- United States

- /

- Healthcare Services

- /

- NYSE:CI

Cigna Group (NYSE:CI) Announces US$1.51 Dividend And New Network Deal With Singleton

Reviewed by Simply Wall St

Cigna Group (NYSE:CI) recently announced a cash dividend of $1.51 per share and entered a multi-year agreement with Singleton Associates to improve in-network access for members in Texas. These moves align with broader market trends, including a recent tech rally and an investor focus on strategic partnerships. Cigna's 14% price increase last quarter aligns with other positive market movements, suggesting these initiatives potentially added weight to the overall trajectory. Other factors such as their share buyback program and executive changes could have also bolstered investor confidence, contributing to the company's notable quarterly stock performance.

Be aware that Cigna Group is showing 3 possible red flags in our investment analysis.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent developments, including Cigna's dividend announcement and partnership with Singleton Associates, are likely to enhance its market position by bolstering investor confidence and potentially driving further share price appreciation. Over a five-year period, Cigna experienced an 85.01% total return, highlighting a strong performance. However, in the past year, Cigna underperformed the US market, which returned 5.9%, while the company focused on initiatives such as executive changes and a share buyback program to maintain investor interest.

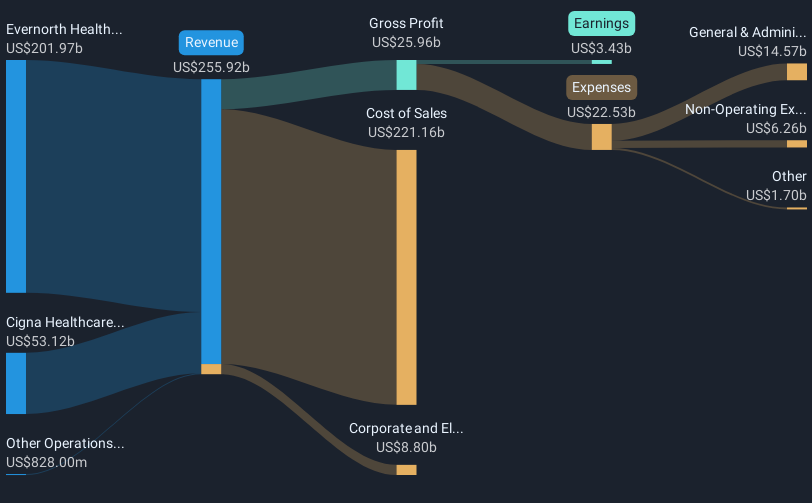

Cigna's partnership efforts and cost management strategies are expected to support revenue and earnings growth despite challenges like elevated medical costs. Evernorth's focus on Specialty Services and new customer initiatives could boost customer retention and drive future revenue. However, investments in healthcare experience improvements might initially weigh on margins. Analysts forecast revenue to grow annually by 4.1% and earnings by 15.3% per year.

With Cigna currently trading at US$337.07, near the analyst consensus price target of US$363.05, the company's recent price increase aligns with these expectations. The low percentage difference suggests that the stock is fairly valued in light of anticipated earnings improvements. Stakeholders may consider how ongoing strategic initiatives might affect Cigna's long-term trajectory, taking into account both optimistic and cautious analyst projections.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Cigna Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CI

Cigna Group

Provides insurance and related products and services in the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives