- United States

- /

- Healthcare Services

- /

- NYSE:CI

The Cigna Group (NYSE:CI) Passed Our Checks, And It's About To Pay A US$1.51 Dividend

It looks like The Cigna Group (NYSE:CI) is about to go ex-dividend in the next four days. The ex-dividend date occurs one day before the record date, which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. This means that investors who purchase Cigna Group's shares on or after the 3rd of June will not receive the dividend, which will be paid on the 18th of June.

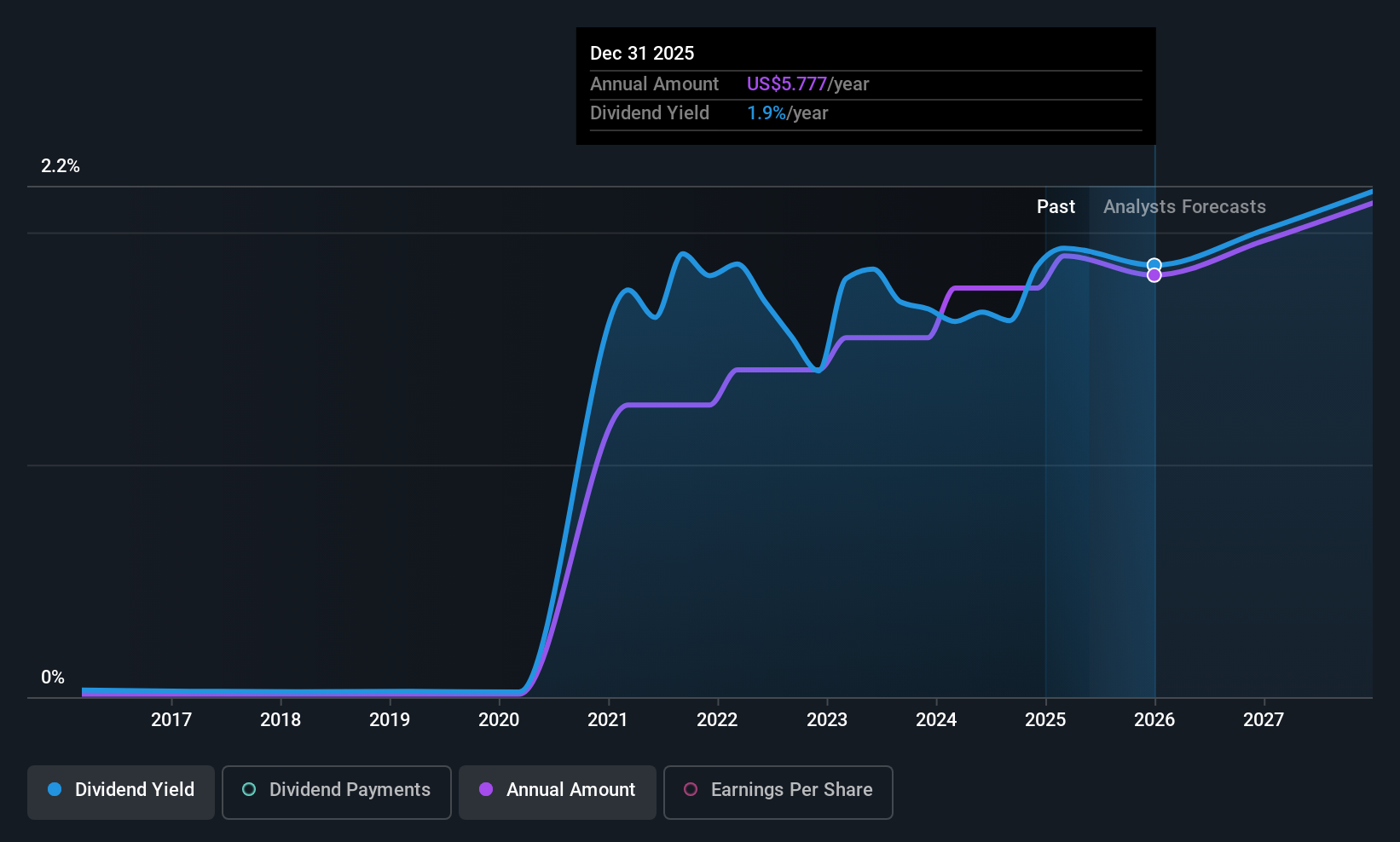

The company's next dividend payment will be US$1.51 per share, and in the last 12 months, the company paid a total of US$6.04 per share. Based on the last year's worth of payments, Cigna Group stock has a trailing yield of around 1.9% on the current share price of US$310.86. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to investigate whether Cigna Group can afford its dividend, and if the dividend could grow.

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Fortunately Cigna Group's payout ratio is modest, at just 31% of profit. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. Thankfully its dividend payments took up just 26% of the free cash flow it generated, which is a comfortable payout ratio.

It's positive to see that Cigna Group's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Check out our latest analysis for Cigna Group

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. This is why it's a relief to see Cigna Group earnings per share are up 6.8% per annum over the last five years. Management have been reinvested more than half of the company's earnings within the business, and the company has been able to grow earnings with this retained capital. We think this is generally an attractive combination, as dividends can grow through a combination of earnings growth and or a higher payout ratio over time.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Since the start of our data, 10 years ago, Cigna Group has lifted its dividend by approximately 65% a year on average. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

Final Takeaway

From a dividend perspective, should investors buy or avoid Cigna Group? Earnings per share have been growing moderately, and Cigna Group is paying out less than half its earnings and cash flow as dividends, which is an attractive combination as it suggests the company is investing in growth. It might be nice to see earnings growing faster, but Cigna Group is being conservative with its dividend payouts and could still perform reasonably over the long run. It's a promising combination that should mark this company worthy of closer attention.

So while Cigna Group looks good from a dividend perspective, it's always worthwhile being up to date with the risks involved in this stock. In terms of investment risks, we've identified 1 warning sign with Cigna Group and understanding them should be part of your investment process.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CI

Cigna Group

Provides insurance and related products and services in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)