- United States

- /

- Software

- /

- NasdaqGS:AVPT

3 US Growth Companies Insiders Are Betting On

Reviewed by Simply Wall St

As the U.S. market rebounds with major indexes posting gains, led by a surge in large-cap tech stocks like Nvidia, investors are closely watching for opportunities that align with the current economic landscape. In this environment, growth companies with high insider ownership can be particularly appealing as they often signal confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 32.3% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 40.7% |

| On Holding (NYSE:ONON) | 28.4% | 24.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 95.9% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

Here we highlight a subset of our preferred stocks from the screener.

AvePoint (NasdaqGS:AVPT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AvePoint, Inc. offers a cloud-native data management software platform across North America, Europe, the Middle East, Africa, and Asia Pacific with a market cap of $2.19 billion.

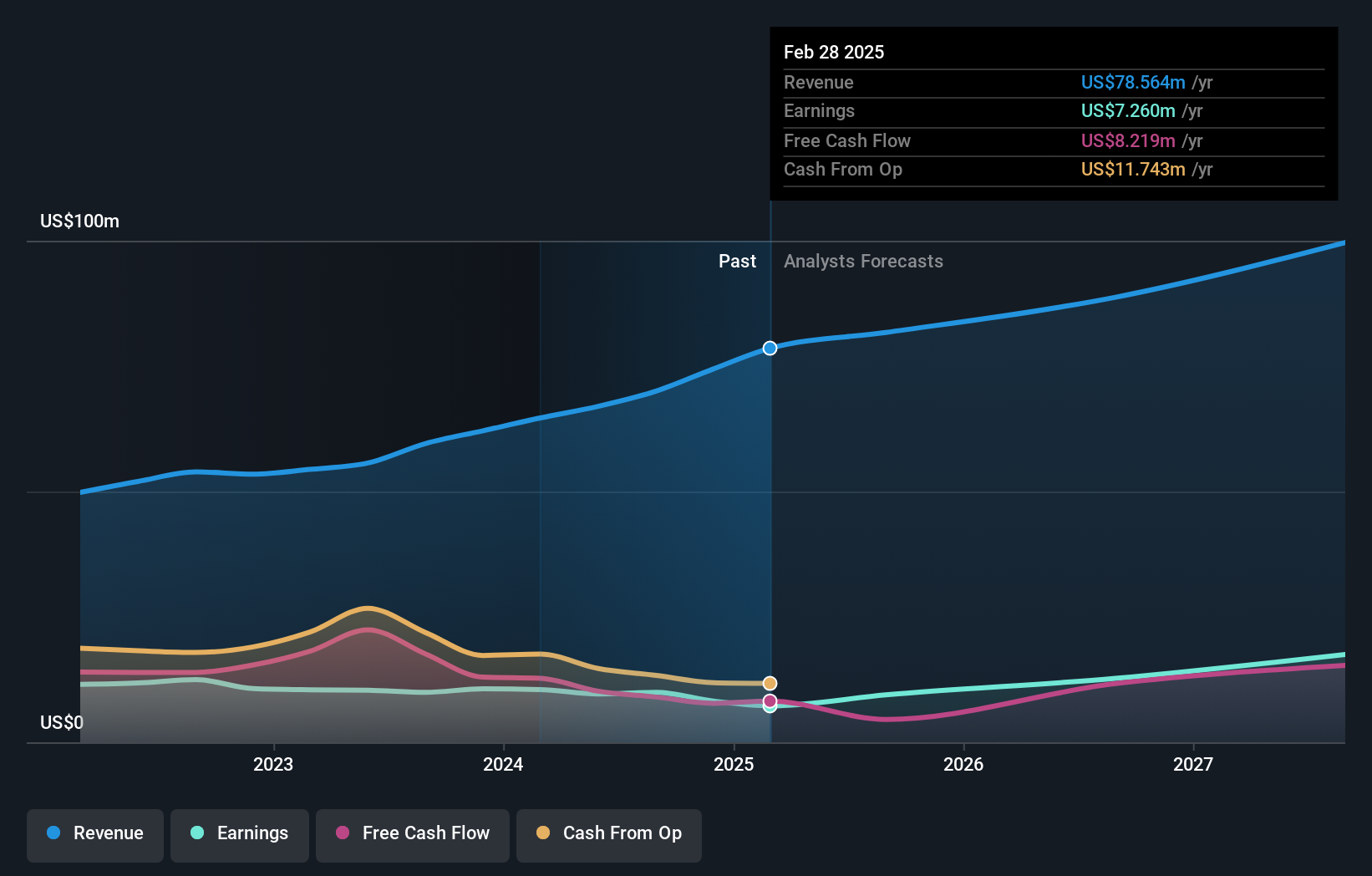

Operations: AvePoint generates $299.88 million from its Software & Programming revenue segment.

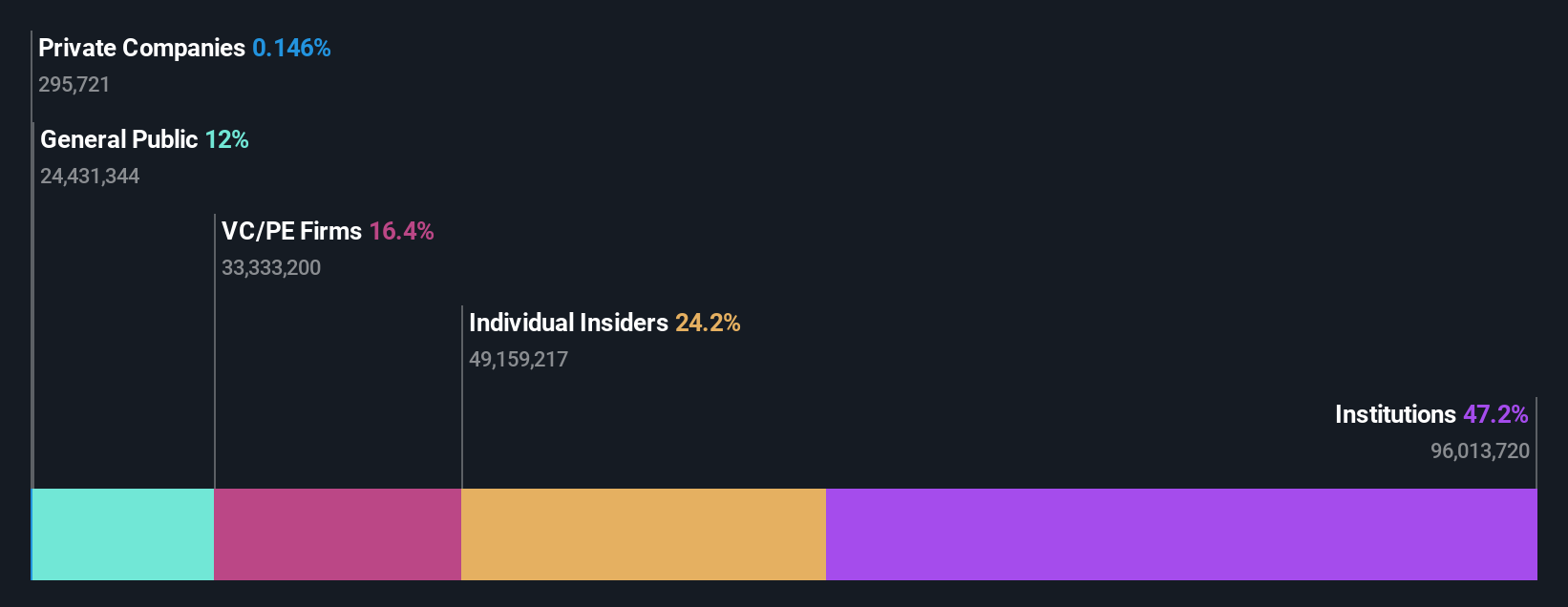

Insider Ownership: 36.8%

AvePoint, Inc. is forecast to achieve above-average market growth by becoming profitable within the next three years. Despite recent insider selling, the company has seen significant share repurchases and maintains a high level of insider ownership. Revenue is expected to grow at 17% per year, faster than the US market average. Recent earnings reports show increasing revenue but continued net losses, while new product developments and strategic partnerships enhance its data protection capabilities.

- Take a closer look at AvePoint's potential here in our earnings growth report.

- Our valuation report unveils the possibility AvePoint's shares may be trading at a premium.

Simulations Plus (NasdaqGS:SLP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Simulations Plus, Inc. develops AI and machine learning-based software for drug discovery and development modeling, with a market cap of $656.45 million.

Operations: The company generates revenue from two primary segments: Services ($26.54 million) and Software ($40.44 million).

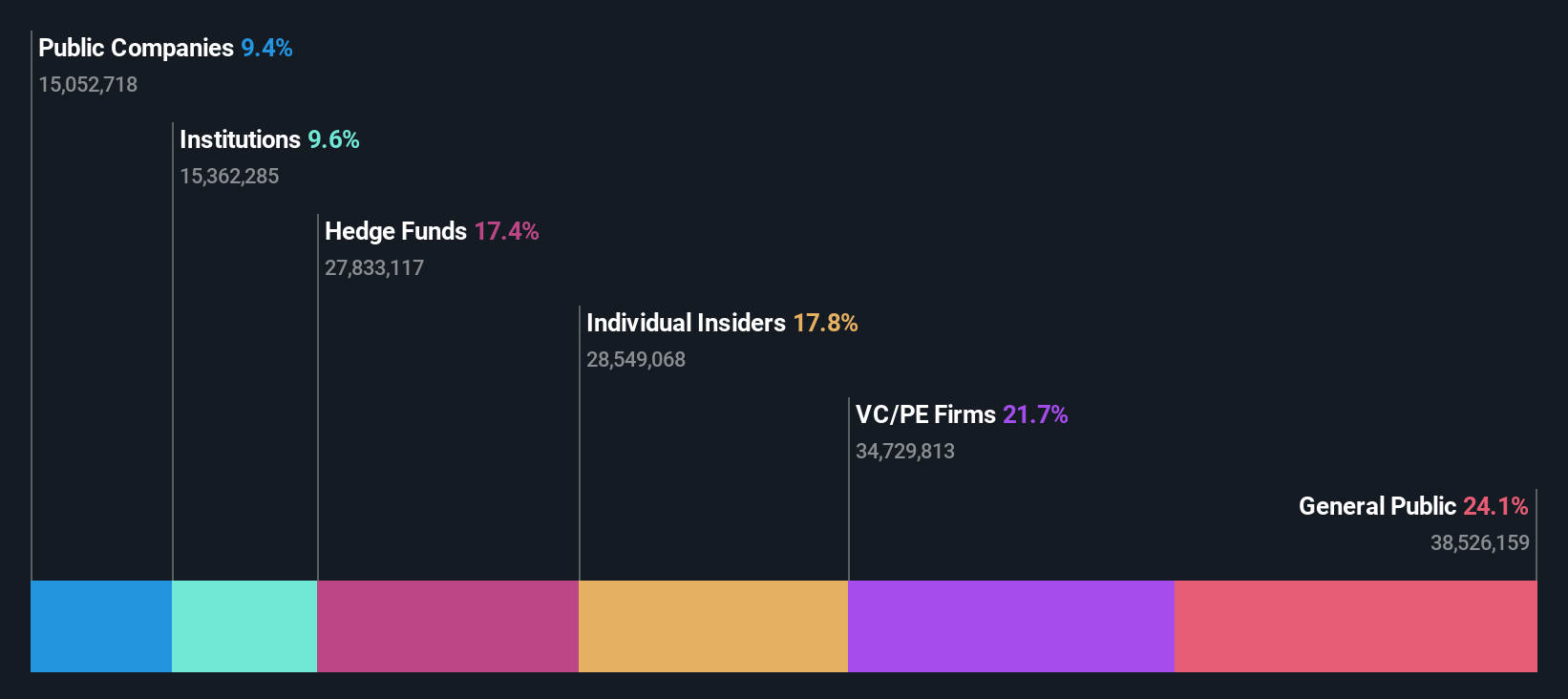

Insider Ownership: 18.4%

Simulations Plus, Inc. stands out for its strong insider ownership and significant growth potential. The company is trading at 41.4% below its estimated fair value, with earnings forecasted to grow 22.31% annually over the next three years, outpacing the US market average of 15%. Recent leadership restructuring and product releases like DILIsym version X aim to bolster future growth. Despite a slight dip in net income for Q3, revenue continues to rise, signaling robust underlying business health.

- Dive into the specifics of Simulations Plus here with our thorough growth forecast report.

- Our expertly prepared valuation report Simulations Plus implies its share price may be lower than expected.

ZKH Group (NYSE:ZKH)

Simply Wall St Growth Rating: ★★★★★★

Overview: ZKH Group Limited operates a maintenance, repair, and operating (MRO) products trading and service platform in China, offering spare parts, chemicals, manufacturing parts, general consumables, and office supplies with a market cap of $478.38 million.

Operations: The company's revenue primarily comes from its Business-To-Business Trading and Services of Industrial Products segment, which generated CN¥8.82 billion.

Insider Ownership: 17.7%

ZKH Group is poised for substantial growth, with earnings forecasted to grow 108.07% annually and revenue expected to increase by 23% per year, outpacing the US market's 8.6%. Despite a highly volatile share price recently, ZKH is trading at good value compared to peers. Recent executive changes include the resignation of Ms. Shuangyi Chen and appointment of Mr. Yang Liu as director, alongside a $50 million share repurchase program enhancing shareholder value.

- Click to explore a detailed breakdown of our findings in ZKH Group's earnings growth report.

- The valuation report we've compiled suggests that ZKH Group's current price could be quite moderate.

Make It Happen

- Investigate our full lineup of 177 Fast Growing US Companies With High Insider Ownership right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVPT

AvePoint

Provides cloud-native data management software platform in North America, Europe, Middle East, Africa, and Asia Pacific.

Flawless balance sheet with reasonable growth potential.