- United States

- /

- Medical Equipment

- /

- NasdaqCM:DCTH

3 US Growth Companies To Watch With Up To 32% Insider Ownership

Reviewed by Simply Wall St

As the United States stock market navigates a volatile period marked by fluctuations in major indices and a notable slump in big-tech stocks, investors are increasingly focused on identifying resilient growth opportunities. In this environment, companies with substantial insider ownership can offer unique insights into potential value creation, as insiders' vested interests often align with long-term shareholder success.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Duolingo (NasdaqGS:DUOL) | 14.6% | 34.7% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.8% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

| Credit Acceptance (NasdaqGS:CACC) | 14.0% | 49% |

| Spotify Technology (NYSE:SPOT) | 17.6% | 29.7% |

Let's dive into some prime choices out of the screener.

Delcath Systems (NasdaqCM:DCTH)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Delcath Systems, Inc. is an interventional oncology company specializing in the treatment of primary and metastatic liver cancers in the United States and Europe, with a market cap of $382.41 million.

Operations: The company's revenue segment focuses on the development and commercialization of Melphalan/HDS and CHEMOSAT, generating $22.64 million.

Insider Ownership: 11.6%

Delcath Systems is positioned for growth with revenue forecasted to increase by 40.5% annually, outpacing the broader U.S. market. The company recently reported a turnaround in its financials with a net income of US$1.86 million for Q3 2024, compared to a significant loss the previous year. Despite past shareholder dilution and limited cash runway, Delcath's FDA-approved Phase 2 trial for HEPZATO™ could enhance its market presence in liver-dominant metastatic colorectal cancer treatment.

- Click to explore a detailed breakdown of our findings in Delcath Systems' earnings growth report.

- Upon reviewing our latest valuation report, Delcath Systems' share price might be too pessimistic.

EHang Holdings (NasdaqGM:EH)

Simply Wall St Growth Rating: ★★★★★★

Overview: EHang Holdings Limited is an autonomous aerial vehicle technology platform company operating in China, East Asia, West Asia, Europe, and internationally with a market cap of approximately $1.01 billion.

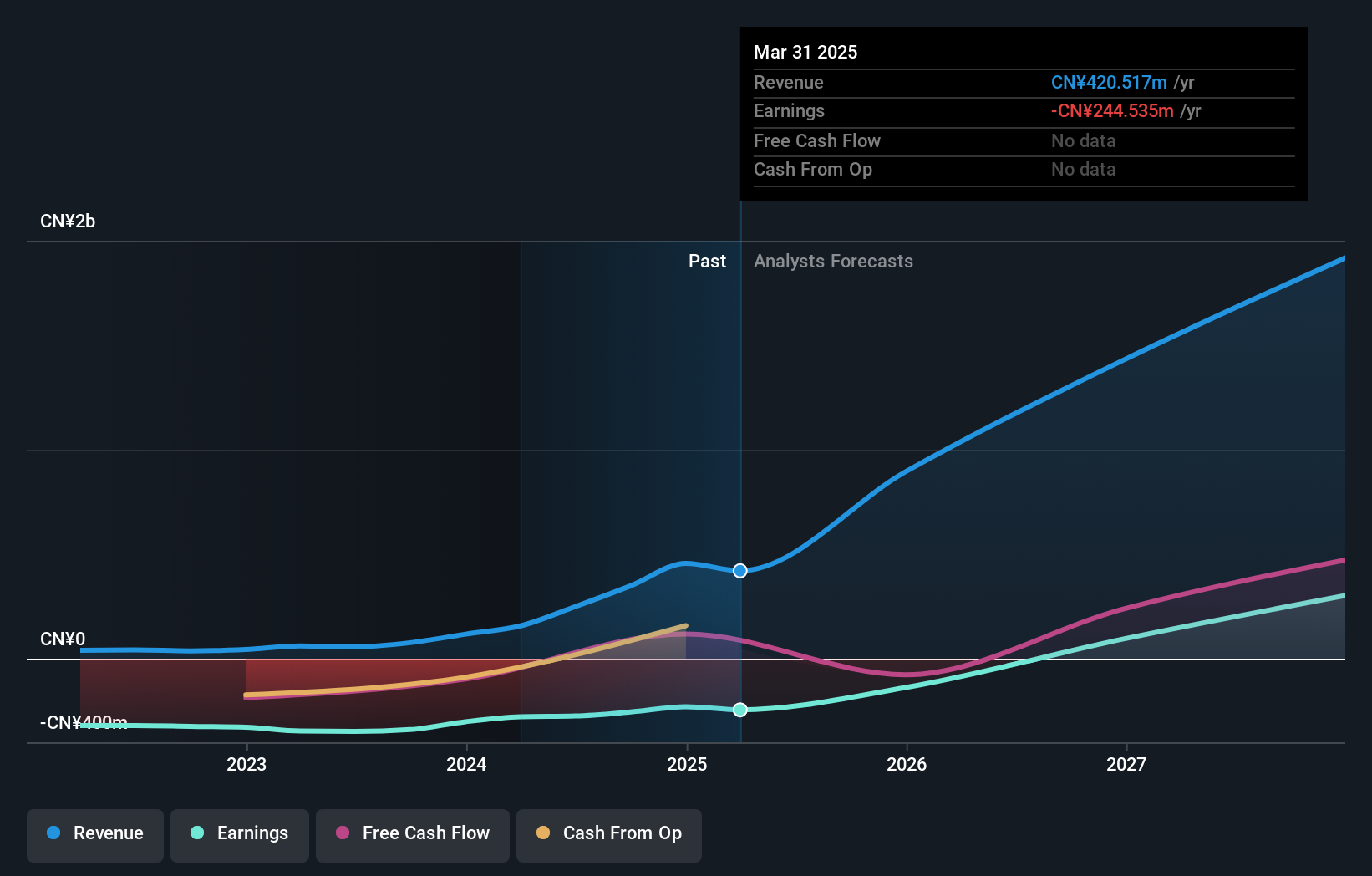

Operations: The company's revenue segment is Aerospace & Defense, generating CN¥348.48 million.

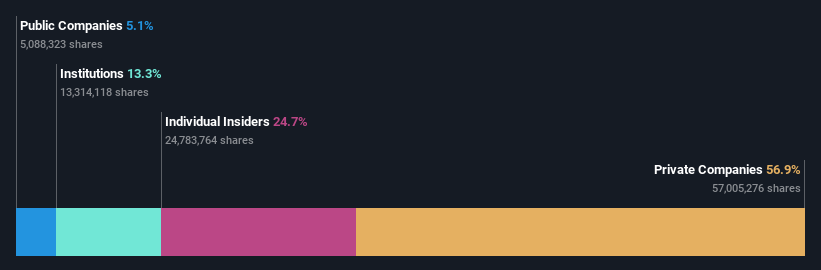

Insider Ownership: 32.8%

EHang Holdings is poised for growth, with revenue expected to rise 36.9% annually, surpassing the U.S. market average. Insider ownership contributes to strategic stability as the company forms alliances to enhance its low-altitude economy initiatives, including a recent partnership with China Communications Information & Technology Group. Despite past shareholder dilution and high share price volatility, EHang's forecasted profitability and innovative advancements in eVTOL technology position it favorably in the evolving aerial mobility sector.

- Click here to discover the nuances of EHang Holdings with our detailed analytical future growth report.

- The valuation report we've compiled suggests that EHang Holdings' current price could be inflated.

Afya (NasdaqGS:AFYA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Afya Limited is a medical education group operating in Brazil with a market cap of approximately $1.43 billion.

Operations: The company's revenue is derived from its Undergrad segment, which generated R$2.78 billion, and Continuing Education, contributing R$164.55 million.

Insider Ownership: 16.1%

Afya Limited shows strong growth potential, with earnings forecasted to grow 21.63% annually, outpacing the U.S. market. The company trades at a significant discount to its estimated fair value and reported substantial year-over-year revenue and net income increases for Q3 2024, reflecting robust operational performance. Despite no recent insider trading activity, Afya's reaffirmed financial guidance underscores confidence in achieving BRL 3.23 billion to BRL 3.33 billion in annual revenue for 2024.

- Get an in-depth perspective on Afya's performance by reading our analyst estimates report here.

- The analysis detailed in our Afya valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Delve into our full catalog of 201 Fast Growing US Companies With High Insider Ownership here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Delcath Systems, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:DCTH

Delcath Systems

An interventional oncology company, focuses on the treatment of primary and metastatic liver cancers in the United States and Europe.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives