- United States

- /

- Healthtech

- /

- NYSE:VEEV

Veeva Systems (VEEV): Assessing Valuation After a Sharp 23% Pullback in the Share Price

Reviewed by Simply Wall St

Veeva Systems (VEEV) has quietly slipped about 23% over the past month and roughly 17% in the past 3 months, even as its underlying revenue and earnings continue to grow at a double digit clip.

See our latest analysis for Veeva Systems.

That slump leaves Veeva’s latest share price at $229.49, and while the 30 day share price return of approximately negative 23% looks sharp, it comes after a solid year to date share price gain and a three year total shareholder return above 35%. This suggests sentiment has cooled rather than the growth story disappearing.

If Veeva’s recent volatility has you rethinking your sector exposure, this could be a good moment to explore healthcare stocks for other healthcare names with different growth and risk profiles.

With revenue and profits still compounding at double digit rates, and the stock now trading at a discount to analyst targets and intrinsic estimates, is this pullback a fresh entry point or is future growth already priced in?

Most Popular Narrative Narrative: 28.4% Undervalued

Compared with the last close at $229.49, the most followed narrative points to a materially higher fair value, anchored in sustained growth and margin expansion.

The resolution of the long-standing dispute with IQVIA removes critical data interoperability barriers, enabling Veeva to fully integrate industry-leading datasets into its Commercial Cloud, which should materially expand its addressable market, improve product adoption across multiple commercial applications, and accelerate top-line revenue growth over the next several years.

Want to see how this growth runway translates into that punchy valuation gap? The narrative leans on powerful revenue compounding and rising margins. Curious which specific profitability milestones and earnings multiples are baked into that outlook? Dive in to unpack the full playbook behind this fair value call.

Result: Fair Value of $320.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained macro uncertainty or slower AI adoption could easily sap growth momentum, challenge premium pricing power, and narrow the perceived valuation gap.

Find out about the key risks to this Veeva Systems narrative.

Another Angle on Valuation

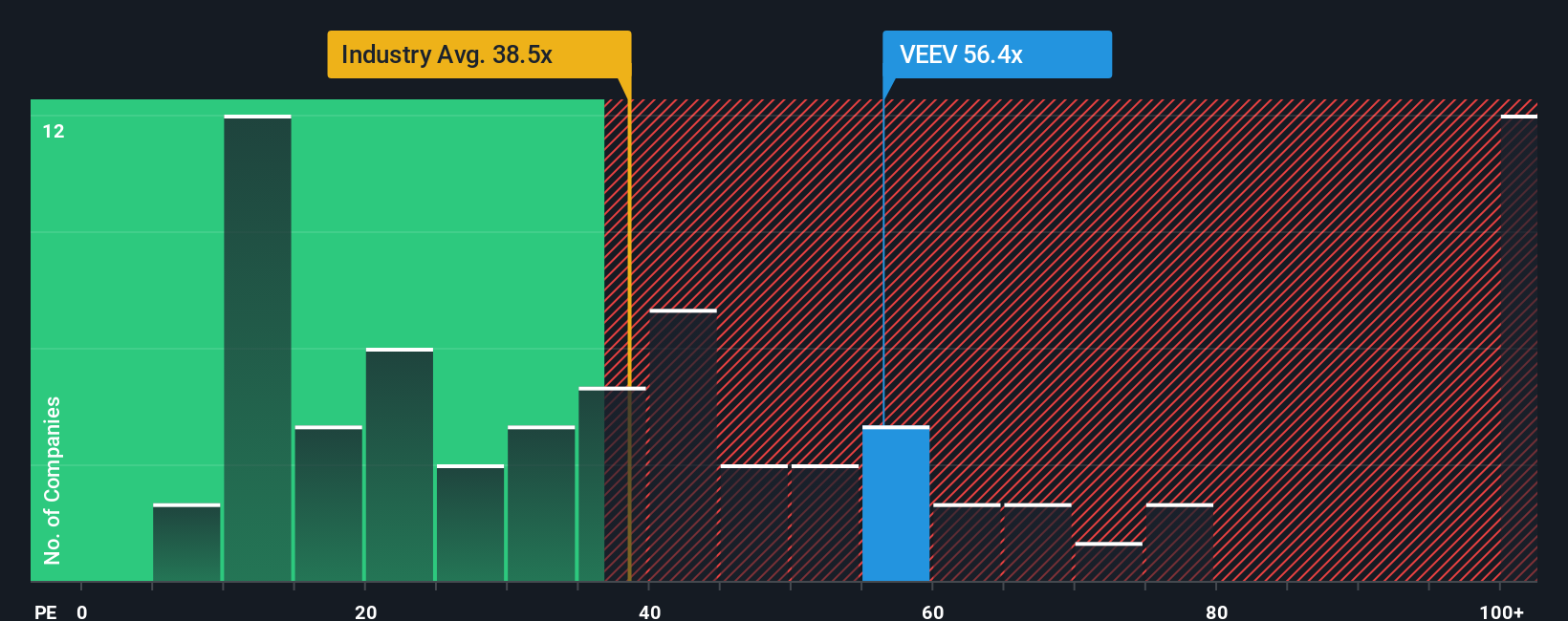

On simple earnings metrics, the picture is less generous. Veeva trades on a 43.8x P/E, well above its 32x fair ratio and the global Healthcare Services average of 32.9x, even if it still sits below peer levels near 61.9x. Is that premium a cushion or a cliff if growth wobbles?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Veeva Systems Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a tailored view in under three minutes, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Veeva Systems.

Ready for more actionable investment ideas?

Set yourself up for your next smart move by putting fresh opportunities on your radar with targeted stock lists you can sort, filter, and compare in minutes.

- Capture potential deep-value setups by scanning these 904 undervalued stocks based on cash flows that the market may be mispricing based on future cash flows.

- Ride structural growth trends by zeroing in on these 25 AI penny stocks positioned to benefit from rapid advances in artificial intelligence.

- Strengthen your income stream by reviewing these 12 dividend stocks with yields > 3% that could add dependable cash returns to your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VEEV

Veeva Systems

Provides cloud-based software for the life sciences industry in North America, Europe, the Asia Pacific, the Middle East, Africa, and Latin America.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion