is below top-tier US dividend payers. A new share repurchase plan may bolster shareholder value alongside steady net income growth and strategic buybacks totaling $131.83 million.

- Dive into the specifics of United Bankshares here with our thorough dividend report.

- Upon reviewing our latest valuation report, United Bankshares' share price might be too pessimistic.

Where To Now?

- Discover the full array of 111 Top US Dividend Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PAYX

Paychex

Provides human capital management solutions (HCM) for payroll, employee benefits, human resources (HR), and insurance services for small to medium-sized businesses in the United States, Europe, and India.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion