- United States

- /

- Medical Equipment

- /

- NasdaqGM:TMDX

A Fresh Look at TransMedics Group (TMDX) Valuation as Investors Anticipate Key Conference Updates

Reviewed by Simply Wall St

TransMedics Group (TMDX) is attracting fresh attention as its executive team prepares to take the stage at the Morgan Stanley 23rd Annual Global Healthcare Conference on September 8. For many investors, these conference appearances are more than just calendar events, as they can bring new details on strategy, expansion plans, or financial goals that move the needle for the stock. With CEO Waleed H. Hassanein and CFO Gerardo Hernandez both scheduled to speak, market watchers are on alert for updates that could influence perceptions of future growth and risk.

In the lead-up to the conference, TransMedics Group's stock price has seen a shift in momentum. Over the past month, shares have dipped almost 9%, and the three-month return sits down 26%. Despite those recent declines, the stock is still up 56% for the year, but remains roughly 25% below its price from this time last year. This pattern suggests that while optimism has fueled strong gains since January, short-term confidence may be cooling as investors await fresh information.

Given this backdrop, some investors may be considering whether now is the moment to step in and capitalize on a potential bargain, or if the current price already reflects everything investors expect from TransMedics Group’s next chapter.

Most Popular Narrative: 25% Undervalued

The most widely followed narrative suggests that TransMedics Group is trading well below its calculated fair value, with significant potential upside if future projections hold true. Analysts cite strong growth drivers and expansion strategies as key reasons underlying this bullish valuation outlook.

Ongoing healthcare modernization initiatives and increased recognition of organ transplantation as a cost-effective treatment are prompting both U.S. and international health systems to invest in advanced transplant infrastructure. This supports broader clinical adoption of the OCS system and should drive both domestic and international revenue acceleration.

Curious how a medical technology company earns such a hefty valuation premium? The story is not just about headline growth. There are bold assumptions about market share grabs, expansion into untapped markets, and margin breakthroughs. Want to see how these factors stack up behind that fair value estimate? Dive deeper to unravel the financial logic powering this compelling narrative.

Result: Fair Value of $138.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, clinical trial setbacks or overseas expansion hurdles could quickly challenge the bullish outlook and cause investors to reconsider TransMedics Group’s growth story.

Find out about the key risks to this TransMedics Group narrative.Another View: Valuing by Market Ratios

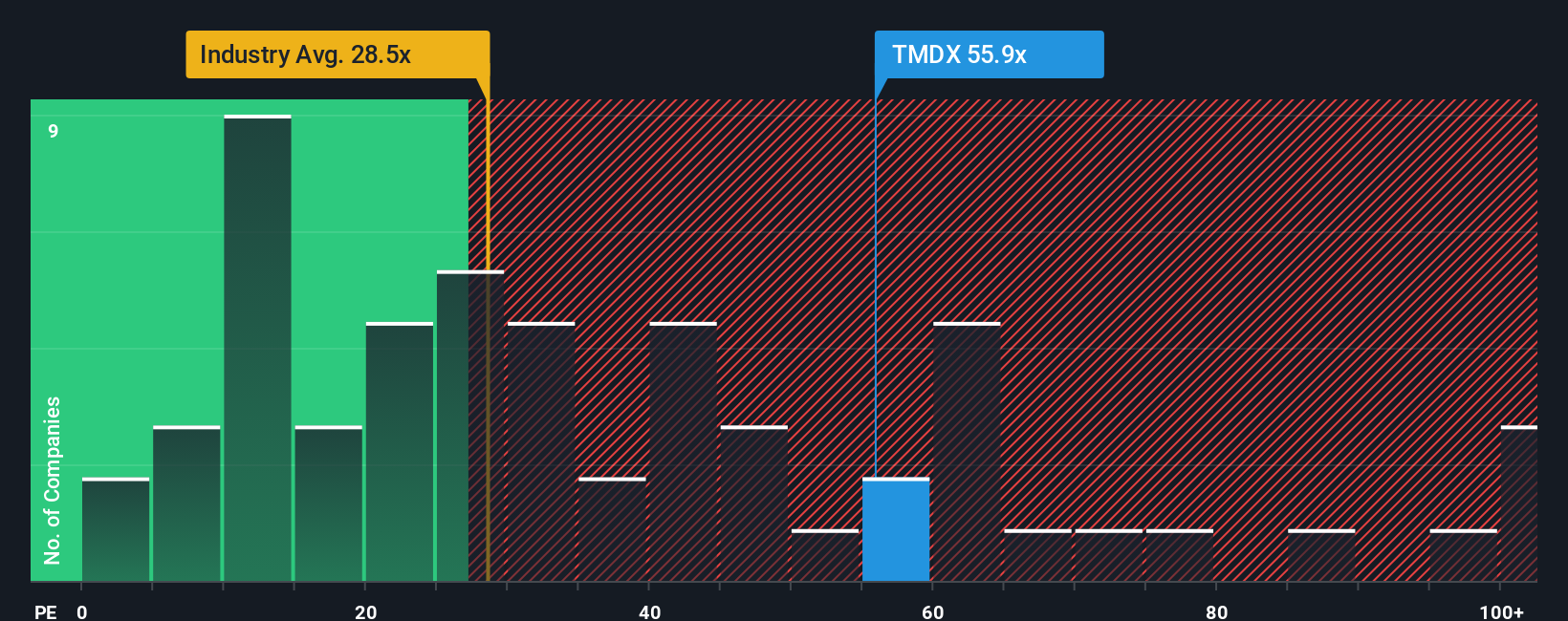

While the previous approach suggests room for upside, looking through the lens of market ratios gives a different impression. When compared to industry benchmarks, the current market price appears elevated. Could investor optimism be running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TransMedics Group Narrative

If you’d rather dig into the numbers and form your own perspective, it’s easy to shape a personal investment story in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding TransMedics Group.

Looking for More Compelling Investment Ideas?

Put your curiosity to good use and harness the power of smart screening tools from Simply Wall Street. Seize new opportunities with these focused ideas that could spark your next big move.

- Spot tomorrow’s tech disruptors early by researching AI penny stocks as they scale artificial intelligence breakthroughs across industries.

- Boost your portfolio’s income potential by targeting companies offering dividend stocks with yields > 3% for those who want reliable returns above 3% yield.

- Stay ahead of the market by uncovering stocks currently trading below their intrinsic worth with our tailored list of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TransMedics Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGM:TMDX

TransMedics Group

A commercial-stage medical technology company, engages in transforming organ transplant therapy for end-stage organ failure patients in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)