- United States

- /

- Medical Equipment

- /

- NasdaqGS:ISRG

With an Understated 30% Profit Margin, Intuitive Surgical, Inc. (NASDAQ:ISRG) may be a Great Find for Investors

Intuitive Surgical (NASDAQ:ISRG). But if you pay close attention, you might gather that its strong financials could mean that the stock could potentially see an increase in value in the long-term, given how markets usually reward companies with good financial health. Specifically, we decided to study Intuitive Surgical's ROE and future growth in this article.

Fundamentals

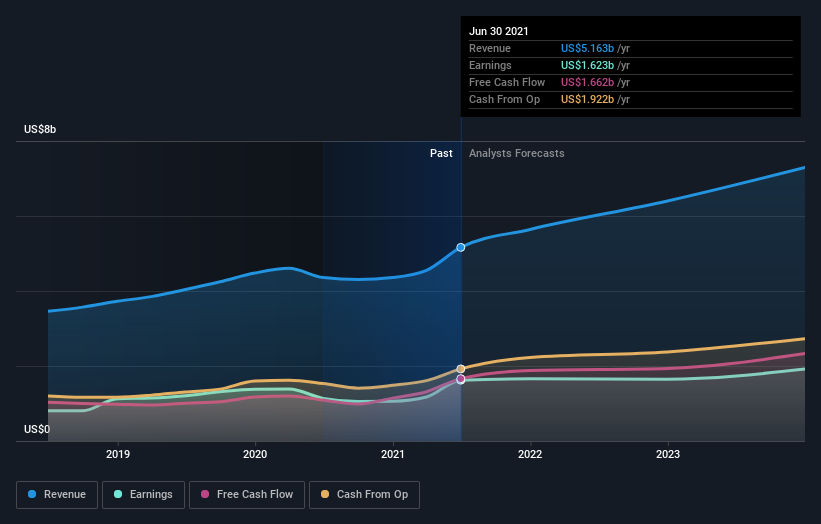

We use estimates of analysts that are following the company in order to see where the company is headed in the future. In looking at the fundamental performance we follow 4 metrics: Revenue, Earnings, Operating and Free Cash Flows.

Check out our latest analysis for Intuitive Surgical

Revenue growth is the company's top line and reflects what we expect to see in the coming years. This translates to earnings or net profit, a.k.a. the bottom line. As investors, we are interested in the cash flows that the company sets aside for investors, that is why we compare earnings with cash flows - Earnings is what the accountants put down in the books, but free cash flows is what goes in the company's cash balance.

When earnings and cash flows diverge - trust the cash flows.

When reviewing Intuitive Surgical, we can see that this is a very profitable business, and that free cash flows are even higher than stated profits! This can be a leading indicator for improved performance in a company and is known as an accrual ratio.

Intuitive Surgical has a very high profit margin of 31%, and projections are that earnings will grow by 10% on an annual level. Revenue is also expected to perform at a 12.5% annual growth rate, which is higher than the expected 8.3% revenue growth rate from the industry.

All of this is reflected in the value of the company, and our models indicate that Intuitive Surgical is undervalued, which might result with an appreciation in the stock price.

Return on Equity

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Intuitive Surgical is:

15% = US$1.6b ÷ US$11b (Based on the trailing twelve months to June 2021).

The 'return' is the yearly profit. So, this means that for every $1 of its shareholder's investments, the company generates a profit of $0.15.

Intuitive Surgical's Earnings Growth And 15% ROE

Intuitive Surgical seems to have a decent ROE. Further, the company's ROE compares quite favorably to the industry average of 11%.

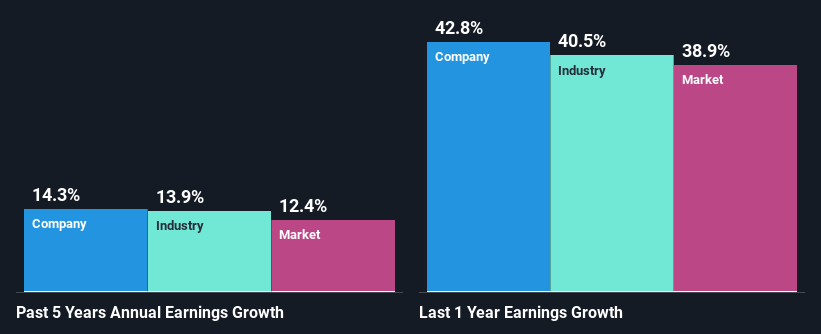

This adds some context to Intuitive Surgical's decent 14% net income growth seen over the past five years.

Next, on comparing Intuitive Surgical's net income growth with the industry, we found that the company's reported growth is similar to the industry average growth rate of 14% in the same period.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in.

This then helps them determine if the stock is placed for a bright or bleak future. Is Intuitive Surgical fairly valued compared to other companies? These 3 valuation measures might help you decide.

Key Takeaways

Overall, we are quite pleased with Intuitive Surgical's performance. The company is highly profitable and seems to be mispriced which may lead to the stock trending upwards in the future.

The company is estimated to keep growing both revenues and profits, and the cash flows indicate that the company is currently understating earnings.

The company is still reinvesting a huge chunk of its profits at a high rate of return. This of course has caused the company to see substantial growth in its earnings and is powering through its growth phase.

If you're looking to trade Intuitive Surgical, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:ISRG

Intuitive Surgical

Develops, manufactures, and markets products that enable physicians and healthcare providers to enhance the quality of and access to minimally invasive care in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives