- United States

- /

- Medical Equipment

- /

- NYSE:ITGR

How Integer Holdings' (ITGR) Operational Upgrades and Analyst Optimism Could Reshape Its Investment Story

Reviewed by Sasha Jovanovic

- Integer Holdings recently received an upgrade to Zacks Rank #2 (Buy), reflecting rising analyst optimism amid improvements in operational efficiency and manufacturing automation efforts.

- This renewed sentiment follows a period of share price underperformance and growing attention to Integer’s expanding margins through continued operational upgrades and strategic investments.

- We'll assess how analyst expectations for stronger margins and operational improvements may reshape Integer Holdings' investment narrative going forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Integer Holdings Investment Narrative Recap

To be a shareholder in Integer Holdings today, you need faith in the company's ability to leverage operational improvements and manufacturing automation to drive margin growth and restore confidence after recent share price weakness. The Zacks Rank #2 upgrade underscores analyst optimism but does not materially change the key catalyst: ongoing margin expansion through efficiency gains, nor does it lessen the central risk of revenue deceleration if timing-related sales in prior quarters mask underlying demand trends.

Among recent announcements, Integer’s Q2 2025 results stand out as most relevant, highlighting 11% year-on-year sales growth and ongoing margin improvements, but also revealing that part of the quarterly outperformance was due to timing shifts and inventory pull-forward. This means that while automation and efficiency upgrades are supporting earnings progress, the sustainability of revenue momentum remains a central question for investors tracking short-term catalysts.

However, investors should be aware that not all revenue gains reflect underlying demand strength and...

Read the full narrative on Integer Holdings (it's free!)

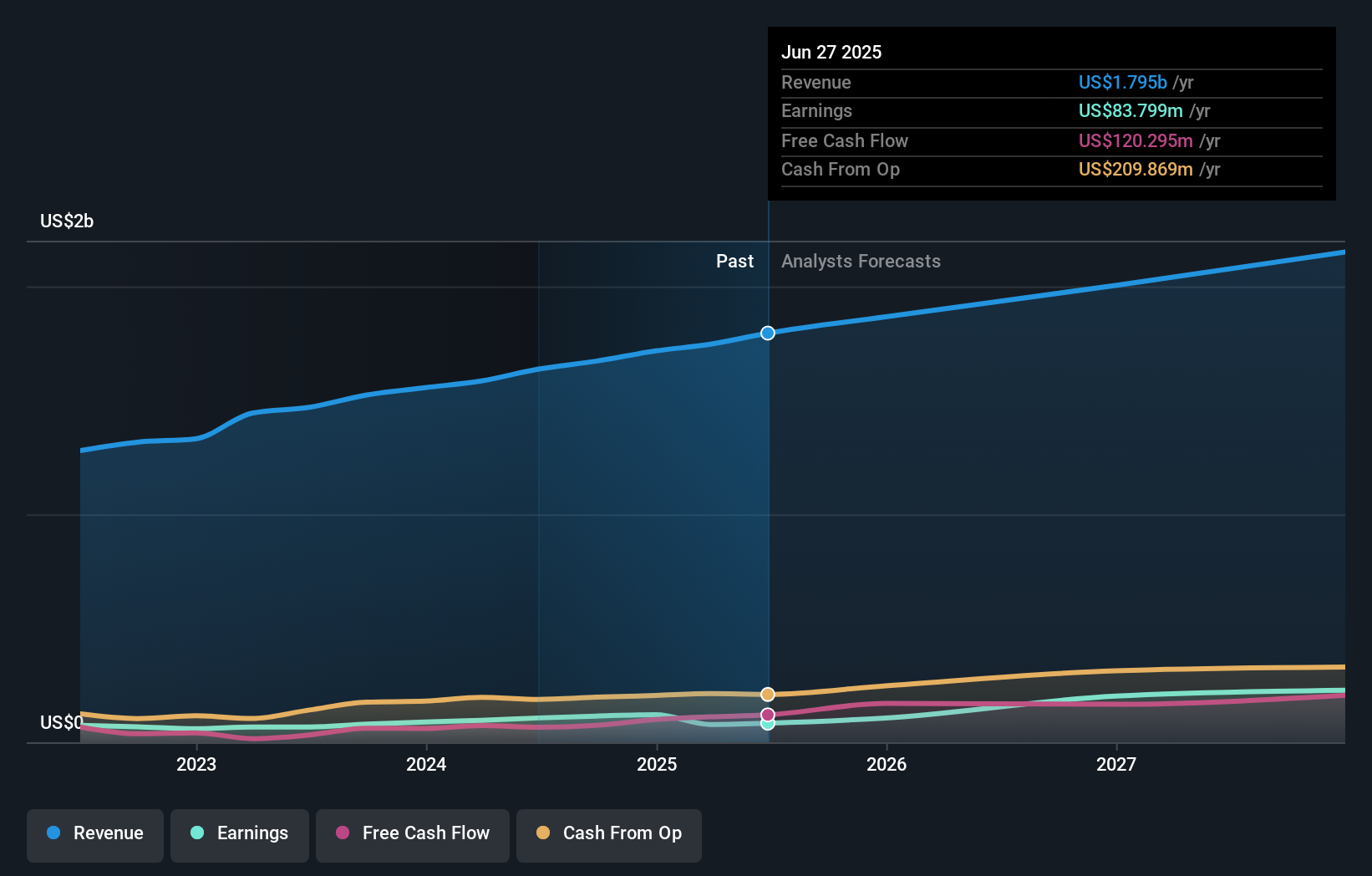

Integer Holdings' outlook anticipates $2.2 billion in revenue and $306.5 million in earnings by 2028. This is based on analysts' assumptions of 7.0% annual revenue growth and a $222.7 million increase in earnings from the current $83.8 million.

Uncover how Integer Holdings' forecasts yield a $140.88 fair value, a 38% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided just 2 fair value estimates for Integer Holdings, ranging from US$32 to US$140 per share. With sales growth partly timing-related and inventory-driven, these varying outlooks show why it’s important to weigh both risks and opportunities when forming your own view.

Explore 2 other fair value estimates on Integer Holdings - why the stock might be worth as much as 38% more than the current price!

Build Your Own Integer Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Integer Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Integer Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Integer Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ITGR

Integer Holdings

Operates as a medical device contract development and manufacturing company in the United States, Puerto Rico, Costa Rica, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives