- United States

- /

- Healthcare Services

- /

- NasdaqGS:WGS

3 Stocks On US Exchange Estimated To Be Undervalued By Up To 36.2%

Reviewed by Simply Wall St

As the U.S. stock market continues to reach new heights, with the S&P 500 recently setting a record high, investors are increasingly on the lookout for opportunities that may be undervalued amidst this rally. In such an environment, identifying stocks that are trading below their intrinsic value can offer potential growth opportunities, especially when broader market indices are performing strongly.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | $18.66 | $36.99 | 49.6% |

| CareTrust REIT (NYSE:CTRE) | $25.97 | $50.31 | 48.4% |

| Smurfit Westrock (NYSE:SW) | $55.30 | $109.74 | 49.6% |

| Sandy Spring Bancorp (NasdaqGS:SASR) | $33.88 | $64.49 | 47.5% |

| Incyte (NasdaqGS:INCY) | $71.27 | $134.85 | 47.1% |

| Array Technologies (NasdaqGM:ARRY) | $6.86 | $13.52 | 49.3% |

| Constellium (NYSE:CSTM) | $9.24 | $18.27 | 49.4% |

| First Advantage (NasdaqGS:FA) | $19.58 | $38.12 | 48.6% |

| Open Lending (NasdaqGM:LPRO) | $5.48 | $10.38 | 47.2% |

| Kyndryl Holdings (NYSE:KD) | $41.87 | $82.10 | 49% |

Let's dive into some prime choices out of the screener.

DexCom (NasdaqGS:DXCM)

Overview: DexCom, Inc. is a medical device company that specializes in the design, development, and commercialization of continuous glucose monitoring systems globally, with a market cap of approximately $34.80 billion.

Operations: The company's revenue is primarily derived from its patient monitoring equipment segment, which generated $4.03 billion.

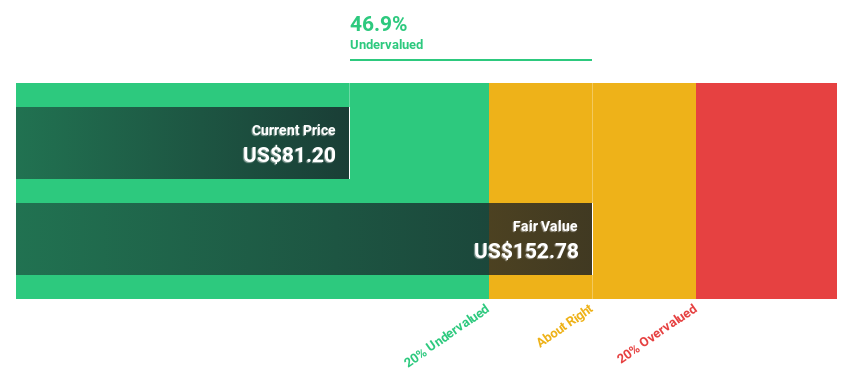

Estimated Discount To Fair Value: 19.6%

DexCom is trading at US$90.53, below its estimated fair value of US$112.6, suggesting potential undervaluation based on cash flows. Revenue growth is projected to outpace the broader market at 12.9% annually, with earnings expected to grow 19.3% per year, surpassing market averages. Recent strategic initiatives include a partnership with OURA and a shelf registration filing for various securities, indicating proactive capital management and expansion efforts amid a competitive landscape.

- Upon reviewing our latest growth report, DexCom's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of DexCom.

GeneDx Holdings (NasdaqGS:WGS)

Overview: GeneDx Holdings Corp. is a genomics company that offers personalized health insights to aid in diagnosis, treatment, and drug discovery, with a market cap of approximately $2.10 billion.

Operations: GeneDx Holdings Corp. generates revenue by providing genomics-based personalized health insights that support diagnosis, treatment guidance, and drug discovery.

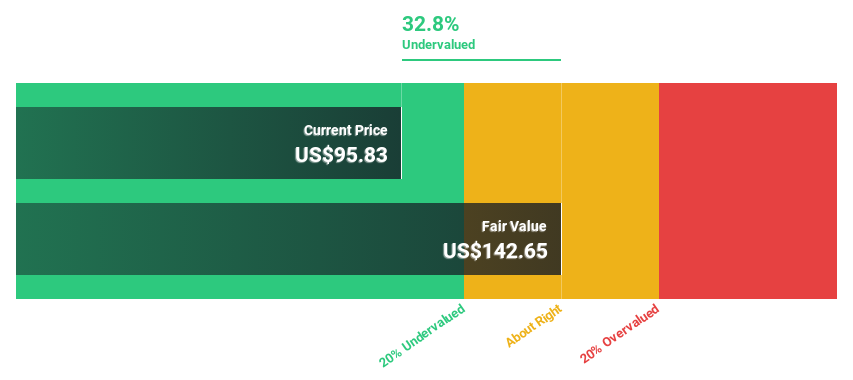

Estimated Discount To Fair Value: 21%

GeneDx Holdings, trading at US$112.76, is considered undervalued with a fair value estimate of US$142.65. The company reported significant revenue growth to US$305.45 million in 2024, reducing net losses substantially from the previous year. With expected revenue growth of 15% annually and profitability anticipated within three years, GeneDx's strategic initiatives in genetic testing and telehealth services are poised to enhance its financial position further amid market expansion efforts.

- The analysis detailed in our GeneDx Holdings growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in GeneDx Holdings' balance sheet health report.

Albemarle (NYSE:ALB)

Overview: Albemarle Corporation provides energy storage solutions worldwide and has a market cap of approximately $9.55 billion.

Operations: The company's revenue segments include Ketjen at $1.04 billion, Specialties at $1.33 billion, and Energy Storage at $3.02 billion.

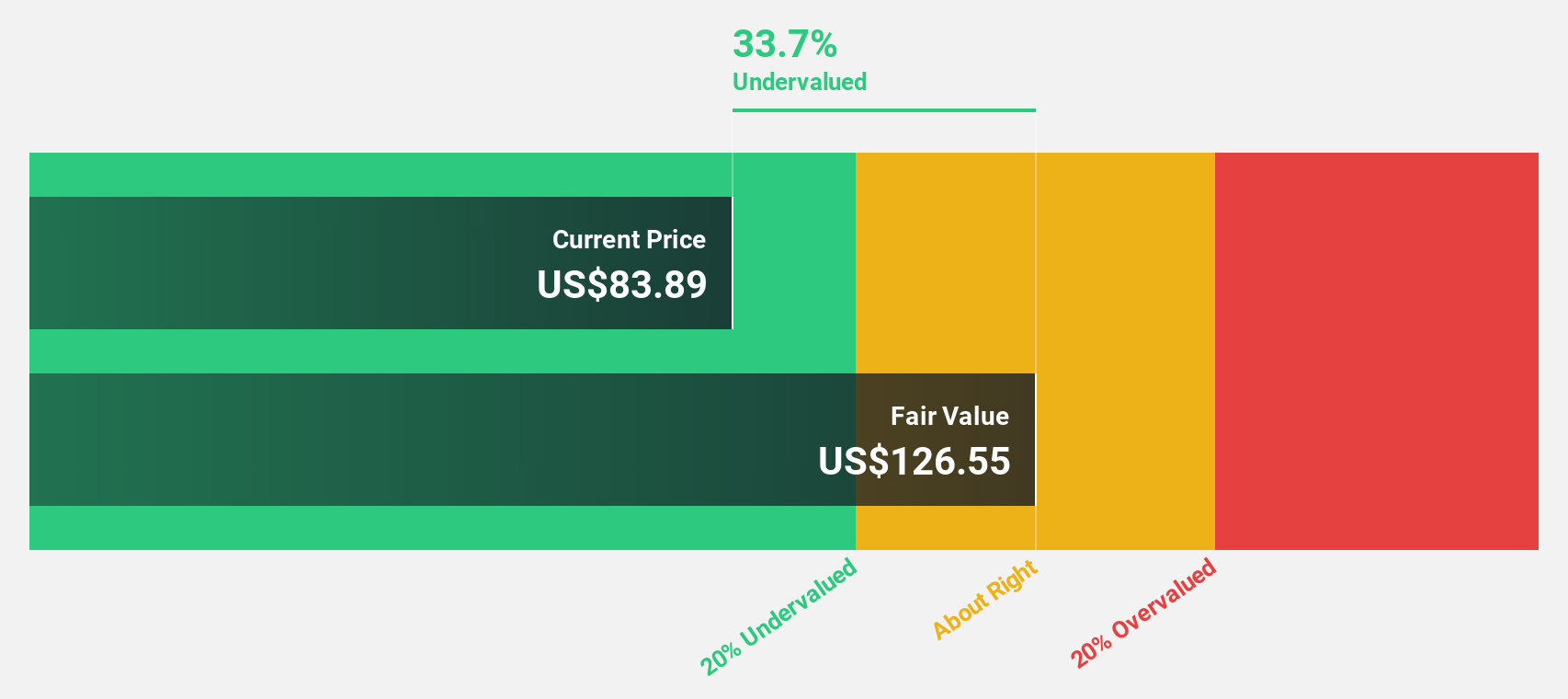

Estimated Discount To Fair Value: 36.2%

Albemarle, trading at US$83.58, is undervalued with a fair value estimate of US$131. Despite reporting a net loss of US$1.18 billion in 2024, the company is forecast to achieve above-average market profit growth and faster revenue growth than the US market over the next three years. However, its dividend yield of 1.94% isn't well covered by earnings or free cash flows, and return on equity is projected to remain low at 8.4%.

- Our comprehensive growth report raises the possibility that Albemarle is poised for substantial financial growth.

- Click here to discover the nuances of Albemarle with our detailed financial health report.

Taking Advantage

- Embark on your investment journey to our 162 Undervalued US Stocks Based On Cash Flows selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade GeneDx Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WGS

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives