- United States

- /

- Healthcare Services

- /

- NasdaqGM:RDNT

RadNet, Inc.'s (NASDAQ:RDNT) 26% Price Boost Is Out Of Tune With Revenues

The RadNet, Inc. (NASDAQ:RDNT) share price has done very well over the last month, posting an excellent gain of 26%. Looking back a bit further, it's encouraging to see the stock is up 93% in the last year.

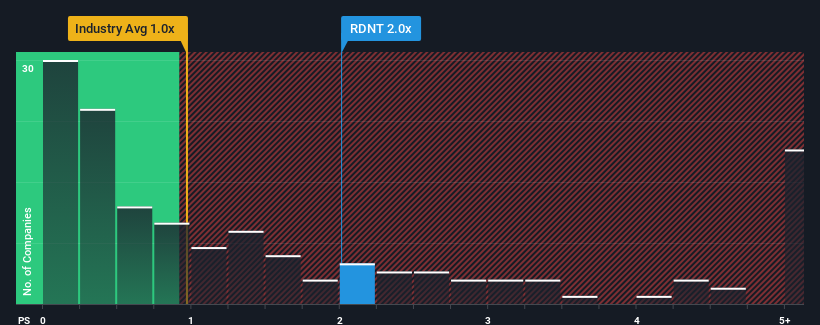

Following the firm bounce in price, given close to half the companies operating in the United States' Healthcare industry have price-to-sales ratios (or "P/S") below 1x, you may consider RadNet as a stock to potentially avoid with its 2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for RadNet

How RadNet Has Been Performing

Recent revenue growth for RadNet has been in line with the industry. It might be that many expect the mediocre revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think RadNet's future stacks up against the industry? In that case, our free report is a great place to start.How Is RadNet's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like RadNet's to be considered reasonable.

Retrospectively, the last year delivered a decent 13% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 47% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 8.0% as estimated by the five analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 8.0%, which is not materially different.

In light of this, it's curious that RadNet's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What Does RadNet's P/S Mean For Investors?

RadNet shares have taken a big step in a northerly direction, but its P/S is elevated as a result. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that RadNet currently trades on a higher than expected P/S. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. A positive change is needed in order to justify the current price-to-sales ratio.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with RadNet (at least 1 which makes us a bit uncomfortable), and understanding these should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:RDNT

RadNet

Provides outpatient diagnostic imaging services in the United States and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives