- United States

- /

- Medical Equipment

- /

- NYSE:ITGR

How Rising Capital Intensity at Integer Holdings (ITGR) Has Changed Its Investment Story

Reviewed by Simply Wall St

- Integer Holdings recently faced increased investor skepticism following reports of operational challenges due to subscale operations and higher capital intensity requirements.

- This development reflects broader concerns about the company's ability to scale efficiently and manage its capital investments in a competitive medical device industry.

- Now, we’ll explore how concerns over rising capital intensity may recalibrate Integer Holdings’ investment narrative and outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Integer Holdings Investment Narrative Recap

To own Integer Holdings, an investor must have confidence in the company’s ability to deliver margin gains and capitalize on growth in advanced medical devices, despite operational scale challenges. The recent news may amplify concerns about managing capital intensity, but the core short-term catalyst, delivering sustained organic revenue growth in high-demand cardio and electrophysiology markets, remains unchanged, while the main risk now centers on the potential dampening effect of higher capital requirements on future margins and investment returns.

Among recent announcements, the March convertible notes offering stands out as particularly relevant. Raising US$875 million through these notes increases Integer’s financial flexibility but adds debt at a time when effective capital deployment and return on investment are under scrutiny from investors monitoring both growth opportunities and capital discipline.

However, investors should be aware that rising capital intensity could put pressure on future margin expansion and, if not managed carefully, could...

Read the full narrative on Integer Holdings (it's free!)

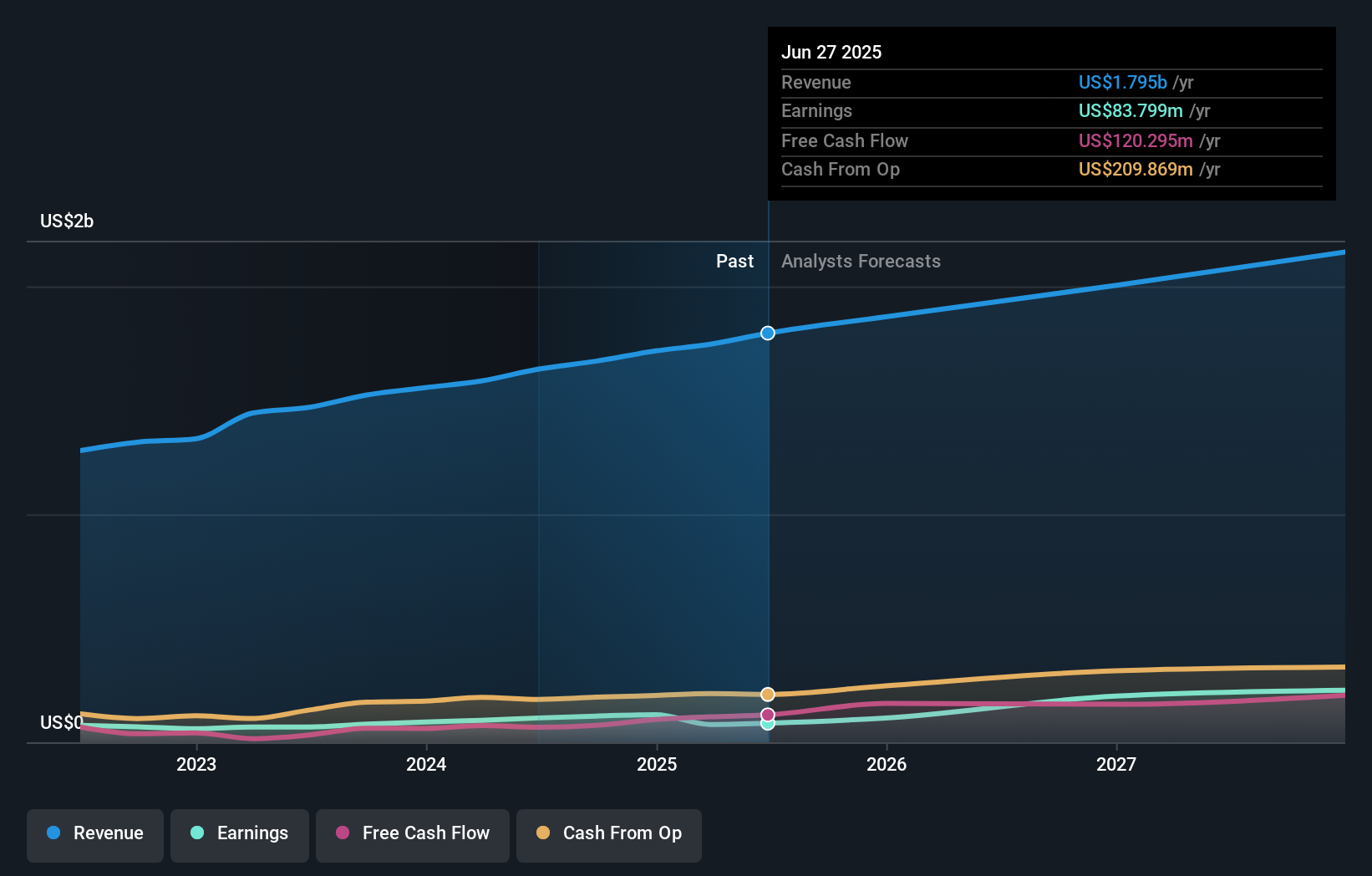

Integer Holdings' outlook anticipates $2.2 billion in revenue and $306.5 million in earnings by 2028. This projection is based on an expected annual revenue growth rate of 7.0% and a $222.7 million increase in earnings from the current $83.8 million level.

Uncover how Integer Holdings' forecasts yield a $140.88 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered two fair value estimates for Integer, ranging from US$140.88 to US$146.79 per share. While many are weighing growth catalysts, concerns over the company’s ability to efficiently scale operations continue to shape wider market sentiment and invite you to compare differing outlooks.

Explore 2 other fair value estimates on Integer Holdings - why the stock might be worth as much as 33% more than the current price!

Build Your Own Integer Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Integer Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Integer Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Integer Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ITGR

Integer Holdings

Operates as a medical device contract development and manufacturing company in the United States, Puerto Rico, Costa Rica, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives