- United States

- /

- Healthcare Services

- /

- NYSE:CNC

Did Policy Tailwinds And Fund Backing Just Reframe Centene's (CNC) Government-Dependency Narrative?

Reviewed by Sasha Jovanovic

- Recently, Centene was highlighted by Hotchkis & Wiley's Mid-Cap Value Fund for its leadership in managed Medicaid, while a Politico report indicated the White House intends to seek a two-year extension of Obamacare subsidies, supporting insurers focused on Affordable Care Act marketplaces.

- This combination of supportive policy signals and endorsement from a major institutional investor underscores how crucial government-backed programs are to Centene’s business model and future revenue streams.

- We’ll now examine how the proposed Obamacare subsidy extension could influence Centene’s existing investment narrative around Medicaid and Marketplace growth.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Centene Investment Narrative Recap

To own Centene, you have to believe that large scale in government-backed health coverage can translate into sustainable margins across Medicaid and ACA Marketplace plans. The latest attention from Hotchkis & Wiley, alongside reports of a proposed two year Obamacare subsidy extension, reinforces the current bull case around Marketplace stability but does not remove the central near term risk that policy or rate decisions could crimp Medicaid and exchange profitability.

Among recent updates, the raised 2025 premium and service revenue guidance to US$164.0 billion to US$166.0 billion stands out, given how closely it ties to Marketplace growth. Stronger than expected enrollment and retention in this segment are already supporting the existing catalyst of Commercial and ACA driven revenue expansion, so any policy moves that help preserve enhanced subsidies would intersect directly with this part of the story.

Yet while policy support can help the top line, investors should also be aware that...

Read the full narrative on Centene (it's free!)

Centene’s narrative projects $195.6 billion revenue and $2.1 billion earnings by 2028. This requires 7.0% yearly revenue growth and flat earnings from $2.1 billion today.

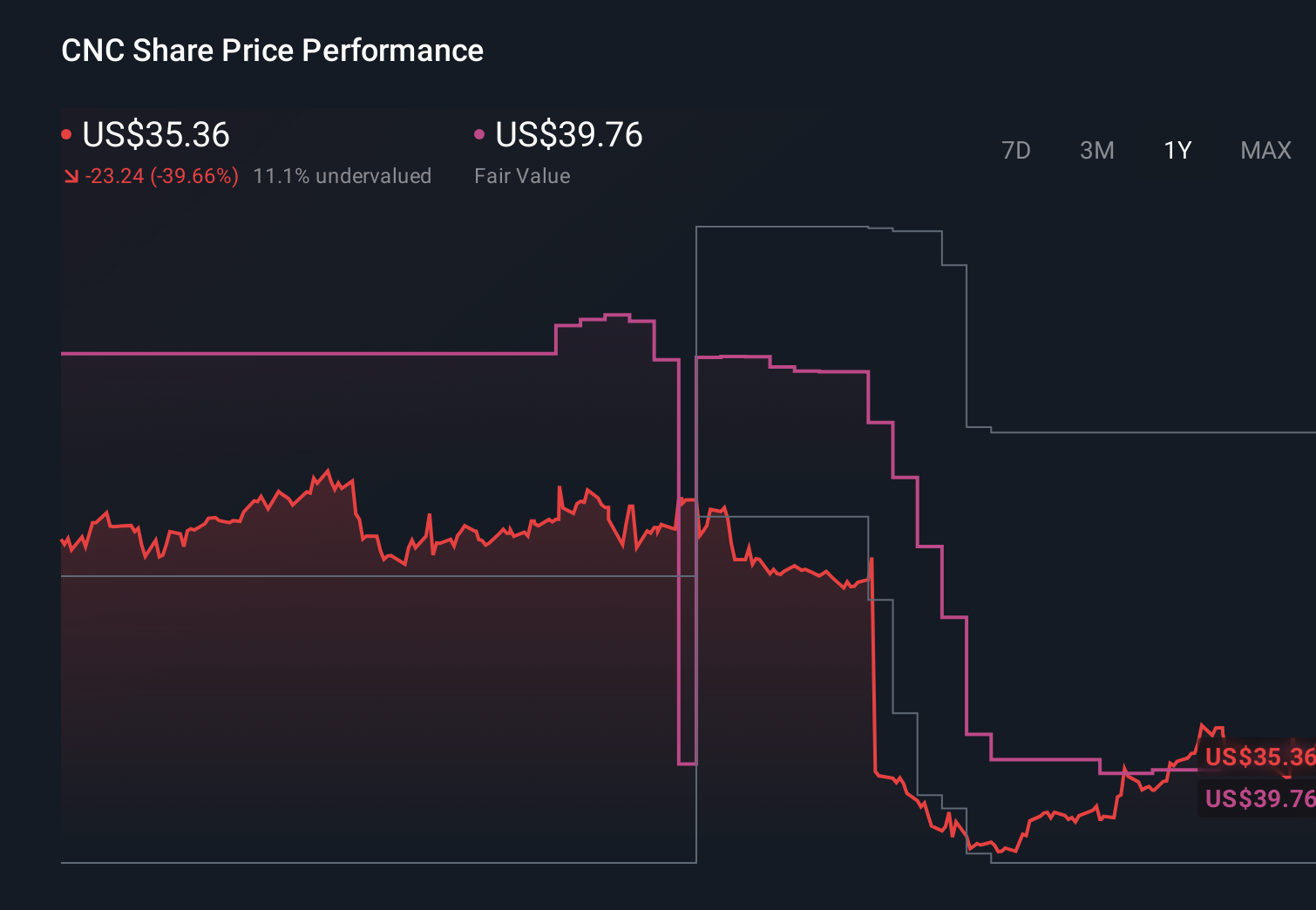

Uncover how Centene's forecasts yield a $39.94 fair value, in line with its current price.

Exploring Other Perspectives

Sixteen fair value estimates from the Simply Wall St Community span roughly US$31.6 to US$185.4 per share, showing how far apart individual views can be. Against that wide spread, the heavy reliance on continued Medicaid and ACA subsidy support reminds you to weigh policy risk carefully and consider several perspectives before deciding how Centene might fit into your portfolio.

Explore 16 other fair value estimates on Centene - why the stock might be worth over 4x more than the current price!

Build Your Own Centene Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Centene research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Centene research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Centene's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNC

Centene

Operates as a healthcare enterprise that provides programs and services to under-insured and uninsured families, and commercial organizations in the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026