- United States

- /

- Medical Equipment

- /

- NasdaqCM:UFPT

What You Can Learn From UFP Technologies, Inc.'s (NASDAQ:UFPT) P/E After Its 26% Share Price Crash

UFP Technologies, Inc. (NASDAQ:UFPT) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. Still, a bad month hasn't completely ruined the past year with the stock gaining 39%, which is great even in a bull market.

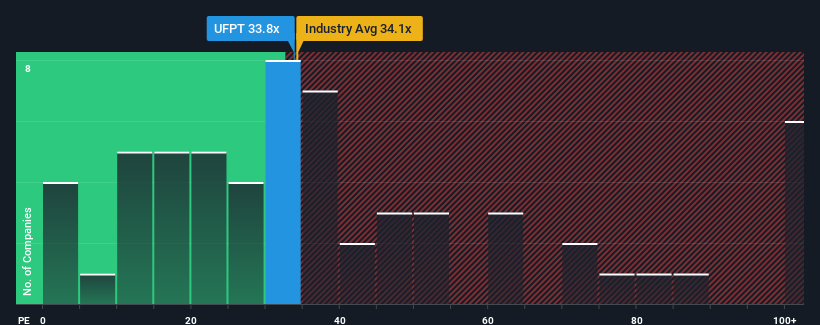

Even after such a large drop in price, UFP Technologies may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 33.8x, since almost half of all companies in the United States have P/E ratios under 18x and even P/E's lower than 11x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

UFP Technologies certainly has been doing a good job lately as it's been growing earnings more than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for UFP Technologies

Does Growth Match The High P/E?

UFP Technologies' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered an exceptional 29% gain to the company's bottom line. Pleasingly, EPS has also lifted 215% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 18% as estimated by the three analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 15%, which is noticeably less attractive.

With this information, we can see why UFP Technologies is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

A significant share price dive has done very little to deflate UFP Technologies' very lofty P/E. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that UFP Technologies maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for UFP Technologies you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:UFPT

UFP Technologies

Designs and manufactures solutions for medical devices, sterile packaging, and other engineered custom products in the United States.

Solid track record and fair value.

Market Insights

Community Narratives