- United States

- /

- Healthcare Services

- /

- NasdaqGS:PNTG

Pennant Group (PNTG): Revisiting Valuation After William Blair Initiates Coverage With a Buy Rating

Reviewed by Simply Wall St

Pennant Group (PNTG) just picked up fresh Wall Street attention, with William Blair’s Ryan Daniels initiating coverage at a buy rating, a move that often nudges new investors to revisit the story.

See our latest analysis for Pennant Group.

The upbeat call lands after a strong run. Pennant’s roughly 17% 1 month share price return and a powerful 3 year total shareholder return signal that momentum is firmly building, despite a still muted 1 year total shareholder return.

If this kind of renewed interest in healthcare operators has your attention, it could be worth exploring similar opportunities across healthcare stocks to see what else is gaining traction.

But after such a sharp rebound and upbeat new coverage, is Pennant still trading at a meaningful discount to its fundamentals, or are investors already paying up for every dollar of future growth on offer?

Most Popular Narrative Narrative: 12.2% Undervalued

With Pennant Group closing at $29.51 versus a narrative fair value in the mid 30s, the story points to potential further upside if its growth plays out.

The accelerating demographic shift of an aging U.S. population is leading to rising demand for home health, hospice, and senior living services, as evidenced by Pennant's strong organic and acquisition-driven volume growth and robust occupancy/pricing trends in senior living. This ongoing demographic wave is likely to continue expanding Pennant's addressable market, supporting durable, long-term revenue growth.

For readers interested in how this demographic backdrop may translate into financial metrics such as revenue trends, margins, and valuation multiples, the narrative provides a detailed framework.

Result: Fair Value of $33.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, looming Medicare reimbursement cuts and persistent labor shortages could quickly erode Pennant’s margin gains and derail the upbeat growth narrative.

Find out about the key risks to this Pennant Group narrative.

Another View: Price Tag Looks Full

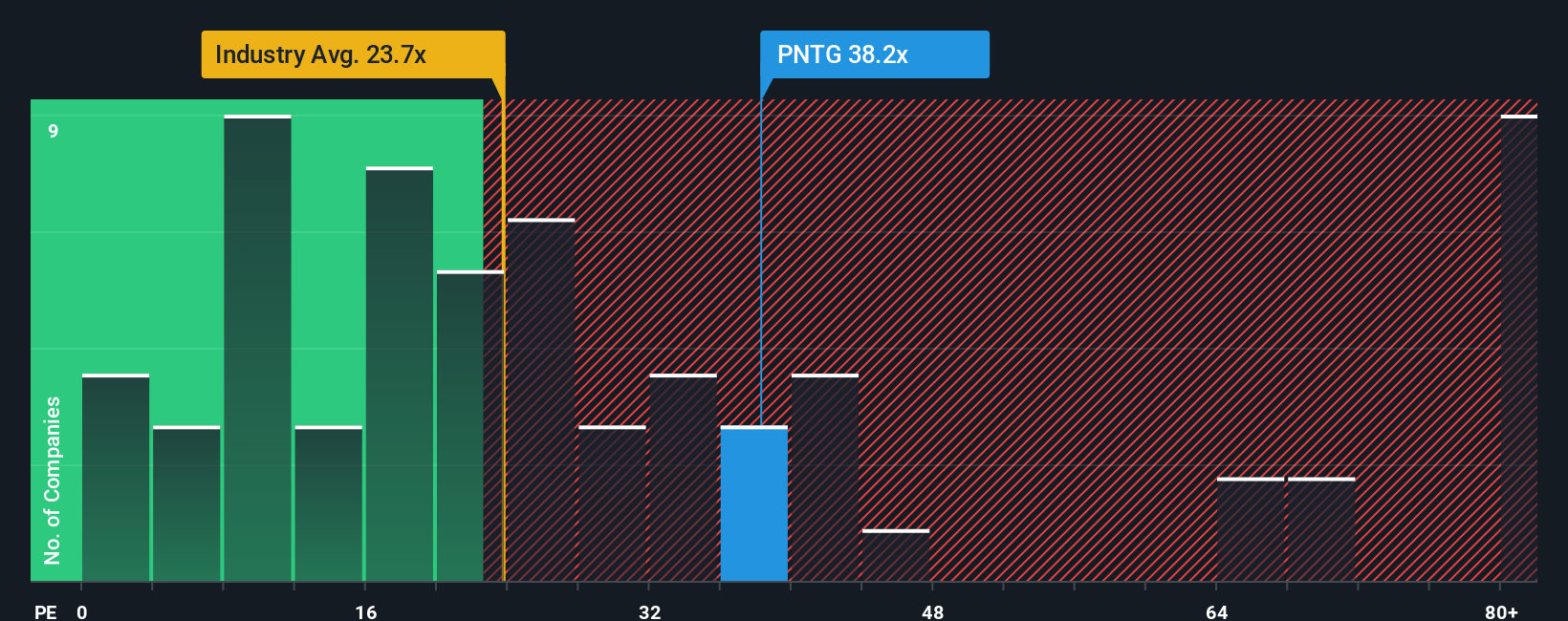

On earnings, the picture is less forgiving. Pennant trades on 38.2 times earnings versus a US Healthcare average of 23.3 times, while our fair ratio is 27.1 times. That rich premium could compress quickly if growth or sentiment wobbles, leaving little room for error.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pennant Group Narrative

If you see this differently or prefer to dig into the numbers yourself, you can build a tailored narrative in just a few minutes using Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Pennant Group.

Ready for more high conviction ideas?

Before you move on, lock in your next set of opportunities by using the Simply Wall St Screener to uncover focused, data driven stock ideas most investors overlook.

- Supercharge your hunt for overlooked bargains by targeting companies trading below intrinsic value through these 905 undervalued stocks based on cash flows grounded in cash flow fundamentals.

- Position yourself for the next wave of innovation by filtering for emerging tech names using these 25 AI penny stocks with strong momentum and scalable AI driven business models.

- Strengthen your income stream by zeroing in on companies with reliable payouts via these 12 dividend stocks with yields > 3% offering yields above 3% backed by solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PNTG

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026