- United States

- /

- Software

- /

- NasdaqGS:TENB

High Growth Tech Stocks In The US For April 2025

Reviewed by Simply Wall St

In the midst of significant market volatility, with the Dow Jones dropping 1,800 points and the Nasdaq sliding by 6% due to a tech sell-off led by chipmakers and Tesla, investors are closely monitoring high-growth tech stocks in the United States. In such turbulent times, identifying strong stocks often involves looking for companies that demonstrate resilience through innovation and adaptability to shifting economic conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.44% | 29.79% | ★★★★★★ |

| TG Therapeutics | 26.03% | 37.60% | ★★★★★★ |

| Alkami Technology | 20.46% | 85.16% | ★★★★★★ |

| Travere Therapeutics | 28.45% | 65.05% | ★★★★★★ |

| Arcutis Biotherapeutics | 25.83% | 58.17% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.73% | 58.77% | ★★★★★★ |

| AVITA Medical | 27.47% | 56.12% | ★★★★★★ |

| TKO Group Holdings | 22.48% | 25.17% | ★★★★★★ |

| Lumentum Holdings | 21.61% | 120.49% | ★★★★★★ |

| Ascendis Pharma | 32.36% | 59.79% | ★★★★★★ |

Click here to see the full list of 234 stocks from our US High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Tenable Holdings (NasdaqGS:TENB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tenable Holdings, Inc. offers cyber exposure management solutions across various regions including the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan with a market cap of $4.09 billion.

Operations: Tenable Holdings, Inc. generates revenue primarily from its security software and services, amounting to $900.02 million. The company operates across multiple regions including the Americas, EMEA, APAC, and Japan.

Tenable Holdings, a cybersecurity firm, has demonstrated its commitment to innovation with significant investments in research and development, highlighted by a recent shelf registration aimed at raising nearly $299 million for potential expansions. The company's strategic focus on enhancing identity security solutions is evident from the launch of Identity 360 and Exposure Center, which simplify complex identity environments and strengthen organizational defenses against escalating threats. Despite a challenging competitive landscape marked by rapid technological evolutions, Tenable's presentations at major tech conferences underscore its proactive approach in maintaining relevance and driving growth within the cybersecurity sector. With an anticipated revenue growth of 7.9% annually, Tenable is strategically positioning itself to capitalize on market opportunities while navigating through its current unprofitable phase towards forecasted profitability in the coming years.

- Dive into the specifics of Tenable Holdings here with our thorough health report.

Review our historical performance report to gain insights into Tenable Holdings''s past performance.

2seventy bio (NasdaqGS:TSVT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: 2seventy bio, Inc. is a cell and gene therapy company dedicated to researching, developing, and commercializing cancer treatments in the United States with a market cap of $255.93 million.

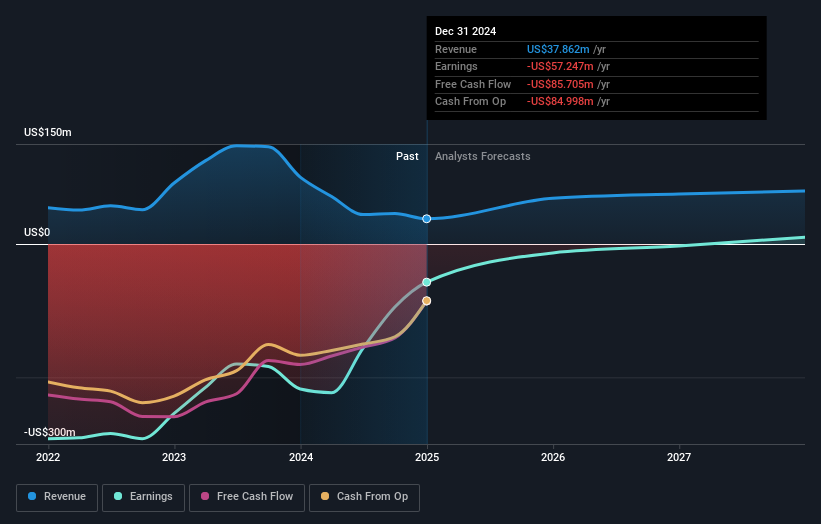

Operations: Focused on cancer treatments, 2seventy bio, Inc. generates revenue primarily from developing and commercializing potentially transformative therapies, with recent figures reported at $37.86 million.

Amidst a challenging year marked by regulatory delays and significant financial losses, 2seventy bio has entered a transformative phase with its impending acquisition by Bristol Myers Squibb for approximately $286 million, signaling a robust vote of confidence from one of the pharma sector's giants. This strategic move is poised to enhance the development and accessibility of Abecma, their collaborative CAR T-cell therapy for multiple myeloma. Despite a net loss reduction from $217.57 million to $57.25 million year-over-year and an earnings growth forecast at an impressive 69.7% annually, the company's journey towards profitability reflects its resilience and potential in high-stakes biotech innovation. The acquisition not only promises substantial financial backing but also aligns with 2seventy bio’s focus on pioneering cancer treatments, potentially accelerating its path to market leadership post-merger.

- Delve into the full analysis health report here for a deeper understanding of 2seventy bio.

Understand 2seventy bio's track record by examining our Past report.

Waystar Holding (NasdaqGS:WAY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Waystar Holding Corp. specializes in creating cloud-based software solutions for healthcare payments, with a market capitalization of $6.07 billion.

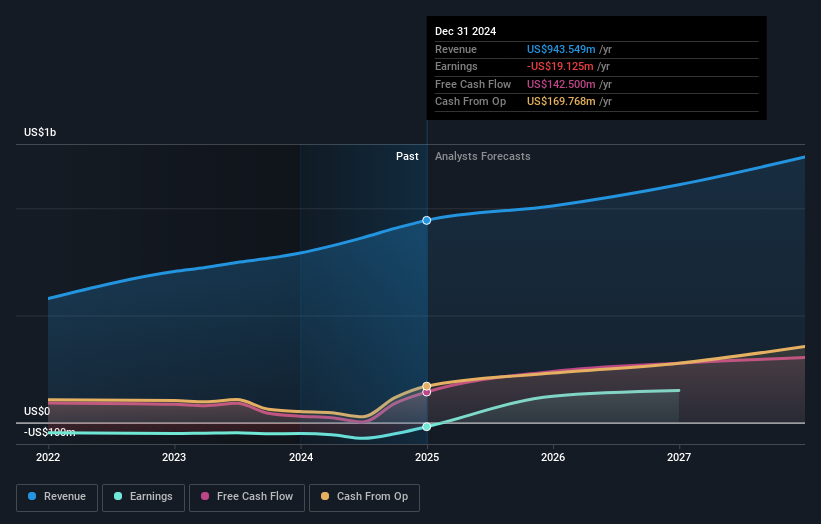

Operations: The company generates revenue primarily from its healthcare software segment, totaling $943.55 million.

Waystar Holding's recent launch of Auth Accelerate and AltitudeAI™ underscores its commitment to tackling healthcare's administrative inefficiencies through advanced AI. These innovations are set to revolutionize the prior authorization and claim denial processes by significantly reducing processing times and improving approval rates, which is critical as the healthcare industry grapples with $350 billion lost annually to such inefficiencies. With a robust 19.3% revenue growth last year and projections for continued expansion at 8.7% annually, Waystar is strategically positioned to capitalize on these pressing industry needs, enhancing provider productivity and patient care outcomes.

- Get an in-depth perspective on Waystar Holding's performance by reading our health report here.

Explore historical data to track Waystar Holding's performance over time in our Past section.

Taking Advantage

- Gain an insight into the universe of 234 US High Growth Tech and AI Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Tenable Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tenable Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TENB

Tenable Holdings

Provides cyber exposure management solutions in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives