- United States

- /

- Food and Staples Retail

- /

- NasdaqGM:YI

US Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As of January 2025, the U.S. stock market is experiencing a surge, with major indices like the S&P 500 reaching record highs amid strong corporate earnings and optimism about AI-related developments. Penny stocks may be an old term, but they continue to offer intriguing opportunities for investors seeking growth at lower price points. Typically representing smaller or newer companies, these stocks can present significant upside potential when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $111.94M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.93 | $6.36M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.80 | $11.61M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.94 | $2.18B | ★★★★☆☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2899 | $10.66M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.90 | $88.72M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.38 | $54.13M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.26 | $22.7M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.92 | $83.39M | ★★★★★☆ |

Click here to see the full list of 706 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

111 (NasdaqGM:YI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: 111, Inc., along with its subsidiaries, operates an integrated online and offline healthcare platform in the People's Republic of China, with a market cap of $40.05 million.

Operations: The company generates revenue of CN¥14.66 billion from its operations in the People's Republic of China.

Market Cap: $40.05M

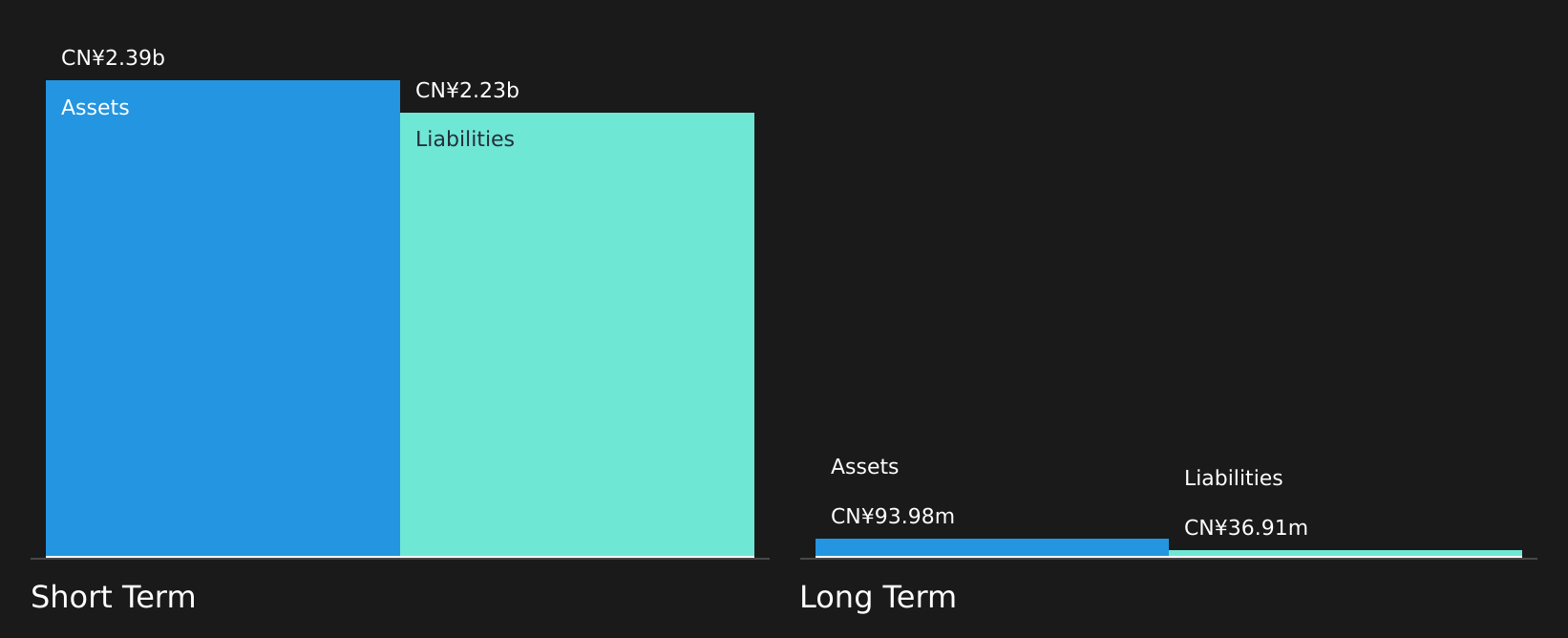

111, Inc. operates with a market cap of US$40.05 million and reported significant revenue generation of CN¥14.66 billion, indicating its active business operations in China. Despite being unprofitable, it has been reducing losses annually by 10.1% over the past five years and maintains a positive free cash flow with a cash runway exceeding three years. The company's stock is trading significantly below estimated fair value but experiences high volatility, recently executing a 1:10 stock split on January 24, 2025. Leadership changes include the appointment of Mr. Yang Luke Chen as director following Dr. Leon Lian Yong Chen's resignation.

- Take a closer look at 111's potential here in our financial health report.

- Assess 111's future earnings estimates with our detailed growth reports.

Butterfly Network (NYSE:BFLY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Butterfly Network, Inc. develops, manufactures, and commercializes ultrasound imaging solutions both in the United States and internationally with a market cap of approximately $837.33 million.

Operations: The company's revenue is primarily derived from providing an AI-enhanced personal ultrasound solution, totaling $76.22 million.

Market Cap: $837.33M

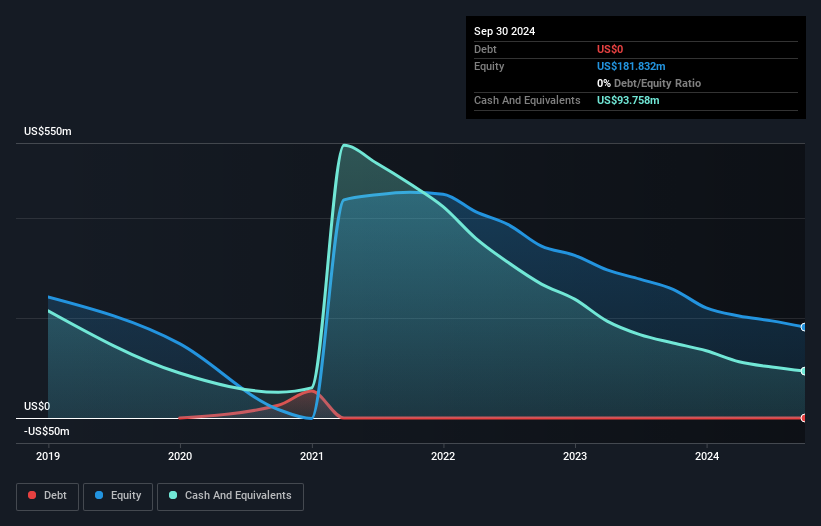

Butterfly Network, with a market cap of US$837.33 million, is experiencing revenue growth, reporting US$20.56 million for Q3 2024 compared to US$15.42 million the previous year. Despite being unprofitable and having a negative return on equity of -54.18%, it has no debt and its short-term assets exceed liabilities significantly, providing financial stability in the near term. The company expects a 35% revenue increase for Q4 2024 and was recently added to the S&P Healthcare Equipment Select Industry Index, reflecting some positive market sentiment despite recent insider selling and stock volatility challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Butterfly Network.

- Gain insights into Butterfly Network's future direction by reviewing our growth report.

Energy Vault Holdings (NYSE:NRGV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Energy Vault Holdings, Inc. develops and sells energy storage solutions and has a market cap of approximately $313.37 million.

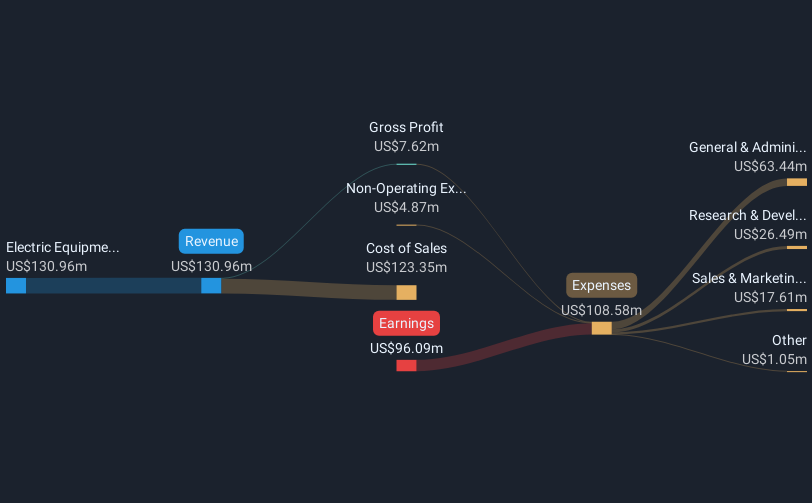

Operations: The company generates revenue from its Electric Equipment segment, totaling $130.96 million.

Market Cap: $313.37M

Energy Vault Holdings, with a market cap of US$313.37 million, is navigating financial challenges, reporting a significant drop in revenue to US$12.73 million for the first nine months of 2024 from US$223.31 million the previous year. Despite being unprofitable with a negative return on equity of -53.67%, it maintains more cash than its total debt and short-term assets exceed liabilities. Recent strategic partnerships aim to enhance its energy storage solutions and accelerate deployment timelines for data centers, potentially bolstering future revenue streams despite current volatility and operational losses.

- Click to explore a detailed breakdown of our findings in Energy Vault Holdings' financial health report.

- Explore Energy Vault Holdings' analyst forecasts in our growth report.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 703 US Penny Stocks now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:YI

111

Operates an integrated online and offline platform in the healthcare market in the People's Republic of China.

Excellent balance sheet and fair value.