- United States

- /

- Healthcare Services

- /

- NYSE:LH

Labcorp Holdings (NYSE:LH) Expands Precision Oncology Portfolio with FDA-Authorized Liquid Biopsy Tests

Reviewed by Simply Wall St

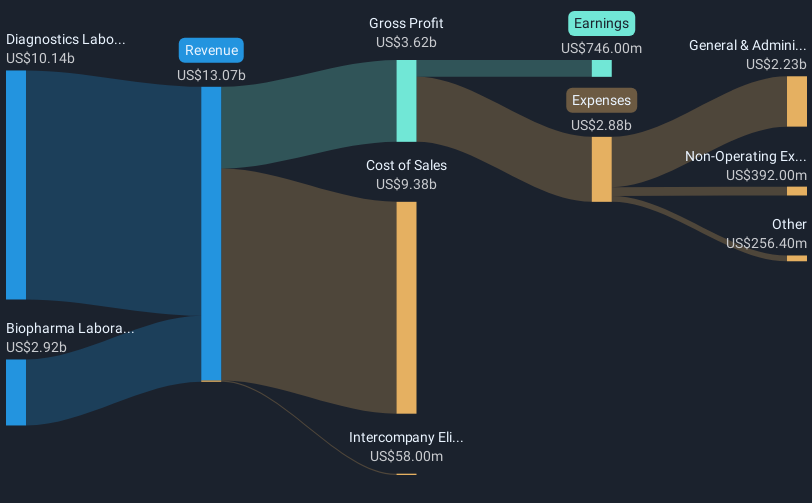

Labcorp Holdings (NYSE:LH) announced an expansion of its precision oncology portfolio with two new solutions, Labcorp Plasma Detect and PGDx elio Plasma Focus Dx, aimed at improving patient care in oncology. These developments, along with upcoming presentations at the AACR 2025 Annual Meeting, align with the company's ongoing efforts to innovate in the medical field. Over the past week, Labcorp's stock rose 1.62%, a movement that generally paralleled the broader market increase of 2.3%. This market trend, driven by rising stocks amid earnings reports and positive economic indicators, likely influenced the modest gain in Labcorp's share price.

We've identified 1 risk for Labcorp Holdings that you should be aware of.

Labcorp Holdings' recent initiatives in precision oncology, such as the launch of Labcorp Plasma Detect and their plans to acquire Invitae, are poised to significantly enhance their genetic testing and oncology diagnostics offerings. This has the potential to drive revenue growth and improve profit margins by tapping into the expanding market for personalized medicine. These innovations specifically align with analyst expectations of future revenue growth, with estimates suggesting an annual increase of 5.5% over the next three years.

Over the past five years, Labcorp's total shareholder return, which includes share price appreciation and dividends, was 56.16%. This figure reflects a significant long-term performance, providing important context against the one-year period where Labcorp outperformed the US Healthcare industry, which experienced a 10.3% decline.

The recent announcement and strategic expansions could also positively impact Labcorp's revenue and earnings forecasts, with projections of reaching US$1.2 billion in earnings by 2028. This optimism is reflected in the analyst consensus price target of US$270.51, which is approximately 18.6% higher than the current share price of US$220.25. While these projections provide a favorable outlook, the company's execution of these expansions will be key in achieving the expected growth figures.

Dive into the specifics of Labcorp Holdings here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LH

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives