- United States

- /

- Healthcare Services

- /

- NasdaqCM:VMD

Undiscovered Gems in the United States to Explore This January 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 3.0%, contributing to a remarkable 25% increase over the past year, with earnings expected to grow by 15% per annum in the coming years. In such a dynamic environment, identifying stocks that are not only poised for growth but also remain underappreciated can be key to uncovering hidden opportunities in your investment portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Cashmere Valley Bank | 15.51% | 5.80% | 3.51% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

Viemed Healthcare (NasdaqCM:VMD)

Simply Wall St Value Rating: ★★★★★★

Overview: Viemed Healthcare, Inc. offers home medical equipment and post-acute respiratory healthcare services across the United States, with a market capitalization of $316.55 million.

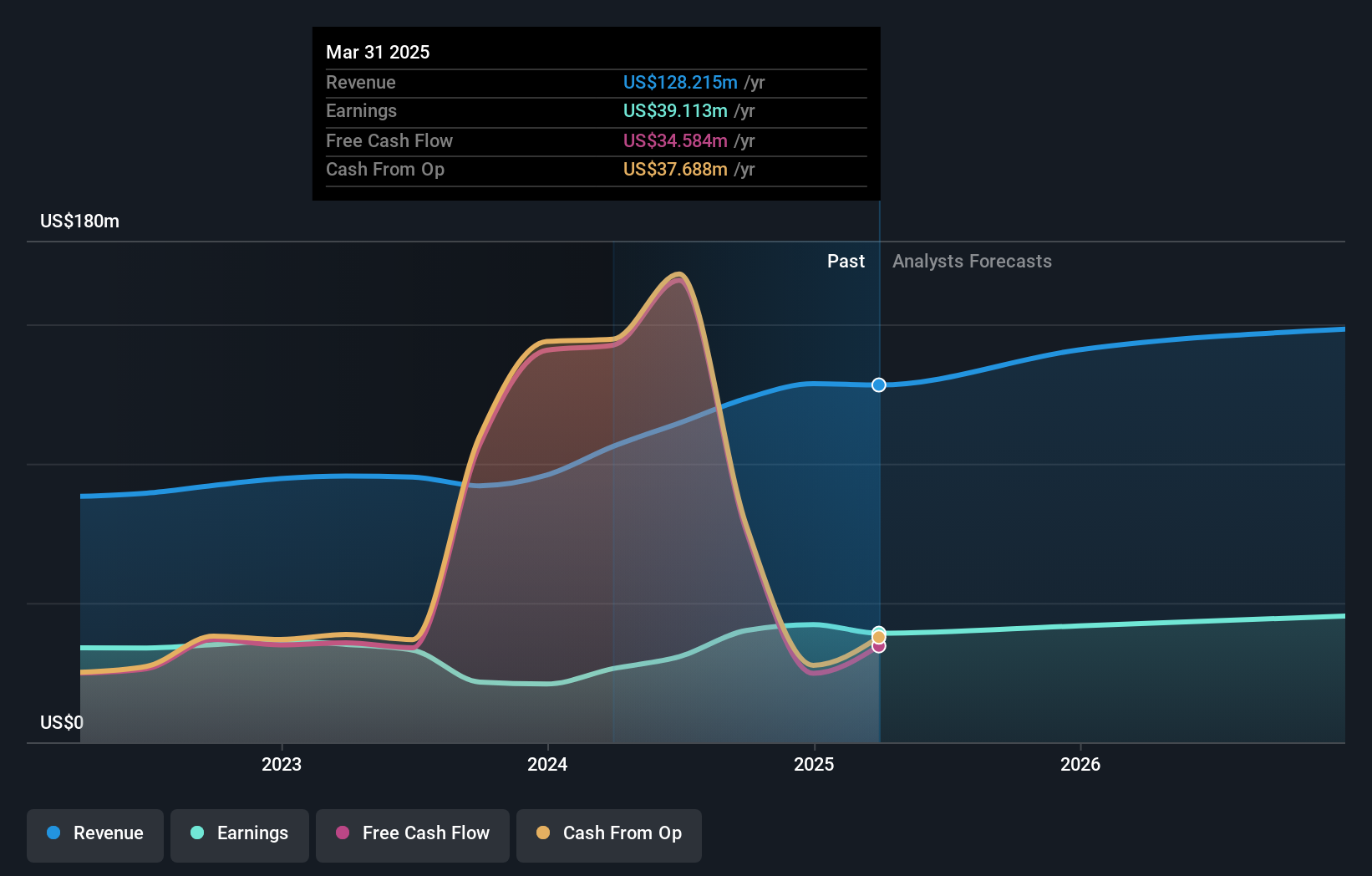

Operations: Viemed generates revenue primarily from its Sleep and Respiratory Disorders Sector, which accounts for $214.30 million. The company's net profit margin has shown variability over recent periods.

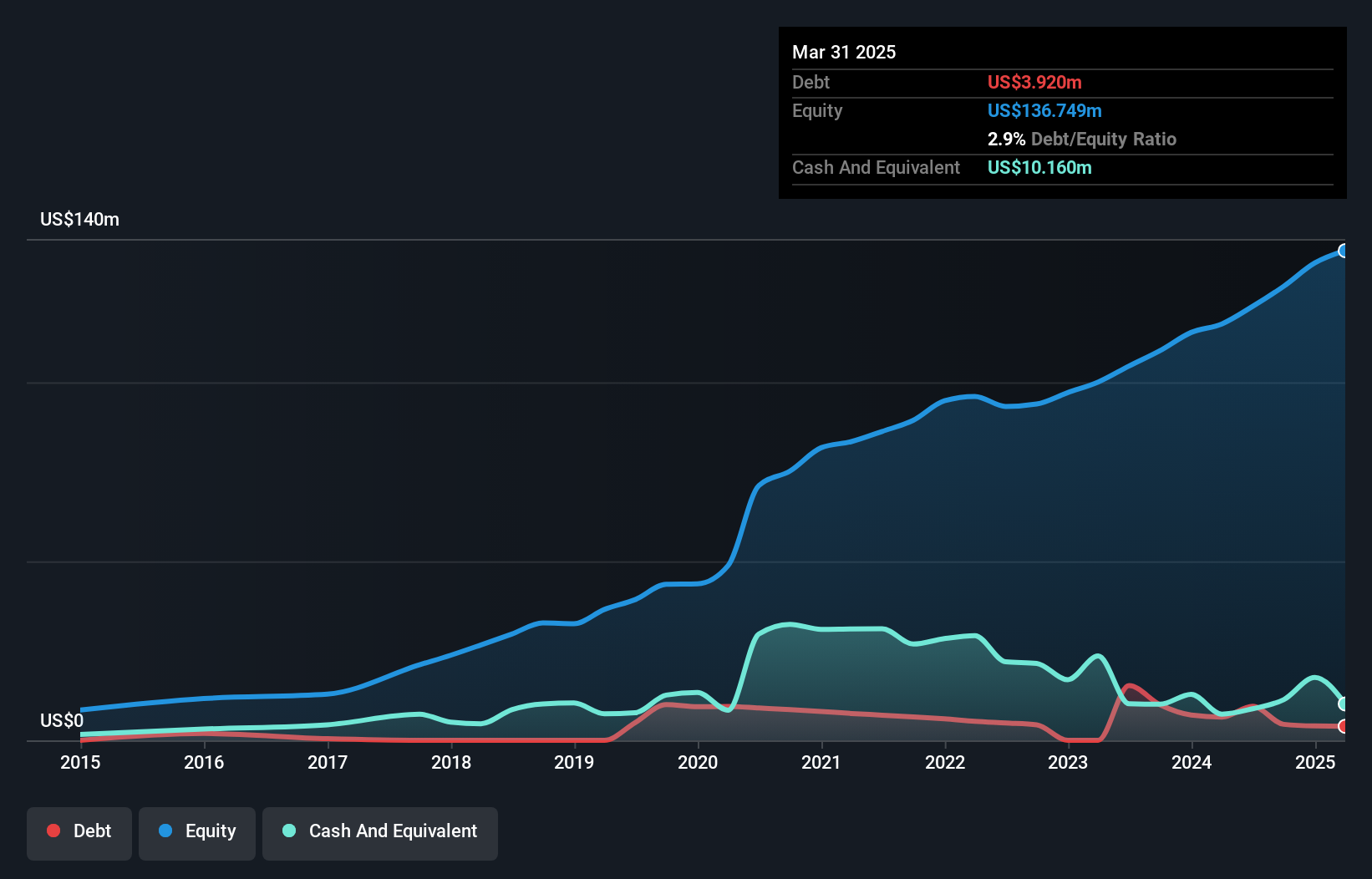

Viemed Healthcare, with its focus on ventilator and sleep therapy services, has shown robust performance in recent quarters. The company reported third-quarter sales of US$58 million, up from US$49.4 million the previous year, while net income increased to US$3.88 million from US$2.92 million. Earnings per share rose to US$0.10 from US$0.08 for the same period last year, reflecting a positive trend in profitability despite challenges like regulatory reliance and capital expenditures for equipment replacements. With a debt-to-equity ratio reduced to 3.5% over five years and strong earnings growth outpacing the industry at 13%, Viemed seems poised for continued expansion supported by its proprietary Engage platform and potential M&A activities.

First Bank (NasdaqGM:FRBA)

Simply Wall St Value Rating: ★★★★★★

Overview: First Bank offers a range of banking products and services to small to mid-sized businesses and individuals, with a market capitalization of $346.02 million.

Operations: Revenue from community banking amounts to $123.43 million.

Earnings for First Bank surged by 85.6% over the past year, significantly outpacing the banking industry's -9.9%. With total assets of US$3.8 billion and equity at US$402.1 million, it demonstrates a strong financial footing. The bank's allowance for bad loans stands robustly at 312%, indicating prudent risk management, while customer deposits form 91% of its low-risk funding sources. Shares are trading at a notable discount to estimated fair value, suggesting potential investment appeal. Recent dividend affirmations and earnings announcements underscore confidence in future performance with net income reaching US$42.24 million for 2024 compared to US$20.9 million previously.

Carter Bankshares (NasdaqGS:CARE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Carter Bankshares, Inc. is the bank holding company for Carter Bank & Trust, offering a range of banking products and services in the United States with a market cap of $404.68 million.

Operations: Carter Bankshares generates revenue primarily through interest income from loans and investments, alongside fees from banking services. The company's net profit margin is 22.5%, reflecting its efficiency in managing costs relative to its revenue streams.

Carter Bankshares, with total assets of US$4.7 billion and equity of US$384.3 million, is making waves despite its challenges. Holding deposits worth US$4.2 billion and loans totaling US$3.5 billion, it operates with a net interest margin of 2.9%. However, the bank faces a high level of bad loans at 8%, paired with an insufficient allowance for these loans at just 28%. On the upside, Carter's earnings grew by 5.8% last year, outpacing the industry average decline of -9.9%, while trading significantly below its estimated fair value by 56.7%.

- Get an in-depth perspective on Carter Bankshares' performance by reading our health report here.

Examine Carter Bankshares' past performance report to understand how it has performed in the past.

Seize The Opportunity

- Click here to access our complete index of 261 US Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VMD

Viemed Healthcare

Through its subsidiaries, provides home medical equipment (HME) and post-acute respiratory healthcare services in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives