- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:REFR

US Penny Stocks To Watch In October 2024

Reviewed by Simply Wall St

As the U.S. stock market gears up for a significant week of earnings and economic data releases, major indices like the Dow Jones, S&P 500, and Nasdaq are showing positive momentum. Amidst this backdrop, investors often look beyond the large-cap stocks to explore opportunities in smaller companies that may offer unique growth prospects. Although penny stocks may seem like a relic from earlier trading days, they continue to represent an intriguing area for investment by highlighting companies with potential value and growth opportunities.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.78982 | $5.74M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.12 | $512.97M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.61 | $2.05B | ★★★★★★ |

| ARC Document Solutions (NYSE:ARC) | $3.43 | $148.35M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.59 | $52.47M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| MIND C.T.I (NasdaqGM:MNDO) | $1.88 | $39.06M | ★★★★★★ |

| Better Choice (NYSEAM:BTTR) | $1.68 | $2.78M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.10 | $98.93M | ★★★★★☆ |

Click here to see the full list of 760 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Research Frontiers (NasdaqCM:REFR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Research Frontiers Incorporated develops and markets technology and devices for controlling light flow globally, with a market cap of $73.40 million.

Operations: The company generates revenue of $1.28 million from its segment focused on the development and marketing of technology and devices that manage light flow.

Market Cap: $73.4M

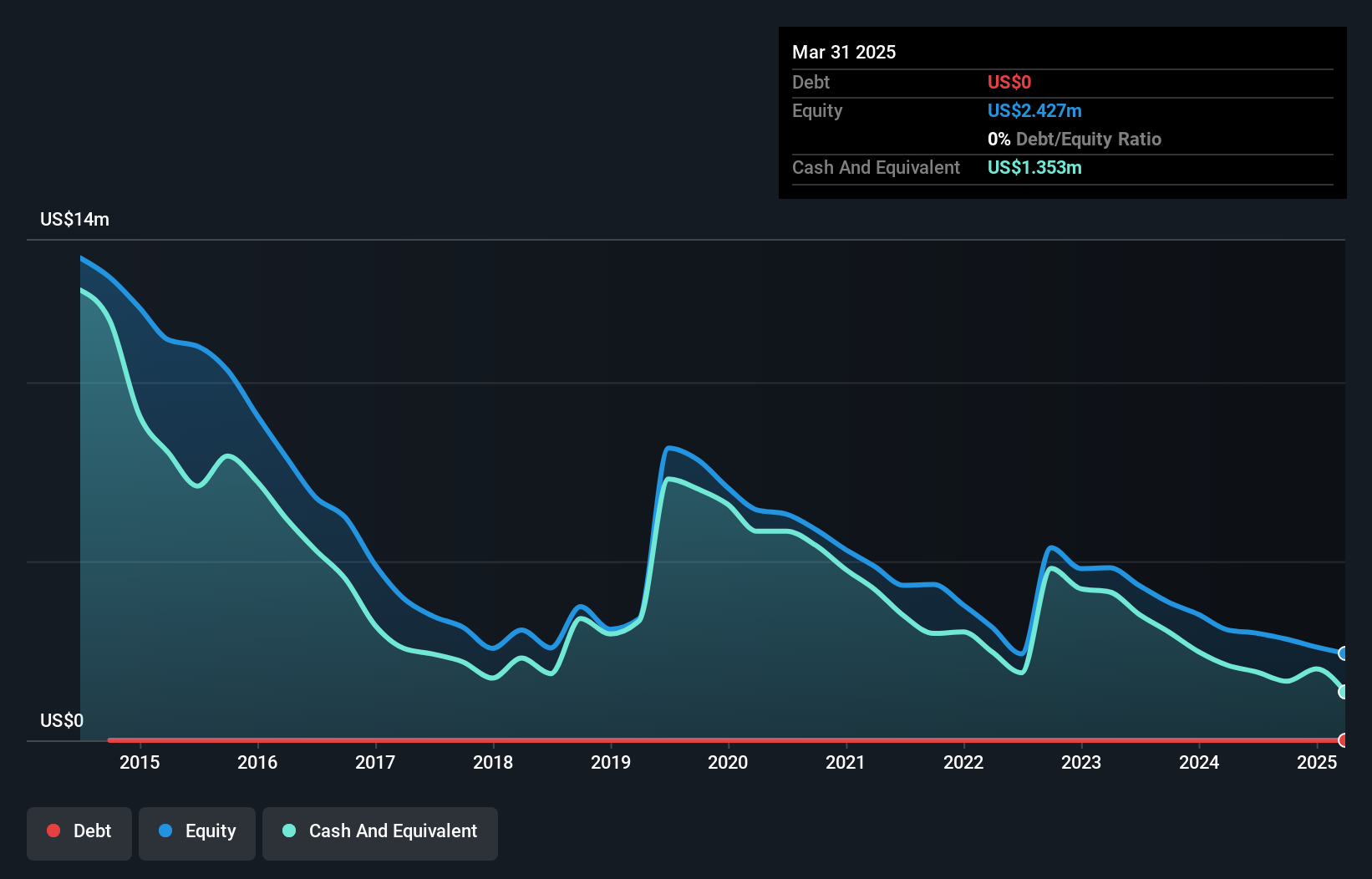

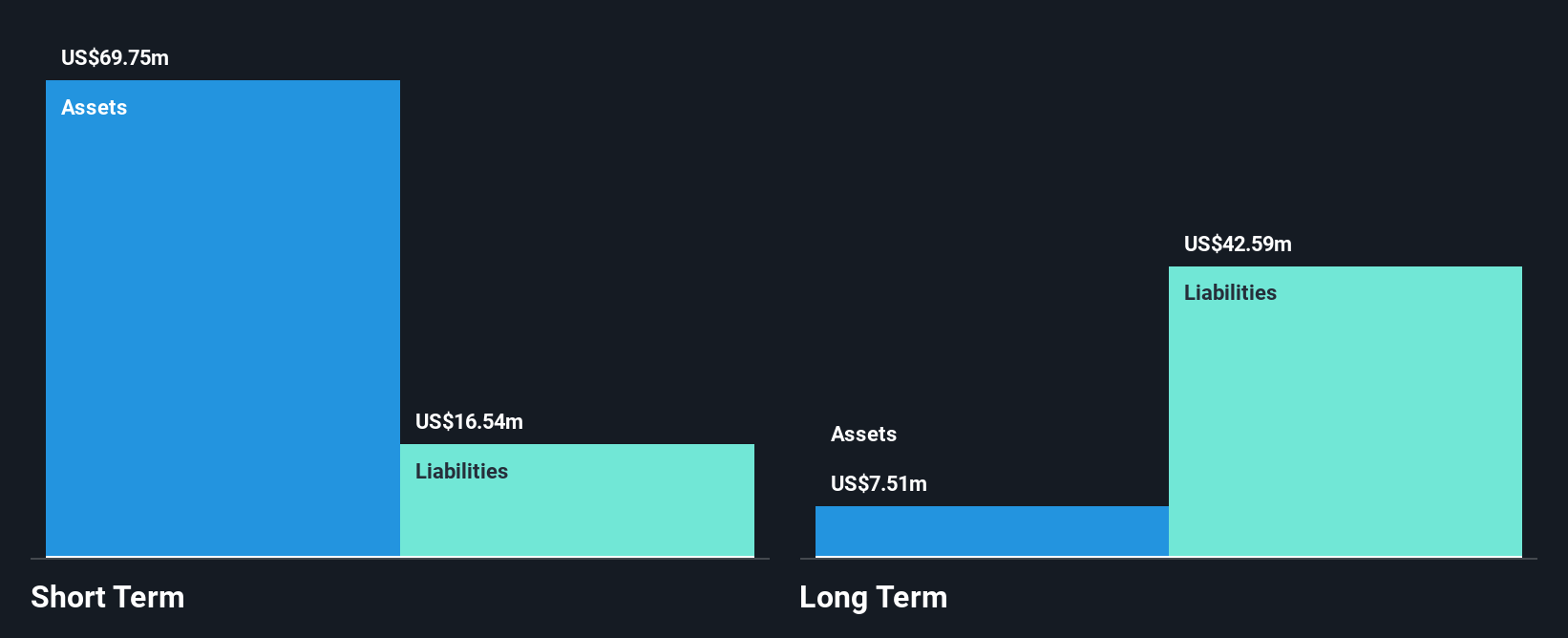

Research Frontiers, with a market cap of US$73.40 million, focuses on light control technology but remains unprofitable with limited revenue of US$1.28 million. The company has reduced its net loss over recent years and reported a smaller loss for the second quarter of 2024 compared to the previous year. It benefits from having no debt and short-term assets exceeding liabilities by a significant margin, providing some financial stability. Despite stable weekly volatility and an experienced board, its negative return on equity highlights ongoing profitability challenges in the competitive electronic industry landscape.

- Click to explore a detailed breakdown of our findings in Research Frontiers' financial health report.

- Assess Research Frontiers' previous results with our detailed historical performance reports.

TELA Bio (NasdaqGM:TELA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: TELA Bio, Inc. is a commercial-stage medical technology company specializing in soft-tissue reconstruction solutions to enhance clinical outcomes while maintaining patient anatomy, with a market cap of $70.68 million.

Operations: The company generates its revenue from the Surgical & Medical Equipment segment, amounting to $64.74 million.

Market Cap: $70.68M

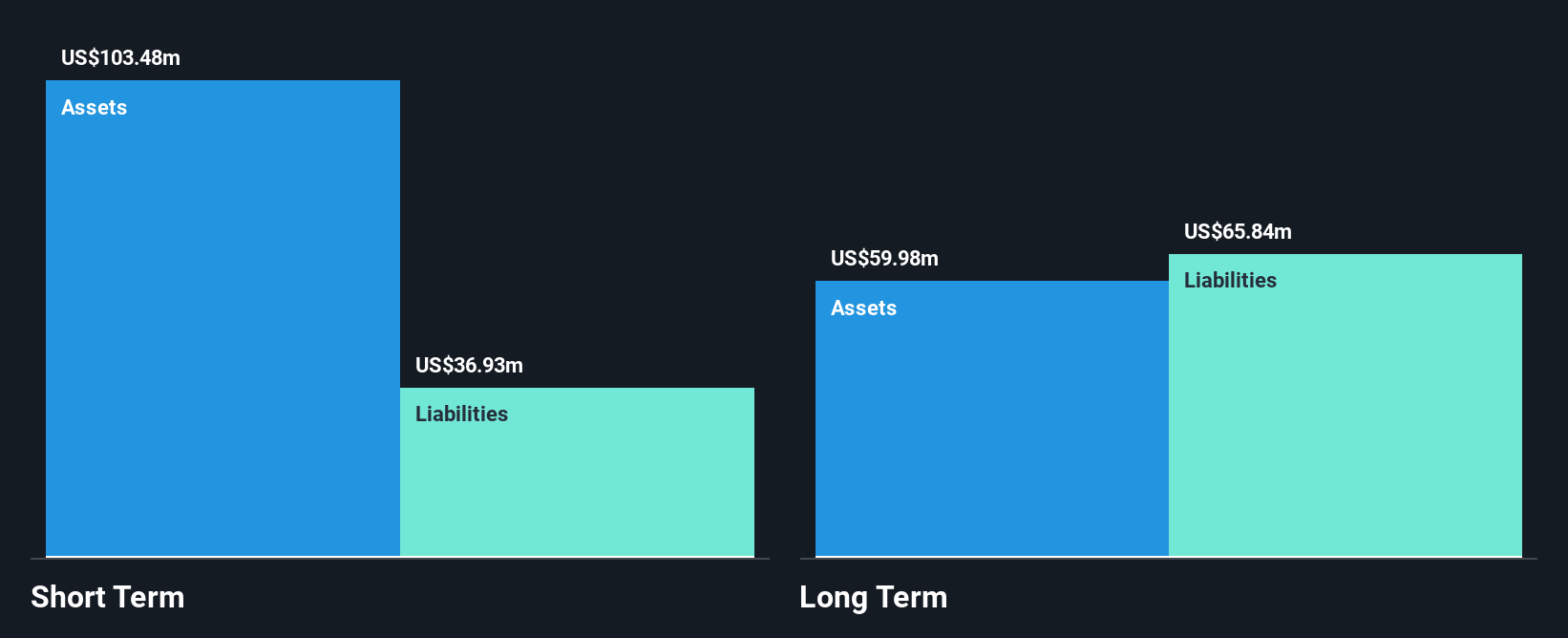

TELA Bio, with a market cap of US$70.68 million, operates in the medical technology sector and is currently unprofitable, with significant debt challenges reflected in a high net debt to equity ratio of 499%. Despite this, the company has shown revenue growth potential and forecasts indicate an annual increase of approximately 21.23%. Recent financial maneuvers include a successful follow-on equity offering raising US$40.05 million, which may bolster its cash runway beyond the current seven-month estimate. While short-term assets comfortably cover liabilities, ongoing losses and negative return on equity underscore profitability hurdles ahead.

- Take a closer look at TELA Bio's potential here in our financial health report.

- Learn about TELA Bio's future growth trajectory here.

SOPHiA GENETICS (NasdaqGS:SOPH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: SOPHiA GENETICS SA is a cloud-native software technology company in the healthcare sector with a market cap of $238.35 million.

Operations: The company's revenue is primarily generated from its healthcare software segment, totaling $64.94 million.

Market Cap: $238.35M

SOPHiA GENETICS, with a market cap of US$238.35 million, is actively expanding its healthcare software segment, generating US$64.94 million in revenue. Despite being unprofitable and experiencing high volatility compared to most U.S. stocks, the company maintains a strong cash position exceeding its total debt and liabilities. Recent collaborations with AstraZeneca aim to enhance the deployment of innovative liquid biopsy tests globally, potentially increasing data-driven insights in cancer research. While analysts anticipate significant stock price growth potential, SOPHiA GENETICS continues to face profitability challenges without immediate forecasts for positive earnings within three years.

- Click here and access our complete financial health analysis report to understand the dynamics of SOPHiA GENETICS.

- Understand SOPHiA GENETICS' earnings outlook by examining our growth report.

Turning Ideas Into Actions

- Jump into our full catalog of 760 US Penny Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:REFR

Research Frontiers

Together with other subsidiary, engages in the development and marketing of technology and devices to control the flow of light worldwide.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives