- United States

- /

- Food

- /

- NasdaqCM:BRFH

Barfresh Food Group And 2 Other US Penny Stocks To Watch

Reviewed by Simply Wall St

As the U.S. stock market flirts with record highs, driven by a surge in AI-related stocks and strong earnings reports, investors are exploring opportunities beyond the major indices. Penny stocks, a term that might seem outdated but still relevant today, often represent smaller or newer companies that can offer unique investment potential. By focusing on those with robust financials and clear growth prospects, investors may uncover promising opportunities among these lesser-known equities.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $110.92M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.87505 | $6.41M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.87 | $12M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.97 | $2.09B | ★★★★☆☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2896 | $11.03M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.925 | $89.18M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.12 | $59.16M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.28 | $22.17M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9272 | $82.51M | ★★★★★☆ |

Click here to see the full list of 709 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Barfresh Food Group (NasdaqCM:BRFH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Barfresh Food Group, Inc., along with its subsidiaries, operates in the United States by manufacturing and distributing ready-to-drink and ready-to-blend frozen beverages, with a market cap of $42.91 million.

Operations: The company's revenue is generated from its non-alcoholic beverages segment, totaling $9.85 million.

Market Cap: $42.91M

Barfresh Food Group, Inc., with a market cap of US$42.91 million and revenue of US$9.85 million, has shown revenue growth but remains unprofitable, with a negative return on equity. The company reported third-quarter sales of US$3.64 million, an increase from the previous year, while its net loss slightly widened to US$0.513 million. Despite having more cash than total debt and reducing its debt-to-equity ratio significantly over five years, Barfresh faces challenges with less than a year of cash runway and high share price volatility. The management team is experienced, providing some stability amidst financial hurdles.

- Get an in-depth perspective on Barfresh Food Group's performance by reading our balance sheet health report here.

- Assess Barfresh Food Group's future earnings estimates with our detailed growth reports.

iCAD (NasdaqCM:ICAD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: iCAD, Inc. provides cancer detection and therapy solutions in the United States and has a market cap of $56.13 million.

Operations: The company's revenue is primarily generated from its Detection segment, which accounts for $18.94 million.

Market Cap: $56.13M

iCAD, Inc., with a market cap of US$56.13 million, focuses on AI-driven cancer detection and therapy solutions. Despite being unprofitable, it has reduced losses by 21.4% annually over five years and maintains a stable cash runway exceeding three years. The company recently showcased its FDA-cleared ProFound Detection Version 4 at major industry events, highlighting advancements in breast cancer detection through improved AI technology and strategic partnerships like the one with Cascaid Health to expand access to its solutions. While short-term assets comfortably cover liabilities, iCAD's share price remains volatile amidst ongoing operational developments.

- Take a closer look at iCAD's potential here in our financial health report.

- Evaluate iCAD's prospects by accessing our earnings growth report.

CareCloud (NasdaqGM:CCLD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CareCloud, Inc. is a healthcare IT company offering cloud-based solutions and business services to healthcare providers and hospitals in the United States, with a market cap of $50.23 million.

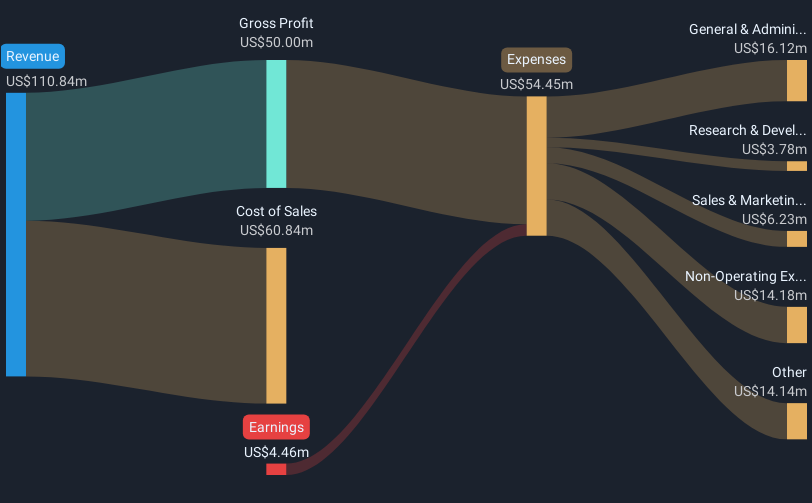

Operations: The company's revenue is derived from two segments: Healthcare IT, which contributes $96.76 million, and Medical Practice Management, accounting for $14.26 million.

Market Cap: $50.23M

CareCloud, Inc., with a market cap of US$50.23 million, is navigating significant leadership changes with the appointment of Co-CEOs and a new President to enhance client experience and drive growth. Despite being unprofitable, CareCloud has shown improvement in net income for recent quarters and maintains sufficient cash runway for over three years due to positive free cash flow. The company recently reduced its credit line with Silicon Valley Bank, indicating strong financial management as short-term assets exceed liabilities. However, the stock remains volatile and insiders have engaged in significant selling over the past three months.

- Unlock comprehensive insights into our analysis of CareCloud stock in this financial health report.

- Learn about CareCloud's future growth trajectory here.

Where To Now?

- Click here to access our complete index of 709 US Penny Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barfresh Food Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BRFH

Barfresh Food Group

Manufactures and distributes ready-to-drink and ready-to-blend frozen beverages in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives