- United States

- /

- Medical Equipment

- /

- NasdaqCM:MBAI

We're Hopeful That Check-Cap (NASDAQ:CHEK) Will Use Its Cash Wisely

We can readily understand why investors are attracted to unprofitable companies. For example, Check-Cap (NASDAQ:CHEK) shareholders have done very well over the last year, with the share price soaring by 178%. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

In light of its strong share price run, we think now is a good time to investigate how risky Check-Cap's cash burn is. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. Let's start with an examination of the business' cash, relative to its cash burn.

View our latest analysis for Check-Cap

How Long Is Check-Cap's Cash Runway?

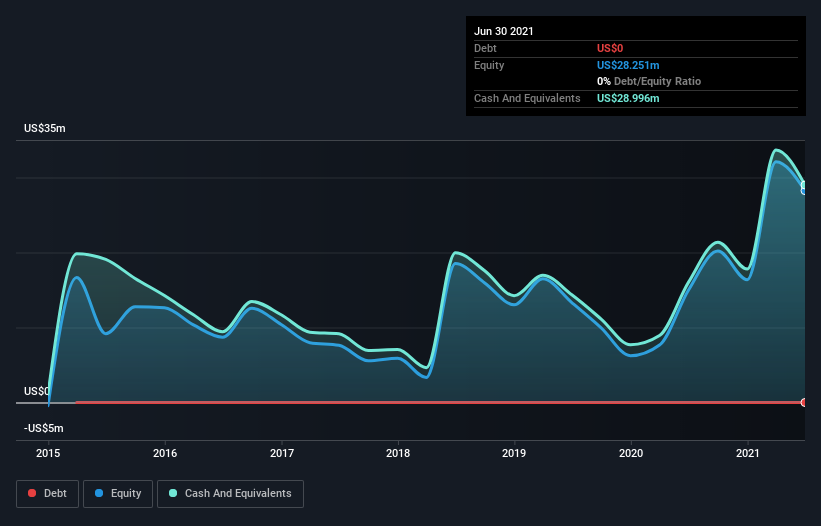

A company's cash runway is calculated by dividing its cash hoard by its cash burn. As at June 2021, Check-Cap had cash of US$29m and no debt. Looking at the last year, the company burnt through US$15m. That means it had a cash runway of around 23 months as of June 2021. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. Depicted below, you can see how its cash holdings have changed over time.

How Is Check-Cap's Cash Burn Changing Over Time?

Because Check-Cap isn't currently generating revenue, we consider it an early-stage business. Nonetheless, we can still examine its cash burn trajectory as part of our assessment of its cash burn situation. With the cash burn rate up 14% in the last year, it seems that the company is ratcheting up investment in the business over time. However, the company's true cash runway will therefore be shorter than suggested above, if spending continues to increase. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Hard Would It Be For Check-Cap To Raise More Cash For Growth?

Given its cash burn trajectory, Check-Cap shareholders may wish to consider how easily it could raise more cash, despite its solid cash runway. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Check-Cap's cash burn of US$15m is about 16% of its US$92m market capitalisation. Given that situation, it's fair to say the company wouldn't have much trouble raising more cash for growth, but shareholders would be somewhat diluted.

How Risky Is Check-Cap's Cash Burn Situation?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought Check-Cap's cash runway was relatively promising. Cash burning companies are always on the riskier side of things, but after considering all of the factors discussed in this short piece, we're not too worried about its rate of cash burn. On another note, Check-Cap has 5 warning signs (and 3 which don't sit too well with us) we think you should know about.

Of course Check-Cap may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:MBAI

Check-Cap

A clinical stage medical diagnostics company, focuses on capsule-based screening technology products.

Moderate risk with worrying balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026