- United States

- /

- Healthcare Services

- /

- NYSE:CCM

Investors Still Aren't Entirely Convinced By Concord Medical Services Holdings Limited's (NYSE:CCM) Revenues Despite 26% Price Jump

Despite an already strong run, Concord Medical Services Holdings Limited (NYSE:CCM) shares have been powering on, with a gain of 26% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 41% in the last twelve months.

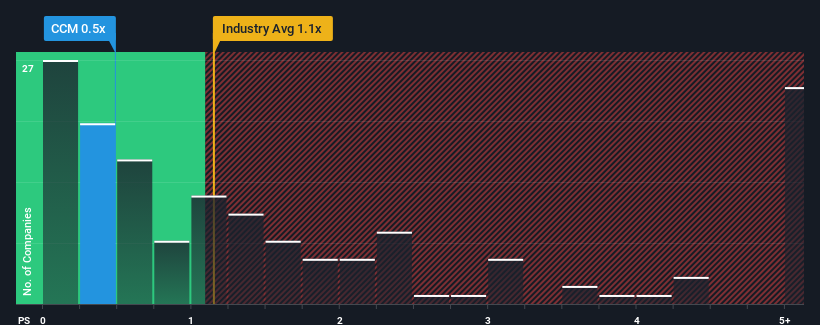

Although its price has surged higher, it would still be understandable if you think Concord Medical Services Holdings is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.5x, considering almost half the companies in the United States' Healthcare industry have P/S ratios above 1.1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Concord Medical Services Holdings

What Does Concord Medical Services Holdings' Recent Performance Look Like?

Revenue has risen firmly for Concord Medical Services Holdings recently, which is pleasing to see. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. Those who are bullish on Concord Medical Services Holdings will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Concord Medical Services Holdings will help you shine a light on its historical performance.How Is Concord Medical Services Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Concord Medical Services Holdings would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 14% last year. This was backed up an excellent period prior to see revenue up by 141% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 7.4% shows it's noticeably more attractive.

In light of this, it's peculiar that Concord Medical Services Holdings' P/S sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Despite Concord Medical Services Holdings' share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Concord Medical Services Holdings revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

Having said that, be aware Concord Medical Services Holdings is showing 4 warning signs in our investment analysis, and 3 of those are significant.

If these risks are making you reconsider your opinion on Concord Medical Services Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCM

Concord Medical Services Holdings

Through its subsidiaries, operates a network of radiotherapy and diagnostic imaging centers in the People’s Republic of China.

Slightly overvalued very low.

Market Insights

Community Narratives