- United States

- /

- Medical Equipment

- /

- NasdaqCM:LFWD

We're Hopeful That ReWalk Robotics (NASDAQ:RWLK) Will Use Its Cash Wisely

We can readily understand why investors are attracted to unprofitable companies. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So should ReWalk Robotics (NASDAQ:RWLK) shareholders be worried about its cash burn? In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

View our latest analysis for ReWalk Robotics

Does ReWalk Robotics Have A Long Cash Runway?

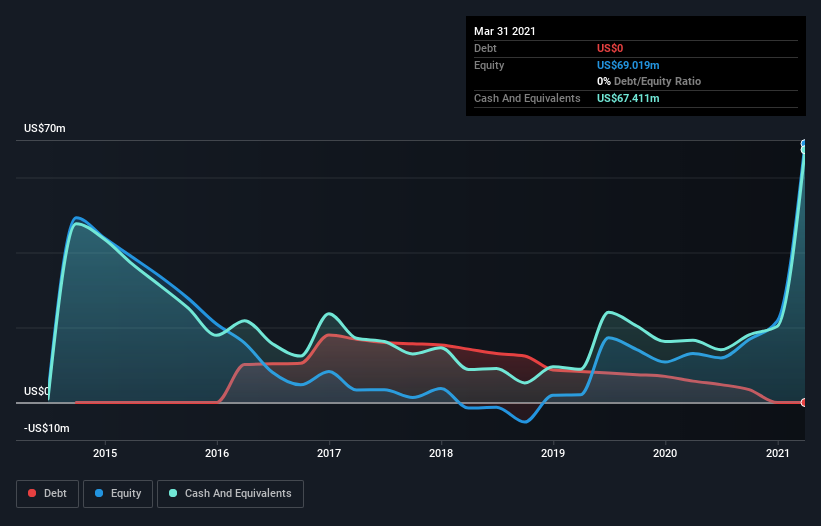

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In March 2021, ReWalk Robotics had US$67m in cash, and was debt-free. In the last year, its cash burn was US$11m. Therefore, from March 2021 it had 5.9 years of cash runway. Even though this is but one measure of the company's cash burn, the thought of such a long cash runway warms our bellies in a comforting way. Depicted below, you can see how its cash holdings have changed over time.

How Well Is ReWalk Robotics Growing?

It was fairly positive to see that ReWalk Robotics reduced its cash burn by 23% during the last year. And considering that its operating revenue gained 22% during that period, that's great to see. On balance, we'd say the company is improving over time. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For ReWalk Robotics To Raise More Cash For Growth?

While ReWalk Robotics seems to be in a decent position, we reckon it is still worth thinking about how easily it could raise more cash, if that proved desirable. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

ReWalk Robotics has a market capitalisation of US$77m and burnt through US$11m last year, which is 15% of the company's market value. Given that situation, it's fair to say the company wouldn't have much trouble raising more cash for growth, but shareholders would be somewhat diluted.

How Risky Is ReWalk Robotics' Cash Burn Situation?

It may already be apparent to you that we're relatively comfortable with the way ReWalk Robotics is burning through its cash. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. And even though its cash burn relative to its market cap wasn't quite as impressive, it was still a positive. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. Taking a deeper dive, we've spotted 5 warning signs for ReWalk Robotics you should be aware of, and 1 of them is a bit unpleasant.

Of course ReWalk Robotics may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading ReWalk Robotics or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:LFWD

Lifeward

A medical device company, designs, develops, and commercializes technologies that enable mobility and wellness in rehabilitation and daily life for individuals with physical and neurological conditions in the United States, Europe, the Asia-Pacific, and internationally.

Flawless balance sheet with high growth potential.