- United States

- /

- Medical Equipment

- /

- NasdaqGS:IDXX

A Look at IDEXX Laboratories's Valuation After Raising Annual Revenue Guidance on Strong Pet and Water Business Trends

Reviewed by Simply Wall St

If you’re keeping an eye on IDEXX Laboratories (IDXX), this week’s move might give you pause for thought. The company has raised its annual revenue outlook, thanks to steady growth in both its pet healthcare segment and its water testing operations. This kind of upbeat guidance is usually welcomed by investors, as it signals confidence from management and hints at real business traction underneath the headlines.

The timing of IDEXX’s guidance update aligns with a broader period of momentum for the stock. Shares are up roughly 57% year to date and have gained 34% over the past year. Even the last quarter alone saw a 22% surge, showing that the market has responded consistently to the company’s execution and growth trends. While recent days saw a modest daily bump amid this positive news, the bigger picture is a story of long-term outperformance supported by real operational growth.

But with such an impressive rally already in the books, the big question is whether IDEXX Laboratories is still attractively valued or if the market has already factored in all this growth potential. Is there more room to run, or could buyers be arriving late to the party?

Most Popular Narrative: 7.5% Undervalued

The most widely followed narrative sees IDEXX Laboratories as moderately undervalued, suggesting its future earnings and business model have yet to be fully reflected in the current share price.

“High customer retention and growing installed base of premium instruments provide IDEXX with stable, high-margin recurring revenue streams, positioning the company to compound earnings growth over time as industry consolidation and elevated care standards continue.”

Craving the blueprint behind this bullish price target? The valuation is driven by a scenario with steady profit expansion and a premium multiple that puts IDEXX in elite company. What ambitious projections and future expectations are driving the story? The full narrative breaks down all the surprising assumptions behind the fair value calculation. Fuel your curiosity by finding out how bold the future could be.

Result: Fair Value of $695.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slowing U.S. clinical visits and rising competition could temper optimism, posing real risks that may challenge IDEXX’s impressive growth narrative in the future.

Find out about the key risks to this IDEXX Laboratories narrative.Another View: Market Multiple Comparison

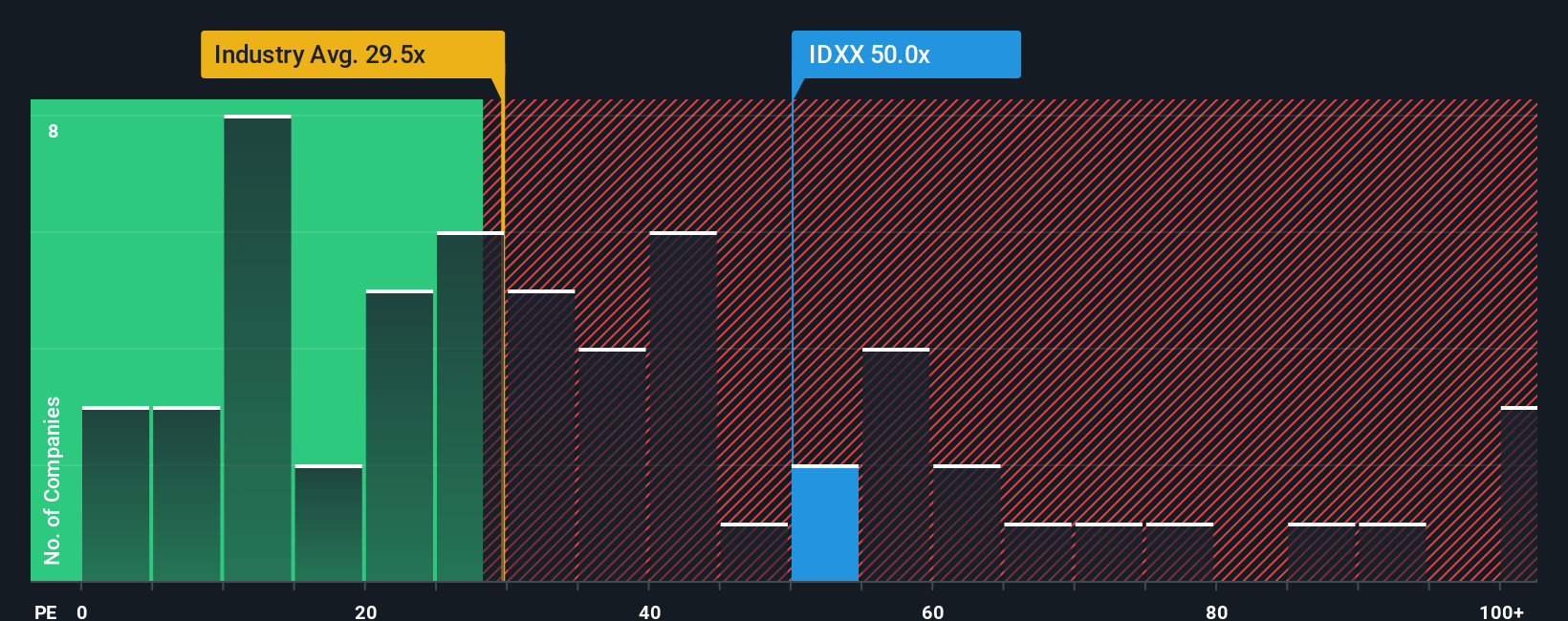

Taking a different lens, let's consider how the company stacks up against others based on its share price versus profits. This approach currently suggests the shares may actually be expensive, which is quite the contrast to the prior outlook. Could the market be overestimating IDEXX's earnings power?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding IDEXX Laboratories to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own IDEXX Laboratories Narrative

If you see things differently or want to dive into your own analysis, you can craft and share your unique view in just a few minutes. Do it your way.

A great starting point for your IDEXX Laboratories research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t leave your strategy to chance. Make sure you’re seeing the best possibilities by using the Simply Wall Street Screener for your next move.

- Catch stocks harnessing the power of artificial intelligence and see which innovators are featured with AI penny stocks to stay ahead of tomorrow’s breakthroughs.

- Get a head start on value by screening for companies trading below their intrinsic worth and access hidden gems through our undervalued stocks based on cash flows link.

- Pursue income and strength by spotting shares paying high-yield dividends, making it easy to target financial resilience with dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:IDXX

IDEXX Laboratories

Develops, manufactures, and distributes products for the companion animal veterinary, livestock and poultry, dairy, and water testing industries in the United States and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026