- United States

- /

- Healthtech

- /

- NasdaqGS:SDGR

Do Mixed Analyst Signals Reveal a Deeper Margin Question for Schrödinger (SDGR)?

Reviewed by Sasha Jovanovic

- In recent days, Schrodinger has seen a flurry of analyst activity, including a coverage initiation by Goldman Sachs with a neutral rating, joined by rating and target reductions from Morgan Stanley and Citigroup.

- This cluster of cautious analyst updates reflects uncertainty about near-term prospects in the healthcare software and drug discovery industry, particularly as the company balances software sales with drug discovery collaborations.

- To assess what this wave of mixed analyst sentiment means, we'll explore how it informs Schrödinger's longer-term investment narrative and margin outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Schrödinger Investment Narrative Recap

To be a shareholder in Schrödinger, you have to believe the company's dual approach, generating revenue from healthcare software and drug discovery collaborations, will overcome near-term volatility to deliver long-term value. The recent cautious analyst commentary, with several firms lowering ratings and price targets, does not materially impact the main short-term catalyst: progress with SGR-1505 clinical trials. The greatest immediate risk remains persistent pressure on software margins and the challenge of expanding the customer base amid weak biotech sector conditions.

Among recent announcements, Schrödinger's June update on SGR-1505 stands out, as the Fast Track designation and encouraging Phase 1 data keep momentum behind the company’s most promising clinical asset. This is especially relevant for investors focused on near-term value creation, because further clinical progress could strengthen partnerships and secure milestone payments, key catalysts highlighted by analysts.

In contrast, investors should also be aware of mounting concerns around shrinking software gross margins and what that could mean for...

Read the full narrative on Schrödinger (it's free!)

Schrödinger's narrative projects $396.6 million revenue and $34.8 million earnings by 2028. This requires 18.6% yearly revenue growth and a $216.1 million increase in earnings from -$181.3 million.

Uncover how Schrödinger's forecasts yield a $27.30 fair value, a 33% upside to its current price.

Exploring Other Perspectives

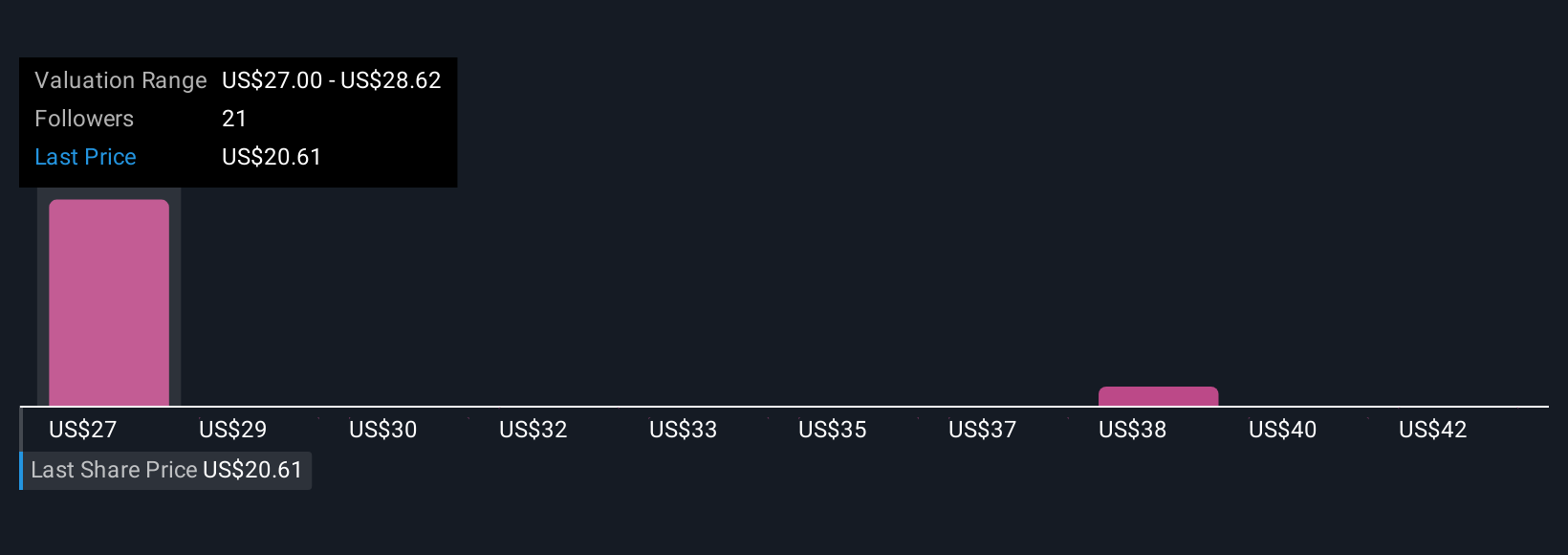

Five Simply Wall St Community members set Schrödinger's fair value between US$27.30 and US$43.20, suggesting wide variance in outlooks. With ongoing caution about sustained software margin pressures, consider how different assumptions may affect the company's future performance and review several alternative views.

Explore 5 other fair value estimates on Schrödinger - why the stock might be worth just $27.30!

Build Your Own Schrödinger Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Schrödinger research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Schrödinger research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Schrödinger's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SDGR

Schrödinger

Develops physics-based computational platform that enables discovery of novel molecules for drug development and materials applications.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives