- United States

- /

- Medical Equipment

- /

- NasdaqCM:HLTH

We Think Cue Health (NASDAQ:HLTH) Needs To Drive Business Growth Carefully

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So should Cue Health (NASDAQ:HLTH) shareholders be worried about its cash burn? For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

See our latest analysis for Cue Health

When Might Cue Health Run Out Of Money?

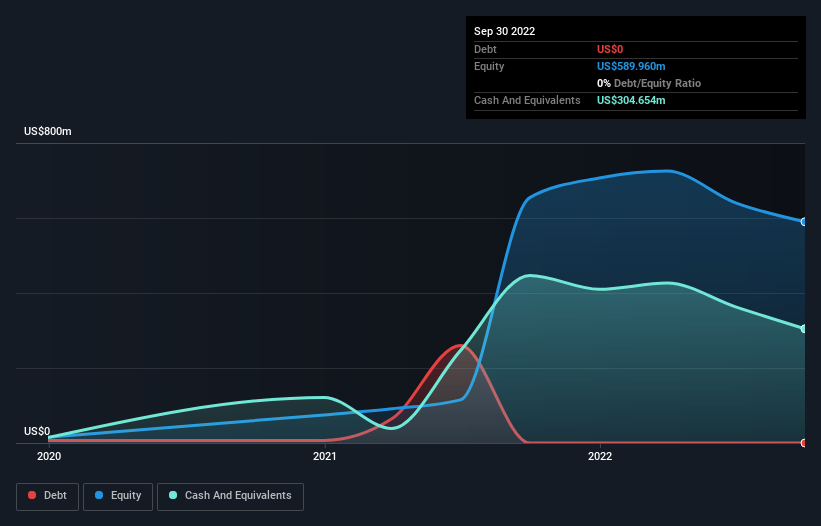

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. In September 2022, Cue Health had US$305m in cash, and was debt-free. Looking at the last year, the company burnt through US$142m. So it had a cash runway of about 2.1 years from September 2022. Importantly, analysts think that Cue Health will reach cashflow breakeven in 4 years. That means unless the company reduces its cash burn quickly, it may well look to raise more cash. The image below shows how its cash balance has been changing over the last few years.

How Well Is Cue Health Growing?

It was quite stunning to see that Cue Health increased its cash burn by 804% over the last year. But the silver lining is that operating revenue increased by 21% in that time. Taken together, we think these growth metrics are a little worrying. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Easily Can Cue Health Raise Cash?

While Cue Health seems to be in a fairly good position, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Cue Health's cash burn of US$142m is about 53% of its US$267m market capitalisation. That's high expenditure relative to the value of the entire company, so if it does have to issue shares to fund more growth, that could end up really hurting shareholders returns (through significant dilution).

Is Cue Health's Cash Burn A Worry?

On this analysis of Cue Health's cash burn, we think its cash runway was reassuring, while its increasing cash burn has us a bit worried. One real positive is that analysts are forecasting that the company will reach breakeven. Looking at the factors mentioned in this short report, we do think that its cash burn is a bit risky, and it does make us slightly nervous about the stock. An in-depth examination of risks revealed 3 warning signs for Cue Health that readers should think about before committing capital to this stock.

Of course Cue Health may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you're looking to trade Cue Health, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:HLTH

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives